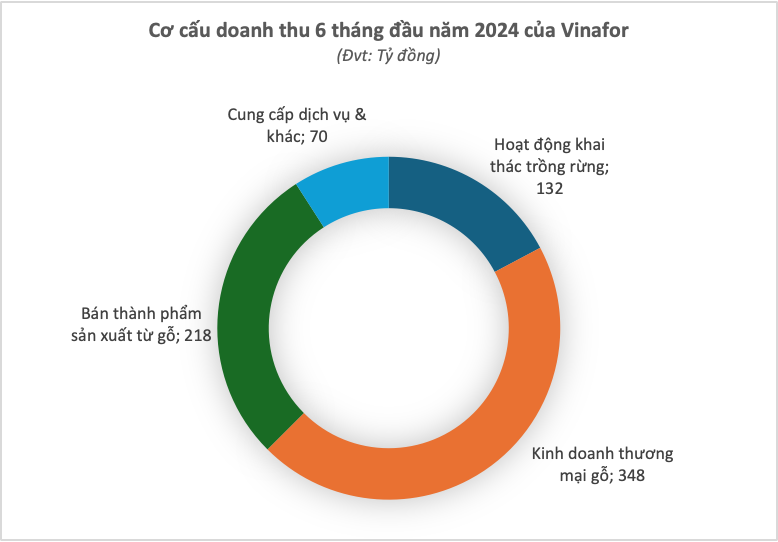

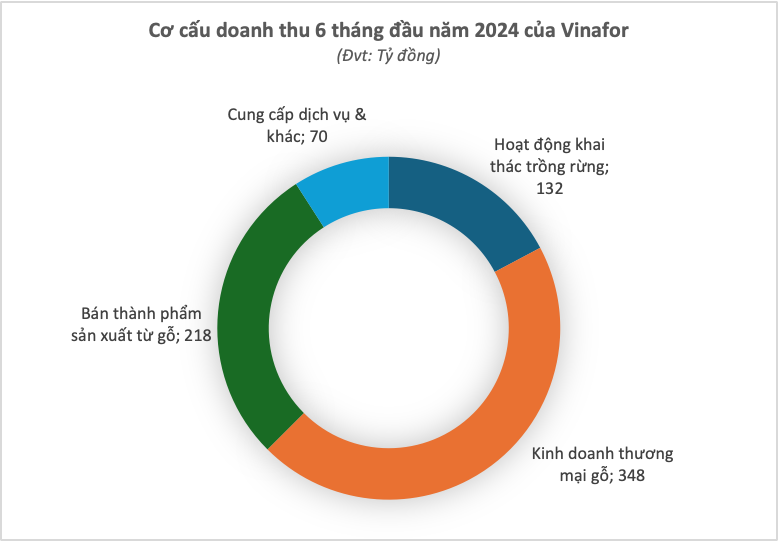

Vietnam Forestry Corporation – JSC (Vinafor, code: VIF) announced its business results for the first six months of the year, with a 3% increase in revenue to 769 billion VND. The largest contributor was revenue from wood trading, amounting to 348 billion VND. Following that, the semi-finished wood products and forest exploitation segments brought in 218 billion VND and 132 billion VND in revenue, respectively.

