On the morning of April 25, Masan Group Corporation (stock code MSN) organized its 2024 Annual General Meeting of Shareholders (AGM) with 7 presentations. Subsidiaries Masan Consumer (MCH) and Masan MEATLife (MML) co-hosted the event today.

Masan Chairman Nguyen Dang Quang stated, “Masan Consumer – Masan’s diamond crown jewel – is a source of pride, steeped in the principles of contemplation, passion, and the sweet moments of serving consumers. It is also an ambassador of Vietnamese cuisine, elevating Masan’s global journey, once again joining Vietnamese consumers in taking solid steps towards bringing Vietnamese cuisine to 8 billion global consumers with strong, beloved brands.”

Mr. Quang shared that Masan Group has decided to IPO Masan Consumer Holdings Joint Stock Company.

Masan Group Chairman Nguyen Dang Quang

Danny Le, Masan Group CEO, reported that in 2024, WCM plans to open 4,000 stores, with the goal of 90% of these stores reaching EBITDA breakeven. In 2019, when Masan acquired the retail chain, the overall results were still negative. Mr. Danny Le assessed the results after 4 years as very encouraging.

In the first quarter of this year, consumer demand has recovered, and WCM opened an average of 1.6 stores per day, with the goal of 75% of stores reaching EBITDA breakeven.

Mr. Danny Le said that Phuc Long’s business results have not met expectations, so it is in the process of streamlining and closing some underperforming stores to optimize operations. Pharmacies in the retail chain will also implement similar measures.

MCH’S NEW PILLAR: OUT-OF-HOME

At the AGM, Masan Consumer Chairman Truong Cong Thang shared that MCH’s future path lies in serving unmet consumer needs. MCH has expanded from the kitchen to products in the refrigerator, products in the living room, and products in the bathroom. The fifth pillar of MCH will be Out-of-Home, including tea, coffee, purified water, self-heating hotpots, snacks, and more.

“The journey over the past 20 years has been very strong with a presence in the home, but with new consumer trends, out-of-home is a market we are targeting,” said Mr. Thang.

In addition, Mr. Thang said that the size of the FMCG market that MCH serves (including spices, convenience foods, bottled beverages, and home and personal care) is currently valued at only $8 billion. MCH has much work to do to compete with other companies and move towards a Vietnamese FMCG market with a size of $32 billion.

What will MCH do in the next 10 years? It will build a new FMCG model with the following strategies: (1) Establish 6 Big Brands worth billions of dollars to give consumers confidence when purchasing products, (2) Bring Big Brands and Vietnamese cuisine to the world, telling the world about the attractiveness of Vietnamese culture and cuisine, (3) Achieve revenue and profit targets for Masan Consumer to be among the top in Southeast Asia.

Similar to the launch of Omachi Self-Heating Hotpot at last year’s AGM, Masan launched the new product Salmon Teriyaki Fried Rice with Self-Heating.

Responding to a shareholder’s question, Mr. Truong Cong Thang emphasized, “MCH’s focus in the coming period is to find a model to enter the global market. It’s not simply a matter of imitating any company or coming up with our own model; there are 3 or 4 different models in each market. We will leverage distribution channels, e-commerce, trade shows, and more, and adapt the model to each market to enter its distribution system. The simplest and most effective method will be replicated.”

WCM TO LAUNCH 40 PRIVATE LABELS

WCM’s leadership said it is focused on “How to change customers’ price perceptions when shopping at WCM.” WCM has historically been perceived as not being price-competitive with other retail chains. Since the end of 2023, WCM has rebuilt its pricing strategy, launching a comprehensive price communication campaign for customers through in-store staff, as well as communicating on digital platforms about the price of WCM goods. In fact, in the rural market, WCM has products that are price-competitive with external stores.

“By the end of 2024, WCM’s price image will have completely changed,” the company’s leadership said.

WCM aims for positive net income after tax in Q1 2025.

Responding to a shareholder’s question, the WCM CEO said that WCM’s revenue in Q1 2024 was VND 7,900 billion, with 70% coming from miniMarts, achieving the goal of EBITDA profit. At the same time, store investment costs have been reduced by 40% through optimizing negotiations when purchasing large quantities and optimizing equipment.

A shareholder asked about the fact that in 2024, WCM planned to increase 400-700 stores per year but revenue did not increase accordingly. The CEO explained that the reason was that the total operating time of newly opened stores was only 4 months, so there was no full-year revenue. Additionally, newly opened stores need time to improve their operating efficiency.

In the coming year, WCM will introduce 40 private labels. Currently, WCM-branded products contribute only 8-9% of revenue, but their profit margin is 3-5% higher in each product category that WCM compared.

PROFIT PLAN INCREASES BY 115%

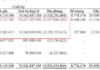

Regarding its business plan, Masan has set its 2024 business plan with revenue in the range of VND 84,000 billion – VND 90,000 billion, an increase of 7.3% – 15%, respectively. Core net profit before minority interest allocation (core NPAT Pre-MI) is expected to be from VND 2,250 billion to VND 4,020 billion, an increase of 31% – 115% compared to the 2023 results. The company plans not to pay dividends in 2024.

The CrownX is expected to have a net revenue of between VND 63,000 billion and VND 68,000 billion, an increase of 9-18% compared to 2023. Of which, Wincommerce (WCM) expects net revenue from VND 32,500 billion to VND 34,000 billion, an increase of 8-13%, respectively.

MCH expects net revenue from VND 32,500 billion to VND 36,000 billion, with growth contributed mainly by the Convenient Food, Beverages, and Home and Personal Care sectors. PLH (Phuc Long Heritage) expects revenue from VND 1,790 billion to VND 2,170 billion, an increase of 17-41%, and plans to open 30-60 new stores outside of WCM, focusing on Hanoi and Ho Chi Minh City.