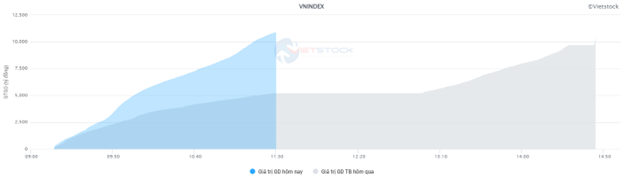

Vietnam’s stock market witnessed a volatile session on August 22nd, with the index closing slightly lower. The VN-Index ended the day down nearly 1.27 points at 1,283, while turnover remained robust, with trading value on HOSE exceeding VND 15,600 billion. However, foreign investors’ net selling pressure weighed on the market, with net outflows of nearly VND 545 billion across all exchanges.

Foreign investors net sold VND 473 billion on the HOSE

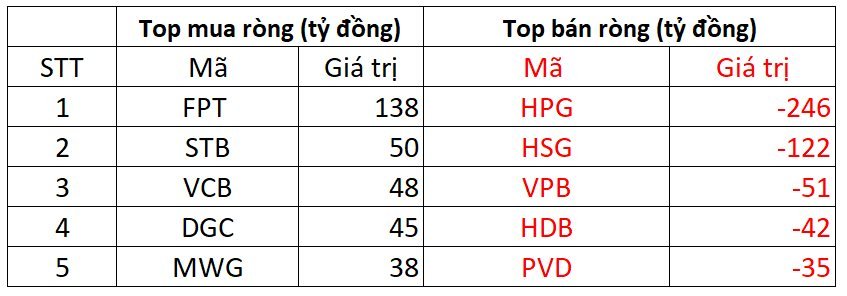

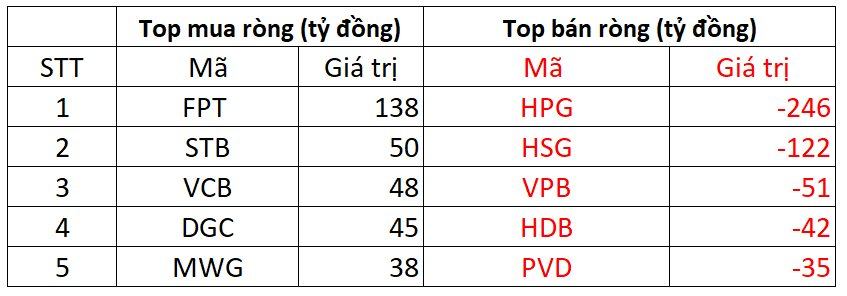

On the buying side, FPT witnessed the largest net buying by foreign investors, with a significant transaction of over VND 138 billion. STB and VCB followed suit, with net purchases of VND 50 billion and VND 48 billion, respectively. Additionally, DGC and MWG also attracted net foreign inflows of VND 45 billion and VND 38 billion, respectively.

On the other hand, HPG faced the strongest selling pressure from foreign investors, with net outflows of nearly VND 246 billion. HSG and VPB also witnessed net selling of VND 122 billion and VND 51 billion, respectively.

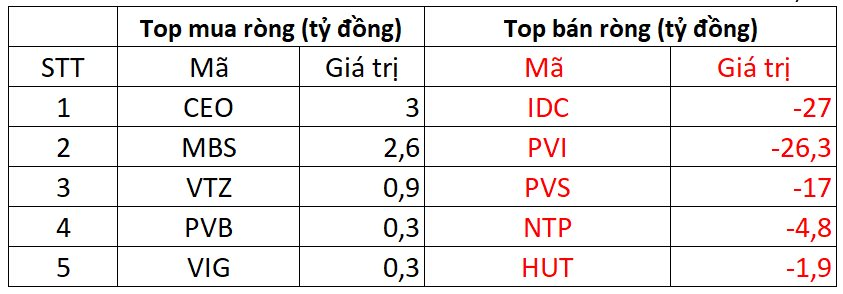

Foreign investors net sold VND 82 billion on the HNX

CEO topped the list of net bought stocks on the HNX, with net purchases of VND 3 billion. MBS followed closely, with net buying of VND 2.6 billion. Additionally, foreign investors also net bought a few hundred million VND worth of VTZ, PVB, and VIG.

On the selling side, IDC faced the highest net selling pressure, with net outflows of nearly VND 27 billion. PVI, PVS, and NTP also witnessed net selling of a few billion to tens of billions of VND.

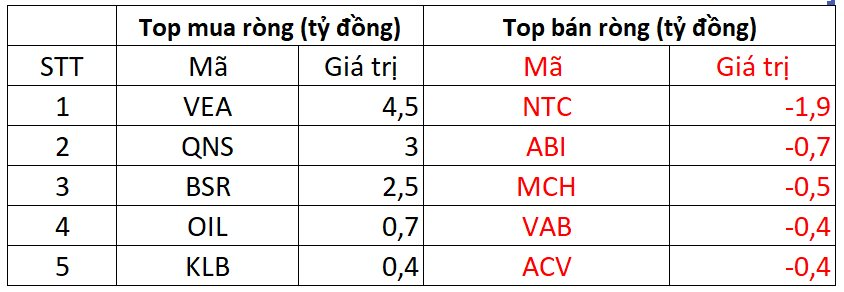

Foreign investors net bought VND 10 billion on the UPCOM

In contrast, NTC faced net selling pressure from foreign investors, with net outflows of nearly VND 2 billion. ABI and MCH also witnessed net selling by foreign investors.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.