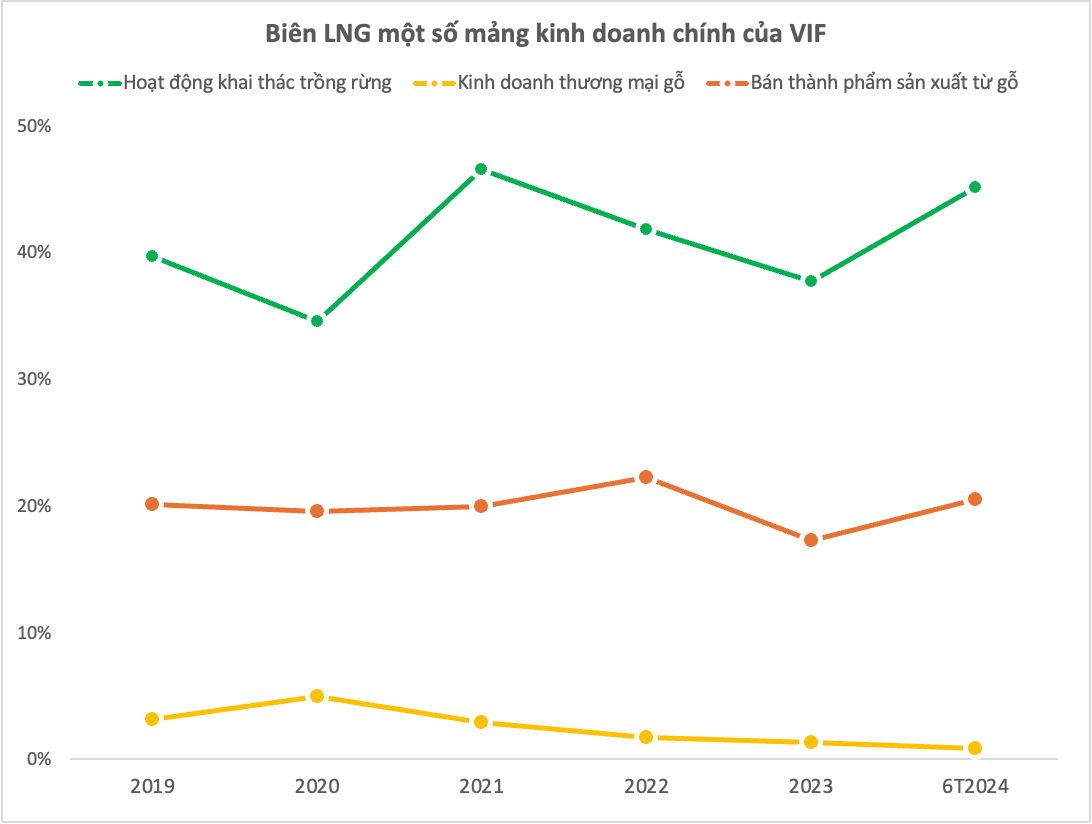

After deducting the cost of goods sold, Vinafor’s gross profit was 136 billion VND, equivalent to an 18% gross profit margin. The gross profit for each segment varied significantly. While wood trading contributed the largest revenue, its profit margin was relatively thin at 1%, resulting in a gross profit of over 9 billion VND.

In contrast, the forest exploitation segment boasted a remarkable 45% gross profit margin – the highest in over two years – translating to a gross profit of nearly 60 billion VND. The gross profit for the semi-finished wood products segment stood at nearly 45 billion VND, with a 20% gross profit margin.

Additionally, profits from joint ventures and associates contributed significantly, amounting to 177 billion VND, a 63% increase compared to the previous year. As of June 30, 2024, Vinafor had 21 associated companies, notably including a 30% stake in Yamaha Vietnam.

After deducting other expenses, Vinafor reported a net profit of 215 billion VND for the first half of 2024, representing a 54% growth compared to the same period last year.

Consistently Generating Billions in Revenue from Forest and Wood Exploitation Annually

Vinafor was formerly known as the Vietnam Forest Products Corporation, established by Decision No. 667/QD/TCCB dated October 4, 1995, of the former Ministry of Forestry. The corporation was formed through the merger of 10 corporations and unions under the former Ministry of Forestry. In 2016, the Vietnam Forestry Corporation – JSC officially commenced operations, with its primary business activities related to the production and trading of forest plantations and tree seedlings, forest planting and exploitation, logging, and manufacturing of wood products…

During the period from 2012 to 2023, the company maintained revenue in the billions each year (except for 2016). Specifically, in 2023, Vinafor achieved a revenue of 1,685 billion VND, of which the total revenue from forest exploitation, wood trading, and wood products amounted to approximately 1,280 billion VND. However, net profit decreased by 43% to 276 billion VND.

