5 Million VDG Shares of Van Dat Group Officially Traded on the UPCoM Market

|

On the morning of September 26, at the Hanoi Stock Exchange (HNX), the ceremony to inaugurate the trading of Van Dat Group Joint Stock Company’s shares took place. Accordingly, 5 million VDG shares were officially listed on the UPCoM market with a reference price of VND 11,000 per share.

At the close of the September 26 session, VDG shares surged to the maximum daily limit of 40%, reaching VND 15,400 per share, with a near 106,000-share buy order at the ceiling price, pushing the market capitalization from a valuation of VND 55 billion to VND 77 billion.

Source: VietstockFinance

|

Earlier, in May 2024, the Company officially became a public company, and all common shares of VDG were registered for centralized depository at the Vietnam Securities Depository (VSD).

Van Dat Group (VDG) was formerly known as Van Dat Architecture Group Joint Stock Company, established in August 2019 with three founding shareholders contributing capital of VND 1 billion, including Mr. Tran Van Anh (currently holding the position of Chairman of the Board of Directors of the Company); Mr. Chieng Quoc Kim and Mr. Le Viet Minh Phap.

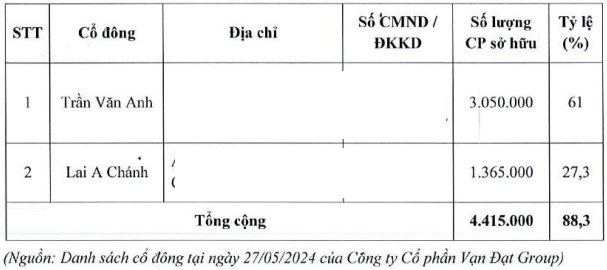

In 2021, the Company’s shareholders supplemented the capital contribution to VND 50 billion, which has been maintained to the present. According to the list of major shareholders of VDG as of May 27, 2024, Chairman Tran Van Anh owns 61% of the capital, and Mr. Lai A Chanh owns 27.3%.

Starting with real estate and multi-sector trading, in 2021, the Company decided to register more business lines and changed its name to Van Dat Group Joint Stock Company.

In order to expand and invest in the fabric production industry, in 2022, VDG acquired a 16% stake in Van Dat Textile Material Production Co., Ltd. – a company specializing in the production of fabric bags, established in 2020 with a charter capital of VND 10 billion.

According to the leadership of Van Dat Group, the Company is focusing on developing its real estate portfolio with projects of villas and adjacent houses in Binh Duong Province. Recently, VDG has also been approved in principle to invest in a project in this area.

In addition, the Company plans to expand into the functional food production sector to target the export market. Along with this is the plan to issue shares to increase capital for strategic shareholders to expand this business, aiming to be listed on the Ho Chi Minh Stock Exchange (HOSE).

Van Dat Group Chairman Tran Van Anh speaks at the inauguration ceremony of VDG share trading on UPCoM

|

How is Van Dat Group performing?

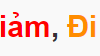

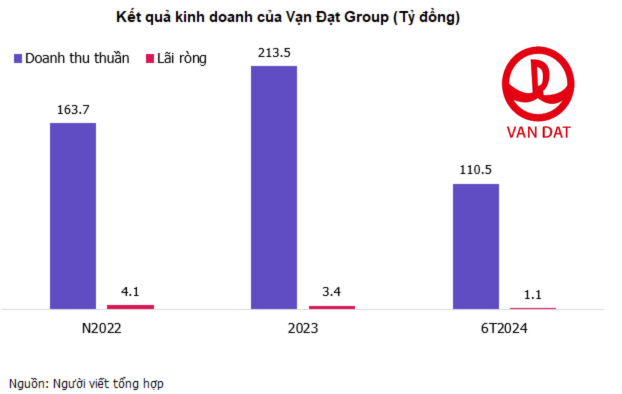

Reviewing the business results, in the last two years (2022-2023), VDG recorded a 30% increase in net revenue from nearly VND 164 billion to VND 213 billion, but profit after tax decreased to VND 2.6 billion, or VND 3.2 billion (down 19%).

In the first six months of 2024, the Company’s net revenue reached over VND 110 billion, up 35% over the same period last year, fulfilling 48% of the yearly plan. Due to the faster growth of cost of goods sold compared to selling prices, profit after tax was minuscule at just over VND 1 billion, down 17%, fulfilling 37% of the yearly target.

On the balance sheet, as of June 30, 2024, Van Dat Group’s total assets decreased by nearly 20% compared to the beginning of the year to below VND 71 billion, with the largest proportion being accounts receivable of nearly VND 23 billion and inventory (all sewing thread products) of VND 21.5 billion. The Company currently has nearly VND 5 billion in cash and over VND 1 billion in bank deposits. In contrast, payables were nearly VND 14 billion, and the Company did not use any financial borrowings.

According to the resolution of the 2024 Annual General Meeting of Shareholders, VDG plans to issue 500,000 shares to pay dividends for 2023 at a rate of 10% (holding 100 shares will receive 10 new shares). The source of issuance will come from undistributed post-tax profits in the audited financial statements for 2023 of the Company. These shares will be freely transferable, and the issuance is expected to take place in the fourth quarter of 2024.

After issuing dividend payment shares, VDG also plans to issue 275,000 ESOP shares to employees at a rate of 5% with a price not lower than VND 10,000 per share. The shares will be restricted from transfer for one year, and the issuance is expected to take place in 2024.

If both plans are fully implemented, VDG’s charter capital will increase from VND 50 billion to VND 57.75 billion.

The Hot Stock: Surging 40% on its UPCoM Debut

Van Dat Group JSC (Van Dat Group) has officially listed its shares on the UPCoM Stock Exchange, with the ticker symbol VDG, during the session on September 26th.

30 April – 1 May holiday, will stock trading take place on Saturday?

In observance of the upcoming April 30th – May 1st holiday, the exchanges will implement the holiday swap, resulting in a trading holiday on April 29th.