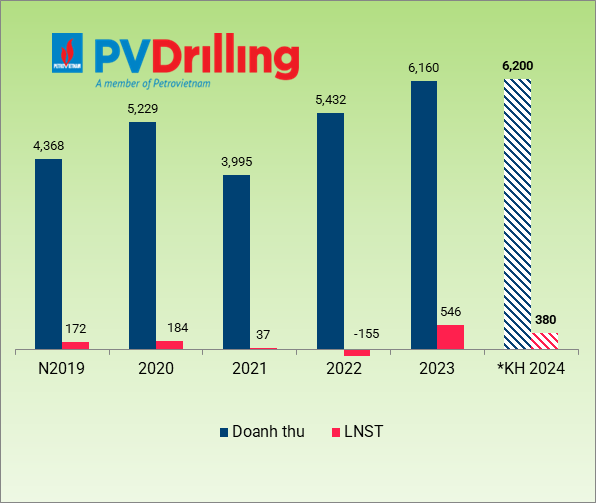

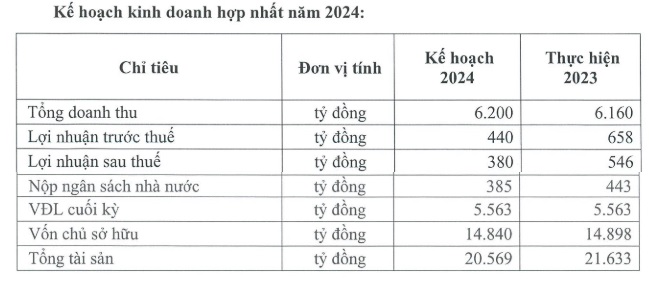

According to the 2024 annual GDCD, PVD plans to submit to shareholders a revenue plan of VND 6.2 trillion, a slight increase compared to the previous year, but with a post-tax profit of only VND 380 billion, a decrease of 30%. The budget contribution target decreased by 13%, to VND 385 billion.

Source: PVD

|

The plan is based on the assumptions that the average price of the 4 self-elevating drilling rigs will increase by 10% – 15% compared to the previous year; the TAD semi-submersible drilling rig will operate continuously in Brunei; the PV Drilling 11 land rig will have work for 4 months; and 0.5 chartered self-elevating drilling rigs.

According to PVD, oil prices are currently high, the drilling rig market is booming, and both rental demand and rental prices are increasing. Drilling, exploration and exploitation programs as well as well abandonment and well repair in countries in the region are also increasing. This is expected to be a growth driver for PVD in 2024 and subsequent years. However, the forecast is that the economy will face many difficulties and challenges that will directly impact the energy sector, leading the Company to set more conservative targets.

|

Results and business targets for 2024 of PVD

Source: VietstockFinance

|

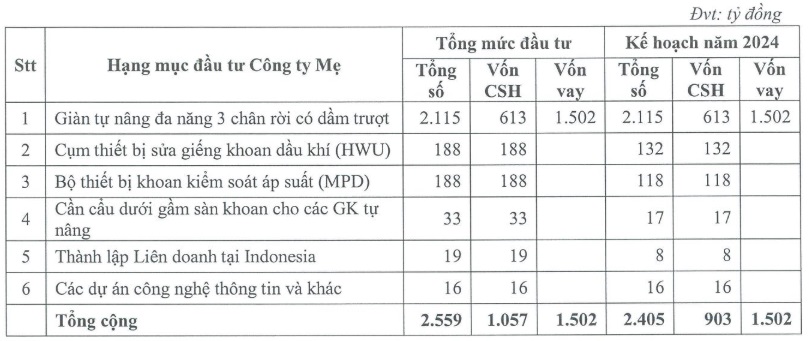

Regarding investment targets, PVD plans to submit a level of nearly VND 2.7 trillion for 2024, mainly for projects carried over from 2023 such as the HWU well repair equipment cluster, construction of workshops, etc., and additional investment in self-elevating drilling rigs, MPD equipment, and CRTi to meet market demand. The majority of the investment plan will be allocated to the multi-purpose 3-leg jack-up drilling rig with skid beams (over VND 2.1 trillion, with over VND 1.5 trillion from borrowed capital).

|

Investment plan 2024 of PVD

Source: PVD

|

Regarding the profit distribution plan, PVD announced that the remaining profit could be used to pay a dividend of VND 263 billion in 2023. However, due to the difficult market situation, PVD is considering suspending or delaying investment projects, giving priority only to necessary machinery and equipment. With the forecast of increasing demand for drilling, exploration, exploitation, and other activities in the near future, the Company is reviewing its needs, balancing cash flow, and will submit a proposal to not pay dividends in 2023.

This amount will be retained in the form of undistributed profits to support the capital for expanding production and business operations in 2024. As for the dividend plan for 2024, the Company said it will consider and submit it at the 2025 Annual GMS.

In addition, PVD will submit to the GMS a proposal to dismiss Mr. Do Duc Chien from his position as a member of the Board of Directors; and at the same time, elect Mr. Nguyen The Son to replace Mr. Chien. Mr. Son holds a Bachelor’s degree in Foreign Economics and is currently Deputy General Director of PVD.

In addition, the GMS will also elect members of the BKS for the 2024 – 2026 term. The Vietnam Oil and Gas Group (PVN) nominates Mr. Le Hong Phuong, Head of the Internal Audit Sub-department of PVD. The Supervisory Board of PVD also nominated 2 BKS members, Mr. Nguyen Van Tai and Mr. Nguyen Binh Hop, to continue participating in the BKS.

The 2024 annual GMS of PVD will take place at 8:30 am on April 24, via online format.