Fat Racing Group JSC (code: DFF) has recently announced the forced sale of a large number of shares related to insiders.

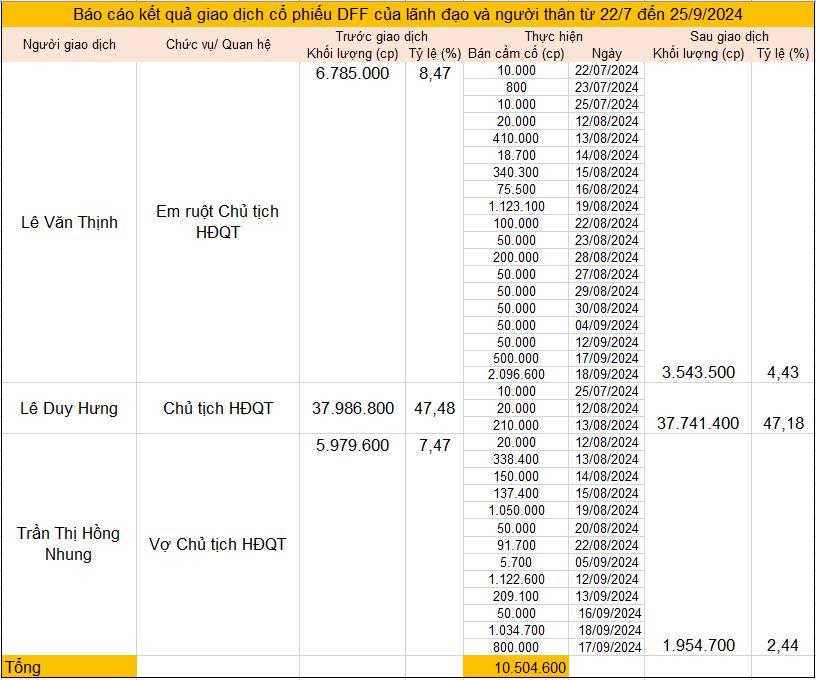

Accordingly, Mr. Le Van Thinh, the younger brother of Mr. Le Duy Hung – Chairman of Fat Racing, had 2.7 million DFF shares sold by the securities company since the beginning of September. As a result, his ownership decreased to 3.5 million units, equivalent to a ratio of 4.43% capital.

Similarly, Mrs. Tran Thi Hong Nhung, Mr. Le Duy Hung’s wife, reported that more than 3.2 million DFF shares were sold in September, reducing her ownership to less than 2 million units (a ratio of 2.44%).

In total, from July 22 to September 25, the securities company forcibly sold more than 10.5 million DFF shares of both the Chairman and his relatives.

After these transactions, the ownership ratio of Mr. Hung, his wife, and related individuals at Fat Racing has decreased to 61.57% capital, equivalent to more than 49.3 million shares.

The forced sale pressure occurred simultaneously with the downward trend of the stock price. This stock had witnessed a 29-session losing streak, with dozens of floor sessions since the beginning of July, before stabilizing and trading sideways from early August until now. Currently, the DFF reference price is at VND 2,600/share, equivalent to a “plunge” of nearly 65% in 2 months, to an all-time low.

The case of DFF shares is similar to that of HPX, NVL, and PDR in the past. The stock prices of these companies dropped sharply, triggering forced sales of the leaders’ shares.

According to our findings, Mr. Le Duy Hung was born in 1979 and studied in the Drilling major, Oil and Gas Faculty of the University of Mining and Geology. Before founding and leading Fat Racing Group in 2009, he was the construction team leader at Licogi 20 from 2002 to 2009.

He established Fat Racing in 2009, mainly operating in the field of land leveling, foundation treatment for works, demolition of structural works, and construction components… This enterprise started trading shares on UPCoM in mid-2021. In March 2022, Fat Racing doubled its charter capital from VND 400 billion to VND 800 billion.

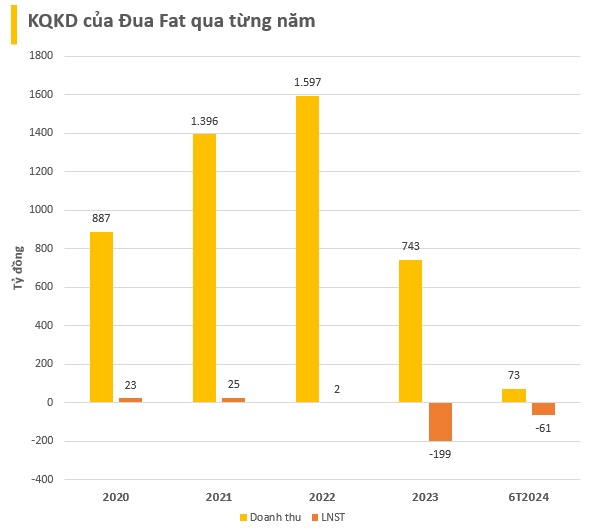

In recent years, Fat Racing’s business performance has been declining. In 2023, the company reported a significant decrease in revenue compared to the previous year, and after deducting expenses, it incurred a loss of nearly VND 200 billion. In the first half of 2024, the company continued to report losses.

Not only facing difficulties in business performance, but Fat Racing is also struggling with its debts. Firstly, Fat Racing issued the DFFH2123001 bond lot on September 1, 2021, with a maturity date of March 1, 2023, an interest rate of 11.75%/year, and a scale of VND 150 billion. However, by the due date of March 1, 2023, there was still an outstanding debt of VND 89.52 billion unpaid to the bondholders.

According to the resolution passed by the bondholders on March 2, 2023, and announced by Fat Racing, the Group, together with the bondholders, agreed on a repayment schedule extending until July 14, 2023, four months later than planned. The interest rate during the overdue period was 17.625%/year, a sharp increase compared to the initial rate.

According to Fat Racing’s Q2/2024 financial report, the balance of the DFFH2123001 bond lot was approximately VND 81.3 billion. In addition, Fat Racing also has a DFFH2124002 bond lot worth VND 299.8 billion, maturing on December 31, 2024.

As of Q2/2024, Fat Racing’s total liabilities stood at VND 3,248 billion (equivalent to 82.7%), five times its equity. The company’s financial debt alone amounted to nearly VND 2,300 billion.

The Tech Tycoon’s Plunge: Stock Plummets as Another CEO’s Foreclosure Sale Shocks the Market

As of early July, this company’s stock price has plummeted a staggering 46% in just one month. The primary reason behind this dramatic drop is the forced selling of shares by the chairman’s family. This unexpected turn of events has shaken investor confidence and raised concerns about the company’s future prospects. With such a significant decline in such a short period, the company is now facing a critical challenge and will need to take decisive action to regain its footing in the market.

HAGL Agrico Posts 13th Consecutive Quarterly Loss, Accumulated Losses Exceed VND 8,000 Billion, Leaving Only VND 6 Billion in Cash

By the end of the first quarter of 2024, HAGL Agrico had accumulated losses of VND 8,149 billion, resulting in its equity capital being only VND 2,487 billion.