In the first half of the year, CSM recorded a 7% decline in revenue to VND 2.4 trillion compared to the same period last year. However, a nearly 14% reduction in cost of goods sold contributed to a gross profit of VND 347 billion, a 70% increase. This is the highest profit the tire manufacturer has achieved since 2015, with a gross margin of 14.3%, almost double the 7.8% of the previous year.

The main contributors to revenue remain export and domestic products, accounting for 95% of total revenue. Export products brought in over VND 1 trillion, a 15% increase, while domestic products reached over VND 1.3 trillion, a 7% increase. Revenue from external supplies, however, fell 72% to VND 148 billion.

According to CSM, the decrease in revenue was due to a drop in supply revenue and revenue from the sale of semi-finished rubber products to Camso, but cost of goods sold also decreased significantly thanks to the company’s efforts in reducing production costs.

| CSM’s business results for the first half of the year from 2009 to present |

General Director Phạm Hồng Phú shared at the 2024 Annual General Meeting of Shareholders that for the past 10 years, CSM has been a supplier of semi-finished rubber products to Camso, the world’s leading manufacturer of forklift tires, contributing about VND 800 billion in revenue annually to CSM. However, after Camso was acquired by Michelin, especially with Michelin’s principle of not outsourcing semi-finished products due to trade secrets, Camso had to build an additional factory in Binh Duong to produce them themselves. The partner had notified CSM two years in advance, and in 2024, CSM no longer supplied these products to Camso, impacting domestic revenue.

Although not included in the plan, according to General Director Phạm Hồng Phú, semi-finished rubber products still contributed to CSM’s business results in the first two quarters of the year, as Camso has not yet been able to operate their own production system.

Compared to the same period in 2023, the company benefited from exchange rate differences, doubling financial revenue to VND 43 billion. This was partly due to interest income from deposits and loans. Another advantage came from a 33% reduction in bank interest expenses, totaling VND 53 billion.

CSM‘s other income also increased significantly by 241%, reaching VND 12.3 billion. In addition to VND 3.7 billion from scrap sales, the company also accounted for an additional VND 8.3 billion in adjustments according to the State Audit Office’s audit report for the 2022 financial statements.

However, selling expenses and management expenses increased sharply by 94% and 198%, respectively, to VND 139 billion and VND 155 billion. Notably, the amount spent on management personnel exceeded VND 98 billion, a 3.6-fold increase.

The tire manufacturer attributed the rise in selling expenses to the implementation of sales policies to promote product consumption and distributor support, as well as increased export shipping costs. Regarding the surge in management expenses, CSM explained that the company had implemented policies for its employees.

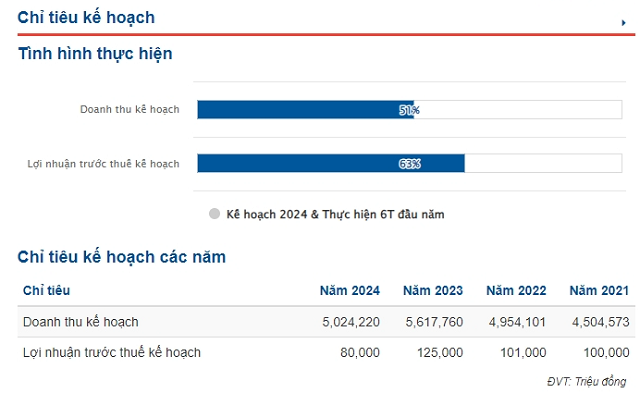

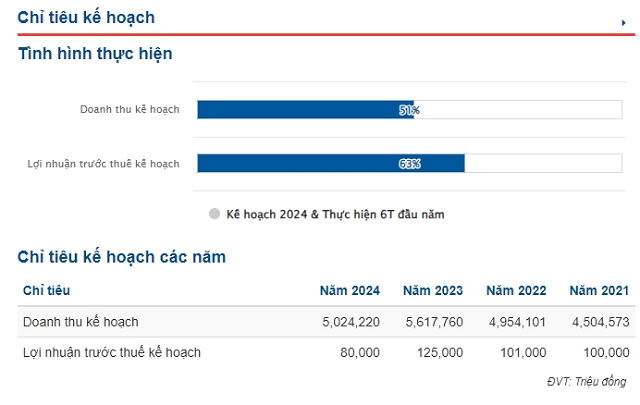

As a result, CSM recorded a net profit of VND 41 billion, double that of the previous year, marking the highest profit since 2017, although it has not yet reached the peak of VND 169 billion in the first half of 2014. For 2024, the company targets a revenue of over VND 5 trillion and a pre-tax profit of VND 80 billion, having already achieved 51% and 63% of these goals, respectively, by the end of the second quarter.

Source: VietstockFinance

|

As of the end of June 2024, CSM‘s total assets were nearly VND 3.9 trillion, with no significant changes from the beginning of the year. A notable change was the short-term accounts payable of VND 512 billion, a 50% increase, mainly due to amounts owed to Viet Trung International (Hongkong) Limited (VND 56 billion) and Thai Hua Rubber Public Company Limited (VND 32 billion), with the remaining VND 275 billion owed to other entities.

At the end of the second quarter, the company reported foreign currency holdings of 10.4 million USD (approximately VND 260 billion, based on an exchange rate of 25,000 VND/USD), a 70% increase from the beginning of the year.

According to Mr. Phạm Hồng Phú, with the current increase in exchange rates, exports have the opportunity to boost sales, especially as the domestic market faces challenges due to increased competition, particularly from products originating from China and other countries.

However, other countries such as China, Thailand, Indonesia, and India also benefit from similar exchange rate fluctuations, and they, too, have reduced their selling prices. Therefore, the global competitive landscape remains largely unchanged.

An advantage arises if CSM purchases raw materials domestically and then exports them for USD earnings. CSM is striving to accelerate exports, but customers are also requesting price reductions, making this a sensitive issue.

Inside a CSM tire manufacturing plant. Source: CSM

|

CSM Shareholders’ Meeting: Expected pre-tax profit of VND 25 billion in Q2

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.