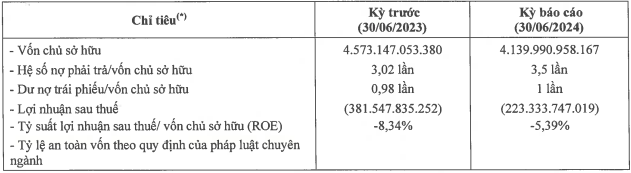

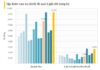

Wincommerce Joint Stock Commercial Services Company reported a post-tax loss of over VND 223 billion in the first six months of 2024. However, this figure is an improvement compared to the loss of nearly VND 382 billion in the same period last year.

The retail giant’s unprofitable business has caused a contraction in its equity, considering the figures as of June 30, 2024, in comparison to the same period last year.

|

Wincommerce’s Semi-Annual Financial Situation

Unit: VND

Source: Wincommerce’s Information Disclosure

|

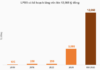

Although as of the end of the second quarter of this year, the company’s outstanding bonds were equivalent to its equity, in July, Wincommerce repurchased VND 1,140 billion of its debt ahead of schedule, with the code VCMH2025031.

After this transaction, Wincommerce has outstanding bond debt with a face value of VND 3,360 billion. These debt lots were issued in 2020 and have a term of five years, meaning they will mature within the next year.

According to information on principal and interest payments provided by Wincommerce to HNX and bondholders, also on August 22, the company paid over VND 179 billion in interest on time for the six-month period of 2024, including interest on the trillion-dollar bond lot repurchased in July.

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.