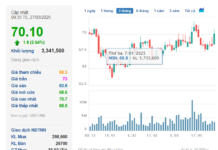

Shares of BLT, owned by Binh Dinh Food Joint Stock Company, soared in the August 14 session after a string of lackluster performances. BLT shares surged to the ceiling price, with no sellers, ultimately reaching 55,300 VND per share. This marks a 58% increase in value since the beginning of the year, the highest in the company’s history.

Trading volume also witnessed a significant spike, with over 60,000 shares matched, far surpassing the average of a few hundred units and even some sessions with no transactions for BLT.

BLT’s acceleration came after the company announced a large cash dividend payout. Specifically, August 30 is the record date for BLT to distribute a 2023 cash dividend with a ratio of 88% (each share will receive 8,800 VND). With over 4 million shares currently in circulation, the company plans to spend 35 billion VND on dividends in this round.

Among the shareholders, the Southern Food Corporation – VINAFOOD II, as the parent company holding 51% of the charter capital, is expected to receive nearly 18 billion VND. Following closely, Mr. Nguyen Phan Quang, Vice President of the company, may receive more than 1 billion VND, owning nearly 3% of the capital. Shareholders will receive the dividend money shortly after, expected to be September 18.

At the 2023 Annual General Meeting of Shareholders, BLT approved a cash dividend payout for 2022 at a rate of 170.5%, corresponding to each share receiving 17,050 VND, with a total expected payout of over 68 billion VND.

However, BLT only made payments to shareholders at a rate of 30% in cash, equivalent to 12 billion VND. Subsequently, the company proposed and received shareholder approval to halt the payout of the remaining 140.5% dividend.

At that time, BLT cited financial difficulties as the reason for the suspension, stating that they lacked the capital to distribute the remaining dividends. This was attributed to a sudden increase in commodity prices of over 50% since July, with average rice prices exceeding 15,500 VND per kg, and BLT’s need to maintain a circulating inventory of over 3,000 tons of rice worth 46 billion VND, leading to constrained capital, reduced capital efficiency, and increased borrowing costs.

Since its listing on the UPCoM in early 2017, BLT has consistently paid cash dividends to its shareholders. From 2017 to 2022, the average cash dividend ratio reached 34% per year, with 2021 being the peak when the total dividend ratio stood at 110% in cash.

Binh Dinh Food Joint Stock Company, formerly known as Nghia Binh Food Corporation, was established in 1975. Bidifood specializes in processing and exporting rice, particularly sticky and fragrant rice, as well as cassava products such as cassava slices and starch. Bidifood’s products have reached 16 countries and territories, including the United States and the European Union.

The company has four branches in the Mekong Delta, the Central Highlands, and South Central regions, with five modern rice milling and polishing factories with a total capacity of 70 tons/hour; six warehouse clusters spanning 50,000 m2, capable of processing and exporting over 120,000 tons of rice, 100,000 tons of cassava slices, and other agricultural products annually.

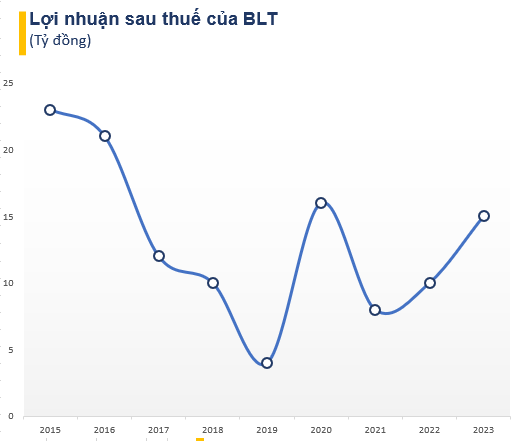

Regarding business performance, Bidifood witnessed impressive revenue growth from 2015 to 2021, peaking in 2021 at over 1,700 billion VND. However, profit margins did not match the revenue scale, hovering in the single-digit billion-dong range and showing a declining trend in recent years.

In terms of business performance, the company recorded a net revenue of 1,478 billion VND in 2023, a 61% increase compared to the previous year. After expenses, the company’s net profit reached nearly 14.5 billion VND, a nearly 46% increase compared to 2022.

Looking ahead to 2024, the company has set a revenue target of 1,250 billion VND, a 15.4% decrease year-on-year. The expected pre-tax profit is projected to decrease significantly by 57% to 7.8 billion VND.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.