With a rate of 17% (VND 1,700 per share) and approximately 147 million shares in circulation, CHP is estimated to spend around VND 250 billion to complete dividend payments to shareholders. The payment is expected to be made on September 25, 2024.

Previously, in late 2023, CHP had an interim dividend payment with a rate of 8% (VND 800 per share), amounting to approximately VND 117.6 billion. With the upcoming payment, CHP’s total dividend payout for 2023 will reach 25%, fulfilling the plan approved by the Annual General Meeting of Shareholders in 2024.

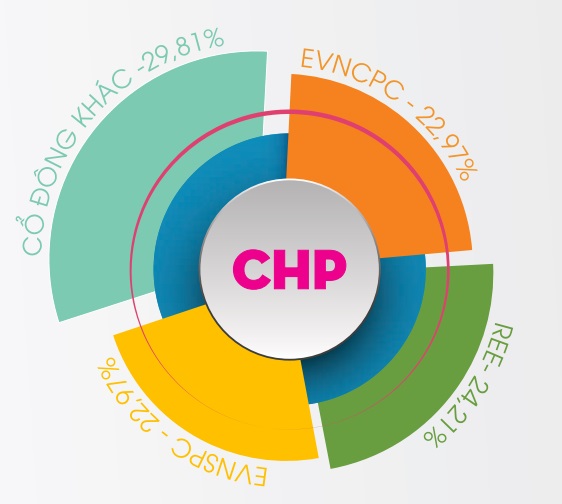

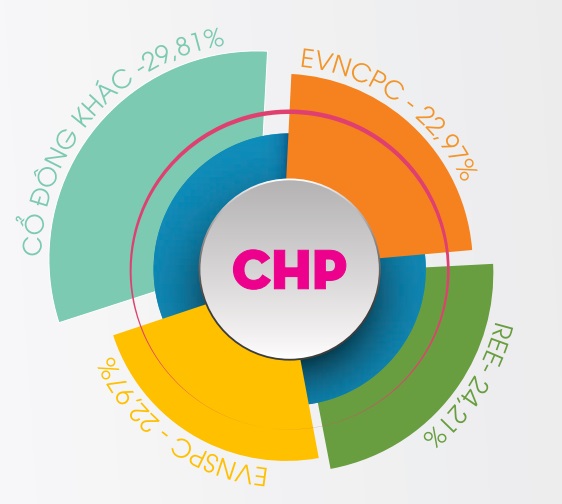

A significant portion of the upcoming dividend will go to two large shareholders belonging to EVN: the Central Power Corporation (EVNCPC) and the Southern Power Corporation (EVNSPC). Each entity holds 22.97% of the charter capital and is expected to receive more than VND 57.4 billion (a total of nearly VND 115 billion). Additionally, another major shareholder, REE Energy – a subsidiary of Refrigeration Electrical Engineering Corporation (HOSE: REE) – currently holding 24.21% of the charter capital, will receive over VND 60 billion.

|

CHP’s Shareholder Structure at the End of 2023

Source: CHP

|

In 2023, despite facing challenges due to unfavorable hydrological conditions, CHP still achieved a net profit of nearly VND 337 billion. Although this figure represents a 34% decrease compared to the previous year, it is the second-highest profit in the past decade for the company.

Entering 2024, the company experienced a shock in the first quarter, with a net profit of only VND 31 billion, a third of the same period last year, due to a significant decrease in water flow into the reservoir. However, the second quarter showed improvement, with a net profit of over VND 40 billion, a 37% increase, thanks to reduced interest expenses.

| CHP’s Business Performance |

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.