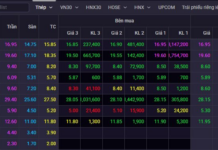

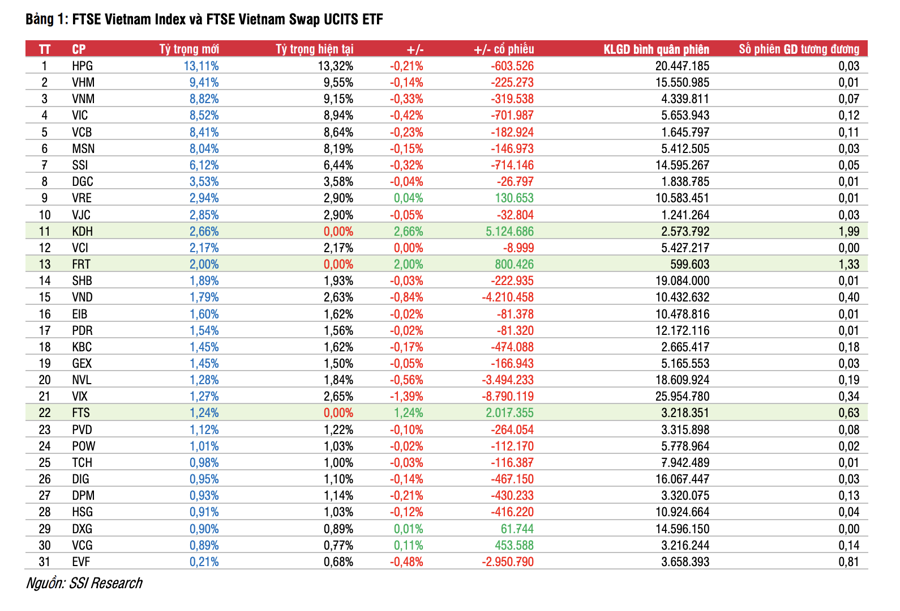

FTSE Russell and MVIS have announced the results of their recent index rebalancing. It’s important to note that these changes will take effect on September 23, so related ETFs will need to complete their portfolio restructuring by this Friday, September 20.

FTSE Vietnam Index: KDH, FRT, and FTS are being added, with no deletions.

FTSE Vietnam All-share Index: There are no additions or deletions to this index. However, it’s worth mentioning that currently, no ETFs directly use this index, so these changes won’t impact any stocks.

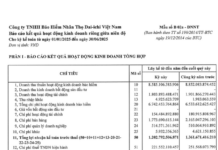

The FTSE Vietnam Swap UCITS ETF has a total asset value of $291.6 million as of September 12, 2024. Specifically, the fund’s total assets have decreased by 17% since the beginning of the year, with a net asset outflow of $51 million and a 3.8% decline in NAV during this period. Based on the new index portfolio results, VnDirect estimates that the fund will purchase approximately 5.1 million KDH shares (2.66% weight), 800,000 FRT shares (2% weight), and 2 million FTS shares (1.24% weight).

At the same time, the fund may sell a large number of shares in VIX (8.8 million shares), VND (4.2 million shares), NVL (3.5 million shares), and EVF (2.95 million shares).

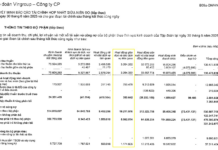

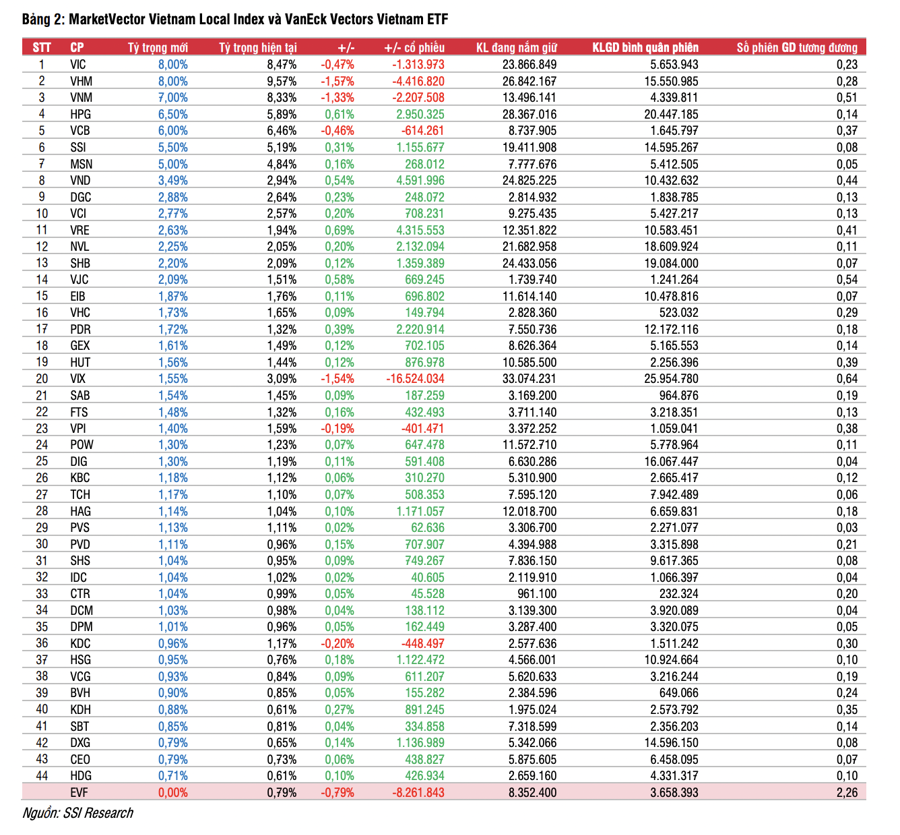

The MarketVector Vietnam Local Index has removed EVF and added no new stocks. Additionally, it’s important to note that HNG was delisted from the HSX on September 6, 2024, and subsequently removed from the index. The portfolio now includes 44 stocks.

The VanEck Vectors Vietnam ETF has a total asset value of $493 million as of September 12, 2024. Specifically, the fund’s total assets have decreased by 6.5% since the beginning of the year, with a net asset outflow of $17.3 million and a 3.3% decline in NAV.

Will MWG Stock Return to the Nearly VND 13,000 Billion ETF Portfolio with the VNDiamond 3.0 Update?

SSI Research has reported that the VNDiamond Index’s rules have been revised to tighten liquidity conditions for stocks while relaxing FOL conditions. The new rules also amend the P/E filter criteria, introduce a formal stock basket determination rule, and add a wS parameter to curb volatility in the index.