VN-Index Closes a Dismal Trading Week

Vietnam’s stock market ended a dismal trading week, recording a drop of nearly 33 points (equivalent to a 2.5% loss) to the 1,255 region, the sharpest decline since the end of June 2024. The downward trend during the past week was relatively swift as the VN-Index failed to break through the 1,295 (+-5) resistance level and quickly weakened, losing the dynamic MA20 and MA50-day trends.

Most experts consider this a technically negative signal, but the market is expected to find a short-term balance around the 1,240 – 1,250 range next week. Investors can take advantage of this opportunity to accumulate stocks with positive business prospects in the last two quarters of the year.

VN-Index Plummets

Low Probability of “Breaking” the 1,240-1,245 Support Region

Mr. Dinh Quang Hinh – Head of Macroeconomics and Market Strategy, VNDIRECT Analysis Block

The market experienced a week of significant losses amid investor caution due to mounting exchange rate pressure, which forced the State Bank to take countermeasures such as resuming the issuance of bills after a two-month hiatus to absorb excess liquidity in the system. This move pushed interbank interest rates higher and narrowed the interest rate differential between the VND and the USD to support the exchange rate. This situation is quite similar to the market adjustment phase in June-July.

However, VNDirect experts believe that this exchange rate pressure is only temporary as the Fed is expected to continue cutting interest rates in the coming period, thereby putting downward pressure on the USD. Specifically, the market still anticipates that the Fed will cut the benchmark interest rate by 25 basis points in the next two meetings in November and December.

At the same time, the market will continue to witness the release of Q3 business results of listed companies next week, with expectations of a generally positive picture, thus supporting the market’s valuation foundation.

Given these factors, the expert anticipates that the market will soon witness bottom-fishing forces as the VN-Index drops to the strong support region of 1,240-1,245, and the probability of breaking through this support region is low. Long-term investors can consider increasing their stock proportion when the index adjusts to this support region, prioritizing stocks with positive business prospects in the last two quarters, including banks, real estate, and import-export companies (garment, seafood, and wood industries).

In fact, VNDirect observes that, in recent months, the strategy of buying stocks near the lower bound of the accumulation channel around 1,250 points and taking profits when the VN-Index touches the upper bound of the accumulation channel at the 1,290 region has been effective.

Potential for Further Market Adjustment

Mr. Nguyen Anh Khoa – Head of Securities Analysis, Agriseco

The negative market performance affects investor sentiment and could create a selling momentum in the next phase, causing the index to continue to plummet, especially since the market currently lacks supportive information for the prospects of listed companies.

The market declined as the USD/VND exchange rate rapidly rose again, approaching the April peak. Just from the beginning of October until now, the USD rate at commercial banks has increased by nearly 3%, a substantial increase in a short period after a cooling-off phase. The USD/VND exchange rate rose sharply as the DXY index rebounded strongly to over 104 points, a roughly 4% increase in the last month. The USD strengthened due to escalating geopolitical risks in the Middle East and the Korean Peninsula, causing investors to view the USD as a safe-haven asset despite the Fed’s interest rate cut.

USD/VND Exchange Rate Surges

Faced with mounting exchange rate pressure, the State Bank resumed bill issuance to ease the pressure on the exchange rate. This is the first time the State Bank has absorbed money through bills after more than five months. Experts believe that this will impact the stock market, particularly investor sentiment. The rising exchange rate will also affect businesses’ costs, especially those relying on imported raw materials or those with USD-denominated loans. Although the exchange rate has risen rapidly in the short term, with the Fed starting the interest rate cut process, this increase is unlikely to persist.

On a positive note, after last week’s adjustment, the VN-Index has retreated to near the MA200-day trend (corresponding to the 1,250-point mark). Given that the market has quickly regained its upward momentum whenever the index retreated to this long-term support since the beginning of the year, we can expect new buying forces to emerge at this level, helping the VN-Index experience a technical rebound next week.

