On August 23, the Investigation Police Agency of the Ha Giang Provincial Police decided to initiate a prosecution and arrest for three months Mrs. Nguyen Lan Huong (DOB: 1973), Chairwoman of the Board of Directors of Duoc Bao Chau Joint Stock Company (DuocBaoChau), for “Illegally printing, issuing, buying and selling invoices and documents for the state budget collection and expenditure.”

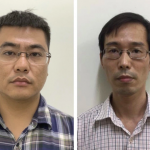

The Investigation Police Agency of Ha Giang Provincial Police executes the temporary detention order against Nguyen Lan Huong. Photo: Ha Giang Police.

|

According to the investigation results, Huong took advantage of the State’s regulations on enterprise registration conditions, the mechanism of self-declaration, self-tax payment, self-printing, issuance, management, and use of invoices to establish many “shell companies” and use them to set up fictitious economic contracts and illegally issue value-added invoices to legalize inputs, outputs, and enjoy value-added tax deductions for Duoc Bao Chau Joint Stock Company.

The authorities determined that Huong committed these acts to inflate the company’s business performance results to meet the conditions for participating in the stock market and issuing shares to raise funds from investors.

In 2022 and 2023, Huong directly performed and instructed accountants to set up fake economic contracts and illegally issue 368 electronic value-added invoices with a total value of VND367 billion to serve the business bookkeeping of Duoc Bao Chau Group.

The functional forces searched the headquarters of Duoc Bao Chau Group. Photo: Ha Giang Police

|

The case is being actively investigated and clarified by the Investigation Police Agency of Ha Giang Provincial Police.

How is Duoc Bao Chau doing in business?

According to the Q4/2023 financial statements, the company had zero revenue, but due to the cost of goods sold of VND6 billion, down 94% compared to the same period, Duoc Bao Chau recorded a gross loss of VND6 billion (a profit of VND22 billion in the same period). After deducting expenses, the company suffered a post-tax loss of VND15 billion, compared to a profit of VND11 billion in the same period.

The results of Q4 further deepened the accumulated loss of Duoc Bao Chau. The company ended 2023 with revenue of only VND65 billion, down 83% compared to the previous year, and a post-tax loss of VND49 billion (a profit of VND23 billion in 2022). Compared to the plan approved by the 2023 Annual General Meeting of Shareholders, the company achieved only 14% of its revenue target.

Before the business downturn in 2023, looking back at the past from 2018-2022, Duoc Bao Chau maintained revenue in the range of VND220-380 billion and consistently made a net profit of VND24-70 billion. The company’s highest profit was in 2019, reaching over VND70 billion.

| Duoc Bao Chau’s Business Results from 2018-2023 |

As of December 31, 2023, Duoc Bao Chau’s total assets were approximately the same as the beginning of the year at VND647 billion, with VND296 billion in short-term assets. The company had only VND266 million in cash, one-tenth of the beginning of the year. Accounts receivable decreased slightly by 4% to VND135 billion. Inventories were VND160 billion, up 18%.

On the other side of the balance sheet, short-term debt increased by 17% to over VND259 billion. Short-term borrowings remained high at VND208 billion, unchanged from the beginning of the year. The company still had VND157 billion in undistributed post-tax profits, 24% lower than at the beginning of the year.

| Duoc Bao Chau’s Capital Sources from 2018-2023 |

As mentioned by the Investigation Police Agency, the notable issue is probably the stock listing. In March 2023, the company submitted a listing registration dossier to the Ho Chi Minh Stock Exchange (HOSE) with the stock code BCH. However, in the latter half of August 2023, Duoc Bao Chau withdrew the dossier, citing the reason that the stock market conditions were not suitable for listing shares and that more time was needed to review and complete the dossier as required.

Previously, on September 29, 2022, Duoc Bao Chau had submitted a listing registration dossier to HOSE. However, on December 13, 2022, HOSE announced the suspension of the dossier review due to the company’s failure to submit the complete and supplementary dossier and the required additional documents within three months of registration.

In the past, Duoc Bao Chau was fined VND350 million by the Hanoi Stock Exchange (HNX) for registering as a public company with the State Securities Commission since June 18, 2019, but failing to list or trade its securities as regulated.

Duoc Bao Chau was formerly known as Duoc Bao Chau Import-Export Joint Stock Company, established in 2014. The company mainly operates in the field of wholesale of food (such as functional foods, cosmetics, etc.) and the production and trading of non-alcoholic and alcoholic beverages and mineral water.

In 2018, the company changed its name to Duoc Bao Chau Corporation Joint Stock Company and increased its charter capital from VND30 billion to VND180 billion.

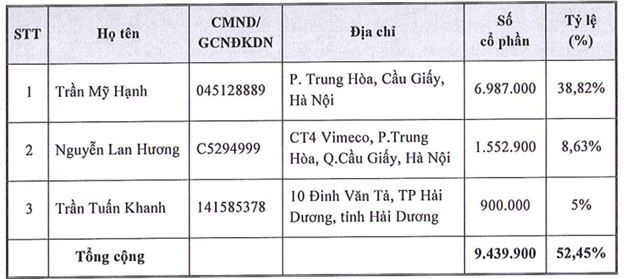

|

List of shareholders holding more than 5% of the charter capital as of December 31, 2020

Source: Duoc Bao Chau

|

[By Thanh Tu]

Finance Company Director Scams and Embezzles Over 300 Billion VND

Ha Dong District Police in Hanoi announced that the Investigation Agency has made the decision to initiate criminal proceedings against Hoang Nam (born in 1979, from Ninh Binh City, Ninh Binh Province) to investigate the crime of Fraudulent Misappropriation of Property.

Proposal to prosecute 4 corporate directors for causing a loss of over 16 billion VND in tax revenue

During the process of importing goods for business purposes, Mr. Doan Manh Duong (Director of Tan Dai Duong Company) has been accused of directing the misdeclaration of categories, names, and codes of the goods on the customs declaration in order to reduce the taxes payable. Additionally, he has been involved in facilitating illegal transactions between two other companies in terms of value-added tax invoices.

Legal lessons from ‘under-declaring property transfers’

The real estate market in Vietnam has faced significant challenges from 2020 until now. Besides objective factors leading to difficulties in real estate transactions, there have been numerous cases of lack of transparency, fraudulent activities, and deception during the transaction process. This has resulted in unpredictable legal consequences for both sellers and buyers.