Entering 2024, with expectations of a recovering market for wood and wood product exports, Vinafor set positive growth targets, aiming for consolidated revenue of nearly 2,000 billion VND and a net profit of 317 billion VND for the entire Corporation. Thus, the company has accomplished 68% of its full-year profit target at the halfway mark.

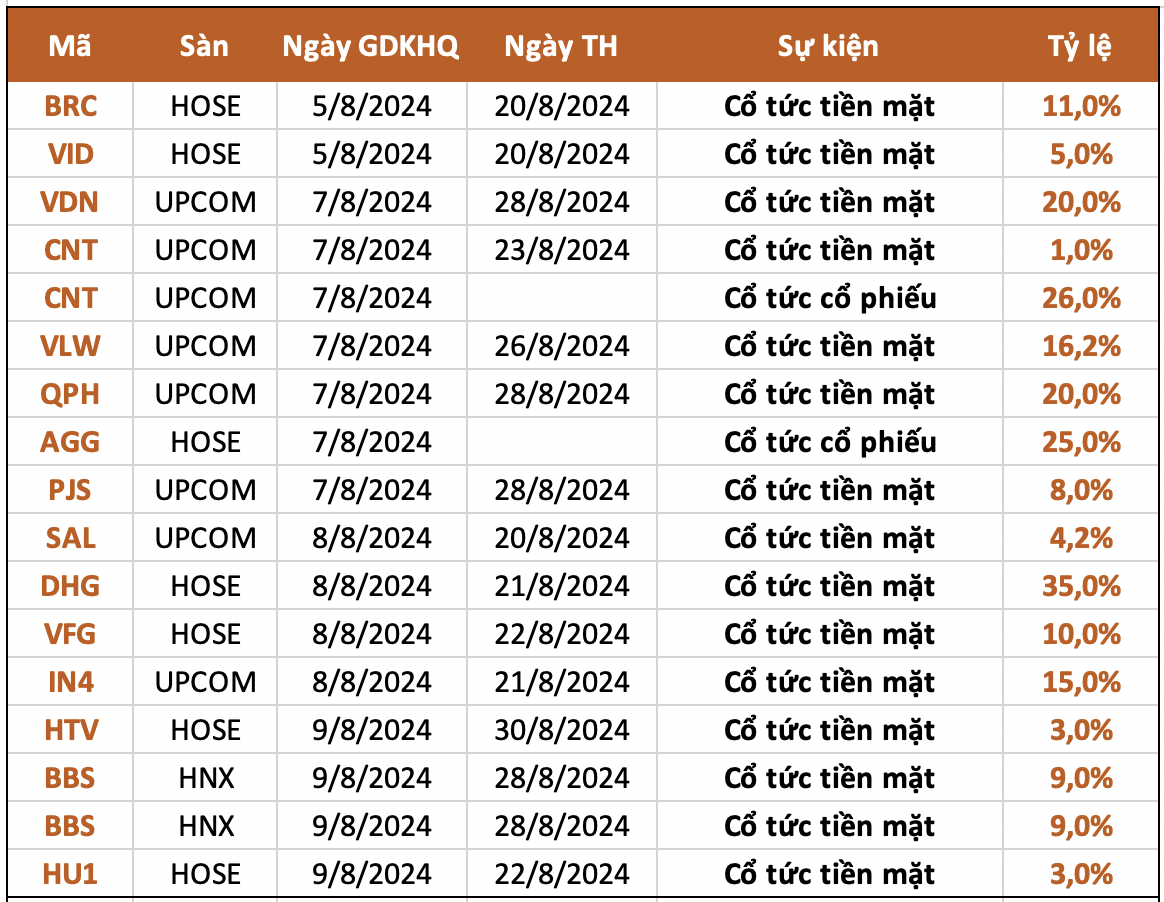

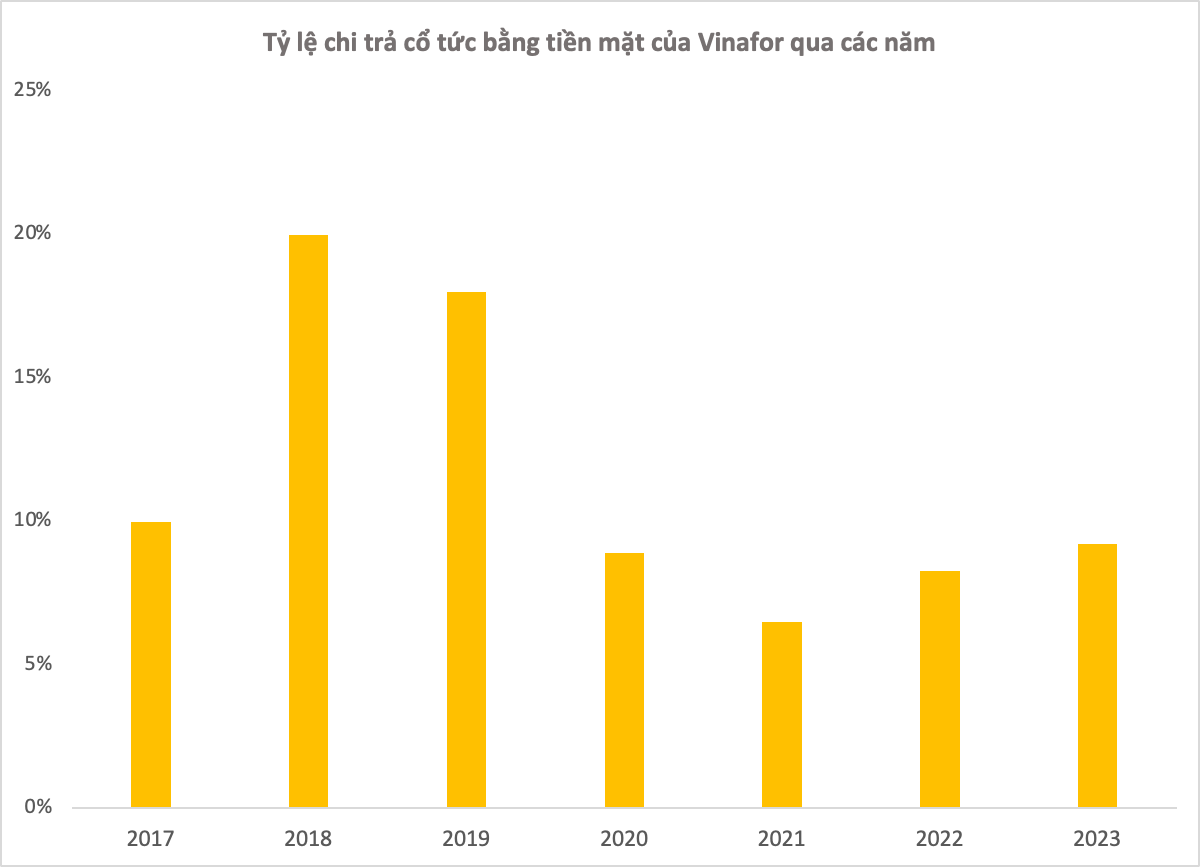

Moreover, Vinafor has a tradition of consistently paying dividends in cash. From 2017 to the present, the company has maintained dividend payments to shareholders at rates ranging from 6% to 20%. Just in early August, Vinafor paid a 2023 dividend to shareholders at a rate of 9.21% (921 dong per share), equivalent to a payout of over 322 billion VND.

In terms of shareholder structure, the State Capital Investment Corporation (SCIC) remains the largest shareholder with a 51% stake, equivalent to nearly 18 million shares. Meanwhile, the T&T Group holds 40% of the capital, representing 14 million shares. Consequently, the cash dividends received by these two major shareholders amounted to 164 billion VND and 129 billion VND, respectively.

On the stock market, VIF shares were initially traded on the UPCoM exchange in 2016 and later listed on the HNX in 2020. Currently, the market price stands at 17,300 VND per share.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.