KBC Venture Corporation, chaired by Đặng Thành Tâm, is renowned for its leadership in Vietnam’s industrial real estate market.

KBC Plans to Raise $1,000 Billion in Bonds

KBC recently announced its proposal to offer $1,000 billion in privately placed bonds to professional securities investors. The company plans to sell 1,000 bonds with a face value of $1 billion each. This bond issue is expected to be released in the third quarter of 2024, with a two-year term and a fixed interest rate of 10.5% per annum.

These bonds are non-convertible and do not include warrants. They are backed by assets and are not considered subordinate debt of the issuing organization.

The bond issue is secured by shares of Saigon – Hai Phong Industrial Corporation (a KBC subsidiary with an ownership stake of 89.26%) valued at 220% of the total face value of the bond issue.

According to the disclosed information, KBC stated that the proceeds from this bond issue will be used to restructure debts with two subsidiaries: Saigon – Bac Giang Industrial Joint Stock Company ($392 billion) and Hung Yen Investment and Development Group Joint Stock Company ($609 billion). The repayment is expected in the last two quarters of 2024.

As of June 30, 2024, KBC’s parent company had long-term loans totaling $4,351 billion from Saigon – Bac Giang Industrial Joint Stock Company (with interest rates ranging from 6.1% to 9% per annum, maturing on April 19, 2027) and $550 billion from Hung Yen Investment and Development Group Joint Stock Company (with interest rates ranging from 1% to 6% per annum, maturing on July 31, 2025).

Additionally, KBC’s parent company recorded long-term payable expenses related to these two subsidiaries, including $393 billion in long-term interest payable to Saigon – Bac Giang Industrial Joint Stock Company and $55 billion in long-term interest payable to Hung Yen Investment and Development Group Joint Stock Company.

KBC and Its Subsidiaries’ “Borrow-Repay, Repay-Borrow” Chorus

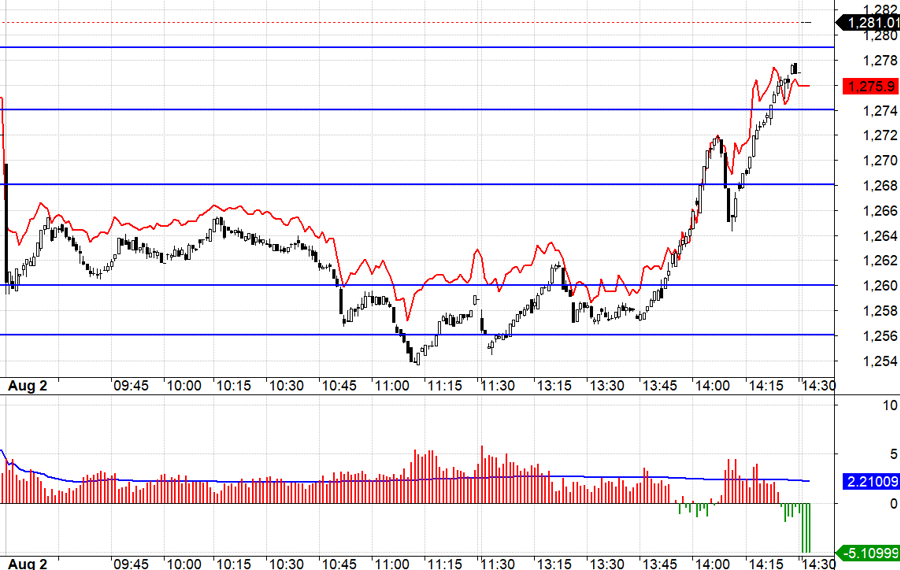

According to investors, KBC’s move to issue new bonds worth up to $1,000 billion shortly after repaying its bond debt in late 2023 could be part of a “borrow-repay” strategy between the parent company and its subsidiaries. This strategy generates funds to repay bond debts, contributing to the improvement of KBC’s financial statements.

In 2023, KBC’s parent company settled $2,882 billion in short-term bond debt (recorded as short-term borrowings) and $974 billion in long-term bond debt (recorded as long-term borrowings).

Now, just over six months later, KBC is planning to issue bonds again, this time to repay debts to its own subsidiaries.

A review of the financial data reveals significant capital connections between KBC’s parent company and its subsidiaries.

Specifically, the parent company frequently borrows from its subsidiaries, with Saigon – Bac Giang Industrial Joint Stock Company being a preferred choice.

From late 2021 to the present, KBC has borrowed from this subsidiary on seven occasions. In October 2021, they borrowed $700 billion (with a two-year term), followed by $200 billion in November 2021 (also with a two-year term). In December 2022, they borrowed a total of $500 billion in three separate transactions (again with a two-year term). Notably, in 2023, KBC’s borrowings increased significantly: they borrowed $1,000 billion in March 2023 (two-year term) and $3,000 billion in October 2023 (also with a two-year term).

During the same period, KBC also borrowed from other subsidiaries: $110 billion from Tan Lap Industrial Infrastructure Development Co., Ltd. in November 2022 (one-year term), $500 billion from Hung Yen Investment and Development Group Joint Stock Company, and $300 billion from Trang Cat Urban Development One-Member Limited Company in December 2022 (both with an 18-month term). In October 2023, they borrowed $2,500 billion from Saigon – Hai Phong Industrial Corporation (with a three-year term).

The data shows that in 2023 alone, KBC borrowed up to $6,500 billion from its subsidiaries. Interestingly, this was also the year KBC fully repaid its bond debt.

In 2024, KBC is issuing bonds again, this time to repay debts to Saigon – Bac Giang Industrial Joint Stock Company and Hung Yen Investment and Development Group Joint Stock Company.

Investors interpret the sequence of “borrow-repay, repay-borrow” actions between KBC and its subsidiaries as a potential financial maneuver or a form of debt restructuring.

In terms of business performance, KBC faced challenges in the first half of 2024, with its parent company reporting a pre-tax loss of $88 billion. To support its investments, KBC’s parent company relied on borrowings, increasing its cash and cash equivalents to $408 billion as of June 30, 2024, up from just $14 billion at the beginning of the year.

Celebrating National Independence: Local Communities Spark Joy with Festive Events.

On September 1st, numerous provinces and cities across the nation commemorated the National Day celebration of September 2nd with a variety of festive activities and events.

The Cash Flow Conundrum: Unraveling the Financial Strategies Behind Vietnam’s First Oil Refinery Project

For this project, the company can enhance the quality of its products and diversify its sources of input. This initiative allows the business to elevate its standards and showcase its ability to innovate and adapt, ensuring it remains competitive and appealing to a wider audience.