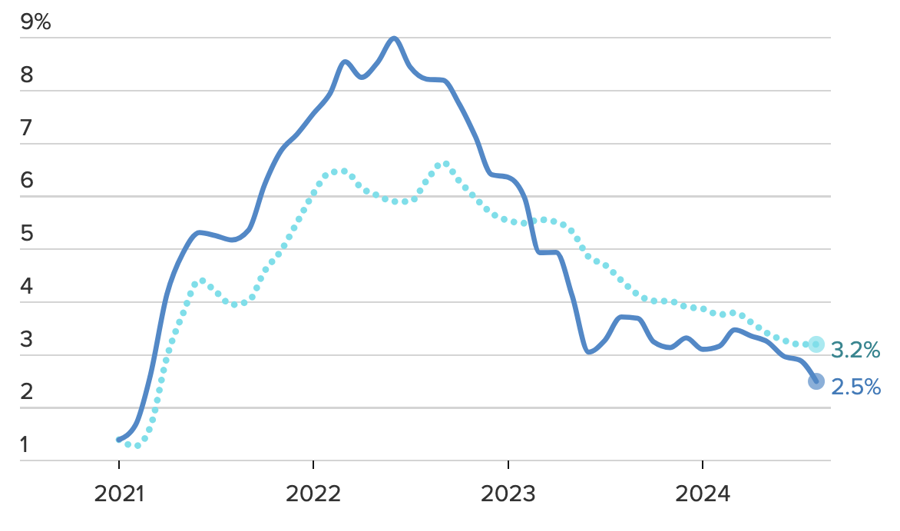

Consumer price inflation in the US for last month met forecasts, and the 12-month rate fell to its lowest since February 2021. However, this descent is thought to be enough for the Federal Reserve to reduce interest rates by only 0.25 percentage points in next week’s meeting, instead of a 0.5-point cut.

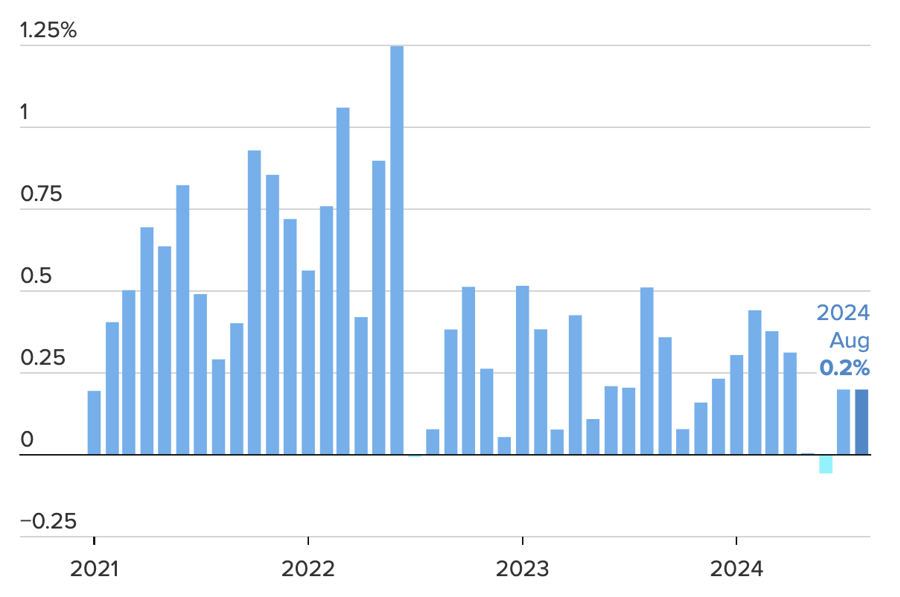

According to a report on September 11 from the US Department of Labor, the consumer price index (CPI) rose 0.2% in August, matching the forecast by economists in a Dow Jones poll. Compared to the previous year, the CPI rose 2.5%, down 0.4 percentage points from July and below the predicted 2.6% increase.

However, the core CPI—which excludes the volatile food and energy sectors—rose 0.3% from the previous month, higher than the expected 0.2% increase. Year-on-year, the core CPI rose 3.2%, in line with predictions.

These statistics indicate that inflation in the world’s largest economy is easing, but housing costs remain a challenge. The housing group in the CPI basket—which accounts for about a third of the index—rose 0.5% in August, contributing significantly to the overall index’s increase. Year-on-year, housing costs were up 5.2%.

Meanwhile, food prices rose only 0.1%, and energy prices fell 0.8% in August. The report also showed a 1% decrease in used car prices, a 0.1% drop in healthcare services, and a 0.3% increase in apparel prices.

Following the report’s release, traders in the futures market bet on an 85% chance that the Fed would opt for a 0.25-percentage-point rate cut at the conclusion of its September 17-18 meeting, according to data from the CME’s FedWatch Tool.

“This is not the CPI report the market wanted to see. Core inflation was higher than expected, making the path to a 0.5-percentage-point Fed rate cut more difficult,” said Seema Shah, chief strategist at Principle Asset Management.

“While these numbers certainly do not preclude Fed action next week, more hawkish FOMC members may seize on today’s CPI report as evidence to argue that the final leg of the disinflation journey needs to be navigated carefully. This would be a reason for the Fed to deliver a more modest 0.25-percentage-point rate cut,” Shah told CNBC.

Real wages for American workers also increased in August, with average hourly earnings rising higher than the month-on-month CPI increase, according to another report by the Bureau of Labor Statistics (BLS). Over the year, average hourly earnings adjusted for inflation rose 1.3%.

Recently, the Fed has shifted its policy priority from fighting inflation to safeguarding employment. Since April, the pace of new job creation in the US non-farm sector has slowed to about half of what it was in the previous five months. Fed policymakers now say that preventing a deeper slowdown in the job market is just as crucial as combating inflation.

Inflation in the US reached a 40-year high last summer, and the campaign to curb rising prices began in March 2022. This campaign involved 11 consecutive interest rate hikes, totaling 5.25 percentage points, bringing the federal funds rate to 5.25-5.5%, the highest in 23 years.

Currently, the market is confident that the Fed will cut rates at next week’s two-day meeting, regardless of the magnitude. Reflecting these expectations, yields on 2-year and 10-year US Treasury bonds are at their lowest levels in over a year. The US Treasury yield curve recently shifted from an inverted state—a recession indicator—to a normal state. This shift is believed to signal an upcoming Fed rate cut and an economic slowdown.

The CPI report is further evidence of easing inflation, but the inflation rate in the US is still above the Fed’s 2% target. Some goods and services remain expensive or have become even more so.

“Even though inflation is easing, that doesn’t mean prices are going down. It just means they’re not rising as fast as they were. In fact, American consumers are still paying over 20% more for goods and services than before the pandemic,” said Lisa Sturtevant, chief economist at Bright MLS.

For instance, airfare prices rose 3.9% in August after falling for the previous five months. Car insurance premiums continued to rise, increasing 0.6% in August, bringing the 12-month total to 16.5%.

In contrast, falling energy prices have significantly contributed to easing inflation. Gas prices in the US fell 0.6% in August and were down 10.3% from a year earlier.