As the year-end peak season approaches, Ms. Hai Yen, owner of a specialty lotus tea business in Dong Thap, feels fortunate to continuously receive gift orders from large companies, with her workshop always bustling with packaging and delivery activities.

However, Ms. Yen also faces challenges in terms of capital rotation, balancing operating costs, and ensuring stable product quality and quantity to meet delivery deadlines.

“I’m just a small-scale household business, and I can’t compare with larger enterprises or chains in terms of scale and reputation. I’m at a disadvantage whether it’s with my suppliers or customers,” shared Ms. Yen.

According to the General Statistics Office of Vietnam, there are over 5.5 million household businesses in the country, contributing approximately 30% to the annual gross domestic product (GDP). However, many of these businesses, like Ms. Yen’s shop, face challenges due to market fluctuations. With their small scale and limited capital, they struggle to develop their production, improve working conditions, and ensure stable incomes for their workers.

Diverse guarantee products to enhance competitiveness in contract execution

Understanding the challenges faced by its customers, National Citizen Bank (NCB) has developed comprehensive and detailed solutions tailored to different industries, sectors, and business scales. As a result, NCB offers flexible financial support to accompany individual customers, small businesses, and household businesses in overcoming difficulties, expanding production, and improving business efficiency.

A notable example is the bank’s guarantee service, specifically designed for individual business customers. This service offers competitive fees, simple procedures, and quick processing times.

NCB continuously introduces practical products to directly support individual customers and household businesses.

|

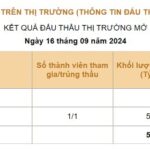

Through this service, business owners can access a range of guarantee products, including payment, bid, contract performance, and advance payment guarantees. Customers can apply for guarantees by pledging their deposit balance in their payment or escrow account at NCB or by using their term deposits or securities issued by NCB.

The guarantee period is also flexible and can be tailored to the economic contract, reducing financial worries for business owners and enhancing their credibility with partners during contract execution and sales transactions.

Ms. Hong Anh, owner of a fashion boutique in Danang, pointed out: “For large orders, suppliers often require advance payments, high deposits, or guarantees.”

“A few days ago, I applied for a bank guarantee from NCB to meet the requirements of a potential partner. Fortunately, NCB’s streamlined and efficient processes meant that I received the guarantee letter just a few hours after contacting them. This not only optimized my costs but also enhanced my credibility during contract negotiations,” added Ms. Hong Anh.

Easy refinancing with attractive interest rates

Mr. Minh Phuc, owner of an industrial machinery and equipment rental shop in Hanoi, shared his experience: “I borrowed nearly VND 2 billion from a private bank to invest in expanding my business. After the promotional interest rate period, my loan interest rate increased to 13% per annum, significantly increasing my repayment pressure.”

Upon learning about NCB’s refinancing package with interest rates as low as 5.49% per annum, Mr. Phuc consulted with the bank and found a suitable package for his financial situation.

“Refinancing with NCB has lightened my burden significantly. I didn’t have to worry about settling the old loan, and I benefited from a very attractive interest rate in the first year. Even after the interest rate floated, it was still much lower than my previous loan,” said Mr. Phuc.

NCB’s refinancing package is becoming a popular choice for customers due to its attractive interest rates.

|

With NCB’s refinancing package, customers can transfer their loan files from other banks without having to prepare funds to settle the old loan. Instead, NCB provides a new loan to the customer to settle the outstanding debt at the previous credit institution, with a maximum loan term equal to the remaining loan term.

Additionally, NCB allows customers to use the same collateral that was pledged at the previous bank for the new loan at NCB, with a loan ratio of up to 85% of the asset value. This simplifies the financial proof requirements, enabling customers to quickly settle their old loans. Moreover, customers can enjoy a principal grace period of up to 24 months, flexible repayment schedules, and complimentary credit cards with attractive cashback and discount benefits.

This product from NCB not only serves as a “lifeline” for small businesses and household businesses but also meets the diverse debt repayment needs of individual customers, such as loans for purchasing, constructing, or repairing real estate, consumer loans, and car loans. It effectively addresses the challenges associated with settling old loans and releasing collateral at other banks.

With its diverse, flexible, and practical policies, NCB aims to be a trusted partner for its customers, helping them navigate market challenges and focus on achieving sustainable business growth and improved efficiency.

For more information about NCB’s financial solutions, please visit the official website https://www.ncb-bank.vn/, contact any NCB branch or transaction office nationwide, or call the hotline (028) 38 216 216 – 1800 6166.

SERVICES

“Banking Sector Makes Sacrifices for the Greater Economic Good”

As of the State Bank of Vietnam’s regular press conference for August 2024, Deputy Governor Dao Minh Tu revealed that as of September 7th, credit growth had reached 7.15% compared to the end of 2023. This indicates a healthy and steady expansion of the country’s credit market, showcasing the resilience and potential of Vietnam’s economy.