According to the extraordinary resolution of the 2024 Annual General Meeting of Shareholders of Van Lang Technology Investment and Development JSC (HNX: VLA), the Company’s shareholders unanimously agreed to dismiss Mr. Pham Dang Hoang Huy from the position of Independent Member of the Board of Directors due to personal reasons and elected a new member for the term 2024 – 2029.

Mr. Duong The Quang

|

Accordingly, Mr. Duong The Quang (born in 1973) has been appointed as the new Independent Member of the Board of Directors of VLA. Mr. Quang previously served as a Member of the Board of Directors and General Director of HD Capital Investment JSC; and a Member of the Board of Directors of Saigon Beer, Alcohol and Beverage JSC (UPCoM: BSD).

In addition, Mr. Quang has held several prominent positions in the past, including General Director of HD Securities JSC (HDS) from 2020 to 2022; General Director of Dong A Bank Securities JSC (DAS) from 2017 to 2020; General Director of Sao Vang Fund Management JSC (SavaCap) from 2015 to 2017; and Investment Director of VinaWealth Fund Management JSC (VinaCapital) from 2011 to 2015. He does not currently own any shares in VLA.

Mr. Quang’s appointment to the Board of Directors is expected to contribute to the standardization of VLA‘s operations as a listed company, enhance the quality of investments, and expand strategic partnerships.

Mr. Nguyen Thanh Tien, Chairman of the Board of Directors of VLA, stated, “The company’s philosophy is that investment is a serious and rigorous process, and our primary focus is on value investing. VLA values talented individuals in the investment field and will continue to recruit and retain them to achieve our goals and vision for the next ten years.”

Van Lang Technology Investment and Development JSC was originally a subsidiary of Vietnam Education Publishing House, established under Decision No. 1338/QD-TCNS dated November 15, 2007. Currently, VLA‘s main business areas include real estate, hotels and resorts, and business consulting and investment.

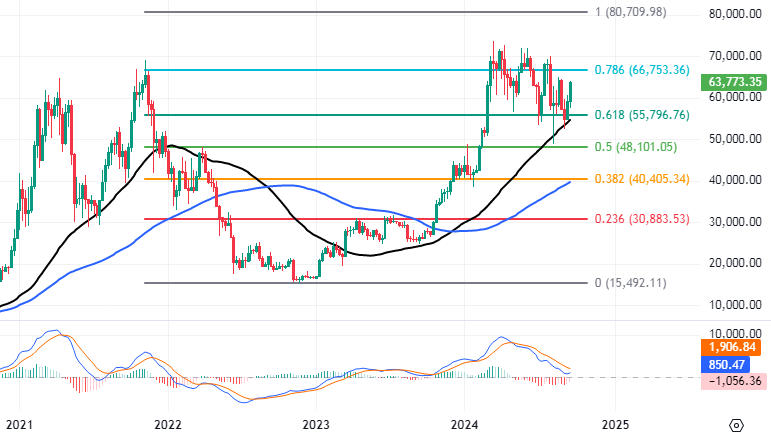

In 2024, in addition to maintaining its training activities, VLA will focus on providing business investment consulting services in the real estate sector and directly investing in the stock market.

In terms of financial targets, VLA aims to achieve a revenue of 20 billion VND and a pre-tax profit of 3.75 billion VND, representing significant growth compared to the previous year. The company plans to distribute a dividend of 4% this year.

Services

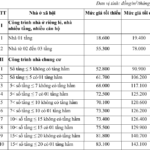

Choose La Mia Bao Loc – Embrace a Fulfilling Life with an Ideal Green Living Standard

Not just a perfect blend of art and inspired Italian-style resort, La Mia Dalat also effortlessly brings each resident to the standards of peaceful living, well-being, and balanced body-mind-soul.

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.