According to the Ministry of Planning and Investment, the business performance of construction enterprises in Q2 2024 improved compared to the previous quarter, with over 26% of enterprises reporting better conditions; nearly 43% maintaining stability, and almost 31% facing challenges.

For Q3, compared to Q2, about 29% of enterprises forecast better conditions; 43% expect stability, and 28% predict more difficulties.

The Ministry of Planning and Investment identified two main factors influencing the business operations of construction companies: rising raw material prices and the lack of new construction contracts.

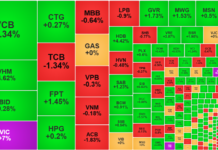

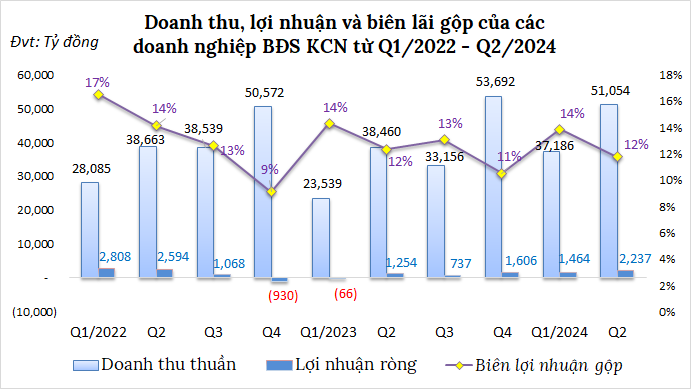

According to VietstockFinance, 96 construction companies listed on the stock exchange (HOSE, HNX, UPCoM) published their Q2 2024 financial statements, reporting a total revenue of over VND 51 trillion and a net profit of nearly VND 2,237 billion, a respective increase of 33% and 78% compared to the same period last year.

The industry has regained its footing with profits surpassing VND 2 trillion after two years. This indicates that, while the construction sector has not yet broken out, it has shown significant improvement. Gross profit margins for these companies ranged from 9-17% over the past ten quarters (since Q1 2022), with Q2 2024 recording 12%.

Source: VietstockFinance

|

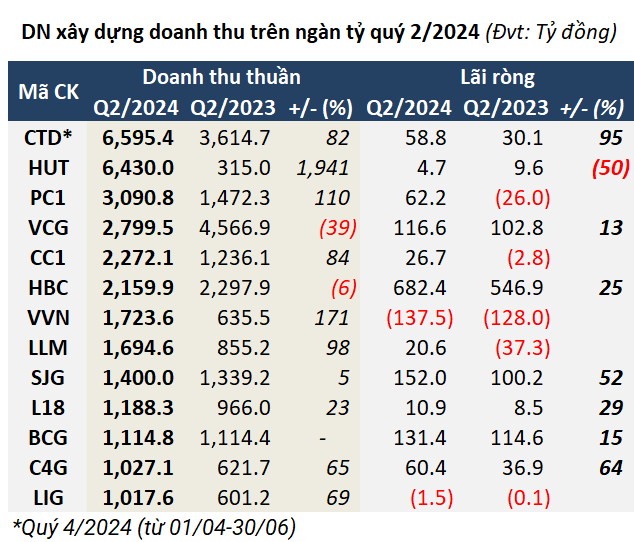

Billion-dollar Revenue

The revenue from construction contracts in Q4 2024 (April 1st to June 30th) of Coteccons, a leading construction company (HOSE: CTD), increased by 83% year-on-year to over VND 6,583 billion. This segment significantly contributed to CTD’s total revenue of more than VND 6,595 billion, an 82% increase, making it the top performer in the construction industry this quarter. Net profit reached nearly VND 59 billion, a 95% increase.

For the 2024 fiscal year (July 1st, 2023 – June 30th, 2024), CTD achieved a total revenue of VND 21,045 billion, a 31% increase, and a net profit of over VND 299 billion, quadrupling the previous year’s figure. Coteccons surpassed its annual plan by 3% in revenue and 1% in post-tax profit.

Meanwhile, Hoa Binh Construction Group (HOSE: HBC) reported a 6% decrease in revenue to nearly VND 2,200 billion in its self-prepared report. However, due to the reversal of management expenses and provisions for doubtful accounts receivable, along with the disposal of fixed assets, their net profit increased by 25% to over VND 682 billion. HBC was the most profitable construction company in Q2 and contributed 30% to the industry’s total profit.

For the first six months, HBC’s net profit exceeded VND 740 billion, compared to a loss of nearly VND 712 billion in the same period last year. The company not only achieved its 2024 profit target of VND 434 billion six months in advance but also exceeded it by nearly 71%.

CIENCO4, a leading infrastructure construction company, recorded a 65% increase in total revenue to VND 1,027 billion, mainly driven by an 88% surge in revenue from construction contracts to nearly VND 899 billion. Net profit for the quarter was over VND 60 billion, an 87% increase and the highest since its listing on UPCoM in 2018. For the first six months, C4G’s net profit reached over VND 102 billion, a 39% increase. The company has achieved 35% and 41% of its 2024 targets for revenue and post-tax profit, respectively.

Source: VietstockFinance

|

Companies with Multiplied Profits

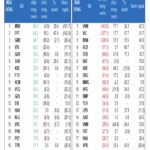

Out of the 96 companies that published their Q2 2024 financial statements, 39 (41%) reported increased profits, 21 had lower profits, 14 continued to incur losses, 15 turned a profit after previously losing money, and 7 became unprofitable. Notably, 18 companies witnessed their net profits multiply.

