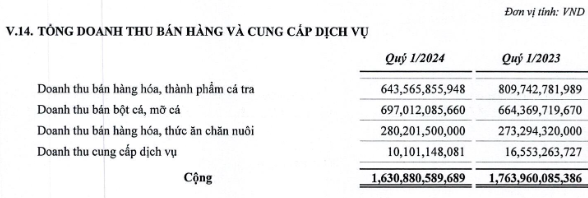

In the first quarter of 2024, revenue from pangasius products (accounting for the largest proportion of 39%) was over 643 billion VND, a decrease of 21%. Meanwhile, revenue from selling fishmeal and fish oil increased by 5% to 697 billion VND, and revenue from animal feed increased by 2.5% to 280 billion VND.

Source: Company’s Financial Statements

|

With the above fluctuations in business segments and excluding deductions, IDI had a net revenue of 1,630 billion VND, a decrease of 8% year-on-year. Gross profit was recorded at 119 billion VND, decreased by 17%, and the gross profit margin was 7%.

|

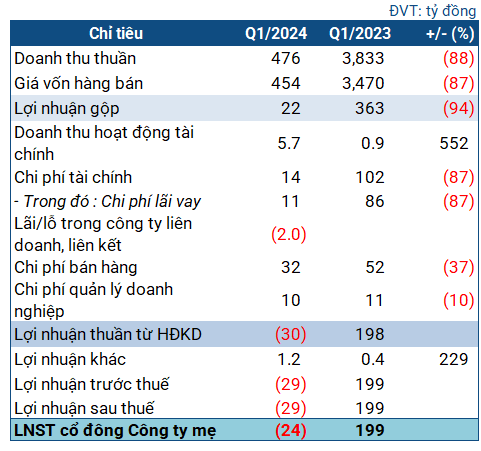

IDI’s Q1 2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

Except for the 9% increase in selling expenses, all other expenses decreased year-on-year; The largest expense was interest expense of 63 billion VND, decreased by 25% year-on-year.

Finally, IDI‘s after-tax profit and net profit were 17 billion VND and 14 billion VND, respectively, decreased by 5% and 6% year-on-year. Compared to the approved plan of net revenue of 8,499 billion VND and after-tax profit of 276 billion VND by the 2024 Annual General Meeting of Shareholders, the Company has achieved 19% and 6%, respectively.

As of March 31, 2024, IDI‘s total assets reached 8,212 billion VND, slightly decreased by nearly 1% compared to the beginning of the year. In particular, cash and cash equivalents were over 570 billion VND, half of the amount at the beginning of the year. Inventories were nearly 1,510 billion VND, decreased by 4%.

Investments held to maturity were over 829 billion VND, increased by 24% year-on-year; mainly due to a 24% increase in short-term deposits to 826 billion VND and no change in bonds at 3.3 billion VND. Investments in contributed capital of EuroPlast Long An Solar Power JSC was recorded at over 245 billion VND.

On the other side of the balance sheet, liabilities were at 4,773 billion VND, decreased by 2% year-on-year. The company borrowed over 3,946 billion VND in short-term bank loans, a decrease of 3.5%; long-term loans of 255 billion VND, a decrease of 7%.

|

Recently, the 2024 Annual General Meeting of Shareholders of IDI approved the issuance of 45.5 million shares to pay dividends for 2022 and 2023, the implementation ratio was 20% or 100:20, i.e. owning 100 shares will receive 20 new shares. Expected to be implemented after receiving the approval document from the State Securities Commission. The corresponding issuance value at par value is over 455 billion VND. If successful, the Company’s charter capital will increase from 2,276 billion VND at the end of Q1 2024 to over 2,731 billion VND. |