Illustrative image

One of the fastest-growing imported goods in the first two months of the year is fertilizer. According to preliminary statistics from the General Department of Customs, Vietnam’s fertilizer imports in February 2023 reached 281,588 tons, worth over 91.5 million USD, down 32.1% in volume and 33.8% in value compared to January. However, the accumulated imports in the first two months of the year were 687,236 tons of fertilizer, equivalent to a value of over 226 million USD, up 113.9% in volume and 82.5% compared to the same period in 2023.

The average import price of fertilizer reached 325 USD/ton, a slight decrease of 7 USD/ton compared to the previous month.

Among the markets, China continues to be the largest supplier to Vietnam in the first two months of the year with 291,224 tons, equivalent to a value of over 380 million USD. However, another big player witnessing an extraordinary increase in exports to Vietnam in the first two months of the year is none other than Russia.

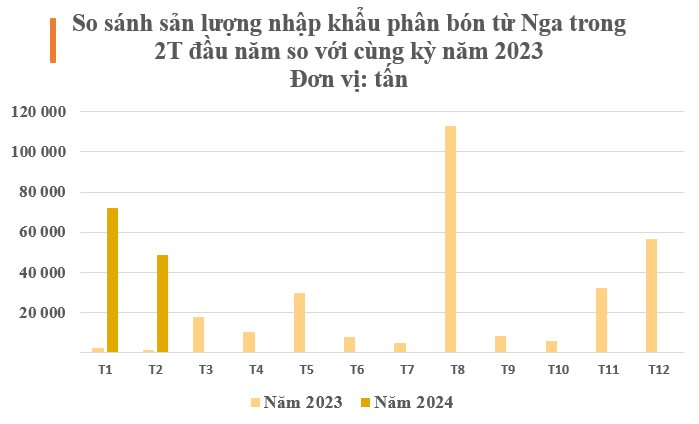

Specifically, in the first two months of the year, Russia exported 120,803 tons of fertilizer to Vietnam, worth over 75.3 million USD, up 3,660% in volume and 3,650% in value compared to the same period last year – the sharpest increase among Vietnam’s suppliers.

In 2023, our country imported 288,727 tons of fertilizer from Russia, equivalent to over 132 million USD. Therefore, after the first two months of the year, the output and value equal half of the total in 2023.

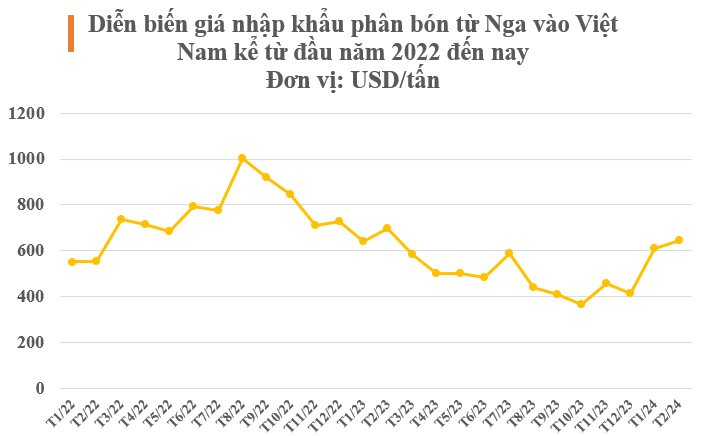

The average import price in February was 645 USD/ton, a decrease of 7% compared to the same period.

Russia is a world powerhouse in fertilizer exports; along with wheat, these are 2 rare ‘ultimate weapons’ that allow Russia to be reassured about revenue after energy market storms following European sanctions against the oil industry.

After the conflict between Russia and Ukraine, Russia had to endure sanctions in several industries from Europe. However, immediately after that, food and fertilizer exports from Russia were exempted from Western sanctions to support food security, especially for poor countries. Moscow has been and is increasing exports to countries like India, Turkey, and Vietnam.

Russia accounts for about 15% of the world’s consumption, at the same time is the leading exporter globally. Russia’s average annual fertilizer production is estimated at about 55 million tons. Europe and the US significantly depend on supply sources from Russia. Specifically, Europe receives 25% of urea, 15% of ammonium nitrate, 1/3 of phosphate fertilizers, and 35% of potash from the Russian Federation. Russia’s market share of potash in the US is 6%, phosphates are 20%, and urea is 13%.

The fertilizer supply is forecasted to tighten further in 2024 when the two major suppliers, China and Russia, increasingly restrict exports. Specifically, Russia has extended its policy of restricting fertilizer exports until May 2024 to protect the domestic market, while China continues to restrict urea exports to ensure domestic supply and stabilize prices.

This could cause a slight increase in fertilizer prices in 2024 compared to previous years.

In the Middle East, the Egyptian Government has decided to indefinitely extend the 30% reduction of natural gas supplies for all urea manufacturers in the country, greatly affecting the global supply.

According to the forecast of the World Fertilizer Association, the growth rate of fertilizer consumption worldwide will slow down in the medium term, from 4% in the 2023 fiscal year to 1.3% in the 2027 fiscal year.