Topping the list is Construction and Design No.1 JSC (UPCoM: DCF) with a net profit of over VND 23 billion, 21 times higher than the same period last year, the highest since its listing on UPCoM in 2017. DCF attributed this impressive performance to the signing and execution of multiple large-scale projects and the successful acceleration of construction progress, resulting in increased revenue and profit.

For the first six months, DCF’s net profit surpassed VND 26 billion, 28 times higher than the previous year. The company has achieved 70% of its 2024 target of VND 46 billion in pre-tax profit.

LGC, a subsidiary of CII (HOSE: CII), recorded a net profit of nearly VND 240 billion in Q2, more than quadrupling the figure from the same period last year. For the first six months, LGC’s net profit reached VND 365 billion, 4.4 times higher, achieving 50% of its annual profit target.

The significant increase in gross profit was mainly due to the acquisition of BOT Trung Luong – My Thuan by LGC in Q4 2023 (owning 89%), resulting in higher revenue from toll fees. Additionally, financial income increased due to the recognition of accumulated financial interests up to the reporting date for the Ca Na Toll Station project – Km 1584+100, National Highway 1 – Ninh Thuan, owned by LGC.

SJE, or Song Da 11 JSC (HNX: SJE), also recorded an impressive net profit of over VND 69 billion in Q2, the highest since 2006 and 6.6 times higher than the same period last year. For the first six months, SJE’s net profit exceeded VND 100 billion, quadrupling the figure from the previous year. The company has achieved 67% of its 2024 target of VND 65 billion in pre-tax profit.

Source: VietstockFinance

|

Ongoing Challenges

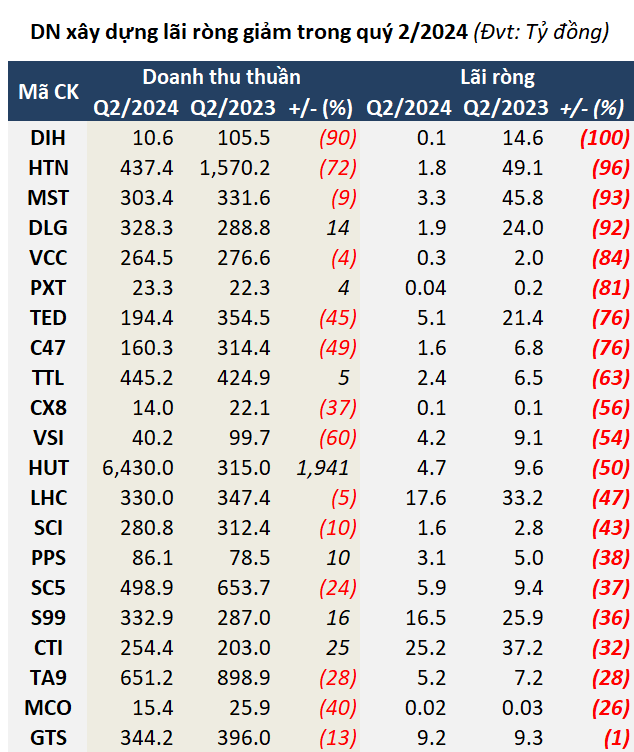

While some construction companies achieved impressive results, others faced challenges. The heaviest loss in the industry was reported by the Vietnam Industrial Construction Joint Stock Corporation (UPCoM: VVN), with a loss of nearly VND 138 billion in Q2. This marks the seventh consecutive quarter of unprofitability for the company, resulting in a six-month loss of over VND 248 billion.

Following closely behind is Vietnam Electrical Construction JSC (HOSE: VNE) with a loss of nearly VND 68 billion in Q2, compared to a loss of VND 3 billion in the same period last year. For the first six months, VNE incurred a net loss of over VND 65 billion, a significant decline from a net profit of VND 3 billion in the previous year. According to VNE, some projects continued to face challenges with compensation and site clearance procedures, resulting in delayed payments from investors. This, in turn, affected VNE’s ability to disburse funds to contractors and suppliers, hindering the progress of construction projects and timely completion for acceptance by investors. Consequently, the company’s total revenue decreased significantly.

Additionally, some companies experienced a drop in profits, such as DIH, a subsidiary of Hoi An Construction and Development Investment JSC (HNX: DIH), which saw its net profit decrease by almost 100%, leaving it with only VND 50 million in profit for the quarter, compared to nearly VND 15 billion in the same period last year.

Meanwhile, Duc Long Gia Lai Group (HOSE: DLG) reported a net profit of just under VND 2 billion in Q2, a 92% decrease. However, for the first six months, DLG’s net profit reached nearly VND 30 billion, a 7% increase.

Source: VietstockFinance

|

Thanh Tú

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Building Giants: Profitability Continues in Q4/2023 – Is the Light at the End of the Tunnel Finally Visible?

In the final quarter of 2023, Hòa Bình Construction reported a post-tax profit of over 100 billion VND, breaking the streak of four consecutive quarters of losses. Similarly, Vinaconex, Coteccons, and Hưng Thịnh Incons also reported post-tax profits of 132 billion VND, 69 billion VND, and 33 billion VND respectively.