Assessing the market’s recovery trend, Mr. Khoa stated that, in the previous two recoveries, the market often witnessed increased buying power at the end of the day, curbing the decline or experiencing a climax sell-off with outstanding liquidity compared to the 20-session average, reflecting panic selling before a rebound. At present, the market has not shown such signals, so the probability of continued adjustment is assessed to be higher.

“80% of stocks tend to move in tandem with the main index. We believe that, given the short-term downward trend and the absence of confirmation of a reversal or early bottoming, investors should consider reducing their stock proportion during early rebounds, especially for stocks that weaken faster than the market (breaking previous supports/bottoms before the VN-Index). Maintaining a high cash proportion will enhance portfolio flexibility, preparing resources for disbursement when the market confirms a bottom,” said Mr. Nguyen Anh Khoa.

Regarding investment opportunities in the current phase, companies are sequentially announcing Q3 financial statements, with business results varying across sectors. This also causes market liquidity to be polarized, focusing on sectors with positive information and high Q3 growth, such as banks, retail, and animal husbandry.

Conversely, stocks of companies with declining profits will face adjustment pressure. The expert believes that this trend will continue in the coming sessions as the Q3 financial statement season reaches its peak, with many large enterprises announcing their results.

The banking sector is expected to report favorable business results, potentially attracting capital inflows and driving the market upward. However, polarization will occur between sectors and enterprises as the low base effect from the previous year is no longer the main story, making investment decisions more challenging.

Seize Opportunities to Invest in Undervalued Stocks

Mr. Ngo Minh Duc, Founder of LCTV Financial Investment Joint Stock Company

The VN-Index has been fluctuating around the 1,250-1,300 range with low liquidity amid various macroeconomic changes. This situation stems from the rapid appreciation of the USD/VND exchange rate in the past two weeks and the State Bank’s interventions. However, selling pressure will ease as the index approaches the critical support level of 1,240-1,250.

The market’s decline, coupled with low liquidity, indicates that buyers remain cautious about repurchasing. Last week’s adjustment mainly involved stocks that had previously surged, such as banks and securities. However, the lackluster liquidity is not a definitive sign that the market has bottomed out, as many stock groups, excluding banks, are not attracting capital inflows.

In Mr. Duc’s view, the market will find a short-term balance around the 1,240-1,250 range next week. The exchange rate adjusted in the last two sessions after reaching 25,450 VND. Additionally, the State Bank’s open market operations in the final two sessions reduced the volume of issued bills.

Currently, Mr. Duc believes that the VN-Index is in an accumulation phase for a new trend. A sharp adjustment is unlikely as the global trend is toward lower interest rates, and the rising exchange rate is only a temporary phenomenon before the US presidential election, coupled with the Treasury’s debt repayment needs.

Therefore, investors should wait for buying opportunities during short-term corrections to strong support levels. Profit-taking is advisable when the market reaches significant resistance levels like 1,280-1,300.

Investors should manage their portfolios by selecting stocks with excellent business performance and attractive valuations. Given the rising exchange rate, investors should avoid chasing stocks or the market during sharp increases, maintaining a maximum stock proportion of 50-70% in their portfolios.

Investors with negative returns due to the “table-sawing” phenomenon should restructure their portfolios, choosing stocks stronger than the market and selling stocks from which capital is being withdrawn.

According to the expert, banks remain undervalued, and investors can consider investing in this sector during market corrections. However, trading in many other sectors, such as real estate, steel, and industrial parks, should be limited due to relatively weak business performance.

The Power Players of the Stock Market: When Prop Desks and Foreign Investors Unite for a Buying Spree

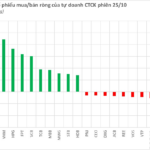

Self-net buying was 499.5 billion VND, with matched orders accounting for 338.3 billion VND of net buying. Foreign investors had a net buy of 456.1 billion VND, with matched orders contributing 398.5 billion VND to this figure.

The Power of Words: Crafting Captivating Copy for the Web

The Art of Persuasion: Unveiling the Secrets of Effective Online Communication

The proprietary trading arms of securities companies aggressively bought hundreds of billions of dong worth of stocks in the last trading session of the week.