25th April 2024, Novaland’s annual AGM was held in Phan Thiet.

|

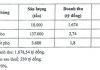

Despite a challenging 2023 financial year, Novaland recorded a consolidated net revenue of approximately 4.757 billion VND and a post-tax profit of nearly 486 billion VND. Consolidated net revenue includes revenue from sales and service fees. Sales revenue reached nearly 4,090 billion VND, driven by deliveries at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Palm City, Lakeview City, Saigon Royal, and other central real estate projects. Revenue from service provision reached 667 billion VND.

Revenue fell short of targets due to a decline in real estate transfer revenue, which was attributed to a loss of market confidence that will take time to recover. On the other hand, post-tax profit exceeded targets mainly due to the Company’s efforts in debt restructuring, operating cost optimization, and financial activities during the restructuring phase.

As of December 31, 2023, Novaland’s unrecognized revenue reached nearly 240 trillion VND from projects where Novaland is the investor and is currently in development cooperation.

Some notable achievements from the debt and bond restructuring activities include a debt reduction of approximately 7.156 billion VND compared to 2022, an agreed restructuring plan for convertible bonds with a total value of 300 million USD, and a total extension of domestic bond principal payments in accordance with Decree 08/2023/ND-CP, exceeding 9.200 billion VND. Notably, the Company completed a bond swap transaction with a total value of 2.346 billion VND for equity in a project. Additionally, the Company successfully negotiated bond swaps and debt settlements using the Group’s products, with a total transaction value of approximately 2.500 billion VND.

For the 2024 plan, Novaland presented the General Meeting with a consolidated revenue target of 32.587 billion VND and a post-tax profit target of 1.079 billion VND. For funding in 2024, the Company expects to raise 16,000 billion VND from financial institutions for project development and business operations.

Recently, on April 22, 2024, Novaland submitted to the Board of Directors a plan to issue shares worth over 11,700 billion VND to existing shareholders. The offering is expected to occur in the second quarter of 2024, after the State Securities Commission issues a certificate of registration for a public offering in accordance with regulations.

This year, revenue-generating projects such as Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram, and residential projects in HCMC will be the focus of development plans. Construction on these projects resumed in the second quarter of 2023, and new product offerings are expected to be introduced to the market from the fourth quarter of 2024.

At the General Meeting, Mr. Bui Thanh Nhon, Chairman of the Novaland Group Board of Directors, shared: “As of today, Novaland has essentially completed the restructuring of its domestic and foreign loans and bonds, and the Company’s assets remain balanced with its liabilities. In the coming period, the Group will continue to restructure its finances and resources, refine its legal framework, change its strategy, focus on its core business, streamline its organization, and participate in the ESG action plan.”

Discussion:

How are Novaland’s project reconstruction plans progressing? Where will the funding come from, and is there a guarantee that the projects will be completed and delivered to customers?

Mr. Ng Teck Yow, Member of the Board of Directors and General Director: The Grand Manhattan project is currently under construction with the support of TPBank and has been underway since April 2023. The project has now completed the resettlement handover, and the remaining portion has been topped out.

In addition, we are also rapidly reconstructing other projects, namely the Hanaba Island and Wonderland phases at NovaWorld Ho Tram and several subdivisions at NovaWorld Phan Thiết, which are being funded by the Military Bank (MB) since May 2023. Projects in central HCMC, such as Victoria Village and Sunrise Riverside, are also being redeveloped. The Aqua City project is also expected to continue construction on several subdivisions with funding support from VPBank.

The Company is currently making every effort to negotiate and continue working with domestic banks and contractors to maintain project development activities and ensure on-time delivery of each phase to homebuyers. For other projects/subdivisions that are also part of the Company’s plan, banks are reviewing and will provide progressive financing in the coming period.

We understand that NovaGroup has recently registered to sell a large number of Novaland shares. Did the General Meeting disclose any impact this will have on Novaland? Will there be a “runaway”?

Mr. Duong Van Bac, Chief Financial Officer: We affirm that there is no “runaway.” NovaGroup and the Chairman of the Board of Directors, Bui Thanh Nhon, have returned to directly manage the Group, as stated in the Chairman’s message. We face challenges and difficulties head-on. Additionally, we raise capital in the international market, and the contracts are very tight, always requiring the founding shareholder to hold a high ownership percentage in the Group to help the Group develop sustainably. NovaGroup‘s registration to sell a large number of Novaland shares supports the restructuring of the Company’s debts. A significant number of NVL shares held by NovaGroup are being sold through margin calls to fulfill commitments to bondholders in some retail bond packages.

Recently, the Company issued a resolution regarding the offering of 11,700 billion shares to existing shareholders. Will this lead to share dilution and reduce the value of shares currently traded on the stock exchange? What is the Company’s opinion on this matter?

Mr. Duong Van Bac, Chief Financial Officer: Firstly, compared to before the crisis, the price of NVL shares has dropped by 80-90%, which is a significant decline for a stock on the market, reflecting the difficulties the company has been facing in the recent past. As of now, the overall situation of the Company has changed positively compared to the end of 2022 and the beginning of 2023, as the Company’s management has previously shared. In the restructuring process, raising new capital provides the Group with additional financial resources, which will help NVL overcome the crisis and accelerate the recovery of business activities.

We would also like to share with our shareholders that there are major partners who are interested in investing in the Company through private placements due to their confidence in our existing foundation, our ability to recover, and our growth potential in the future. Even in the structure of the recently issued international convertible bond package, investors accepted a conversion price of 40,000 VND/share, which is almost three times higher than the current price. However, for now, the Group’s management team is prioritizing the preemptive rights of existing shareholders at a price lower than the market value. This is also a way to protect the interests of existing shareholders who have accompanied and supported the Company throughout the recent period. If there are any surplus shares, we will then consider allowing new shareholders to participate.

I believe that a successful issuance will lay a solid foundation for the Group to quickly return to growth, increase the overall value of the Company, and thereby increase the value of shareholders’ investments in the Company. We believe that this is the most meaningful way to show our gratitude to the community and to those who are the true owners of the Company.

There has been a lot of information indicating that Novaland’s projects are being unfrozen. What is the current status of the unfreezing process?

Moving forward, we will continue to update shareholders and all Novaland customers on the outcomes of each subsequent legal step through official announcements. As shareholders are aware through various media outlets and official updates from project owners, some of Novaland’s projects are currently part of the government’s and local authorities’ key legal unfreezing plans in areas where Novaland is investing, such as the 30.2-hectare project located in Binh Khanh Ward, Thu Duc City, and The Grand Manhattan project located in Co Giang Ward, District 1, both in Ho Chi Minh City,