I. MARKET ANALYSIS OF OCTOBER 29, 2024

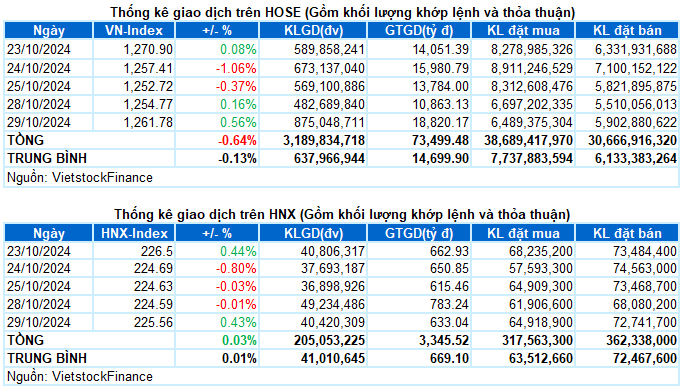

– The main indices recovered during the October 29 session. The VN-Index closed up 0.56% at 1,261.78 points; HNX-Index reached 225.56 points, up 0.43% from the previous session.

– The matching volume on HOSE reached nearly 491 million units, up 22.6% from the previous session. The matching volume on HNX increased by 4.6%, reaching more than 37 million units.

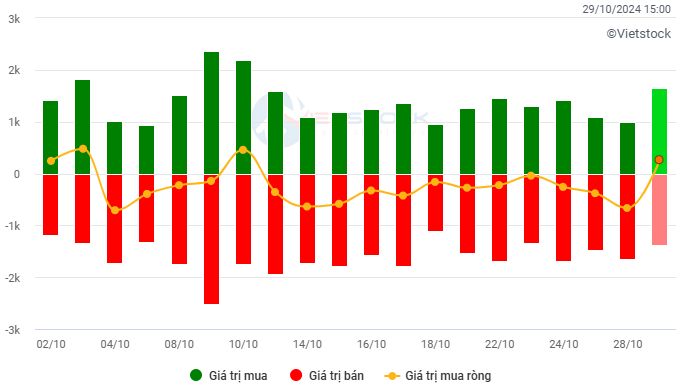

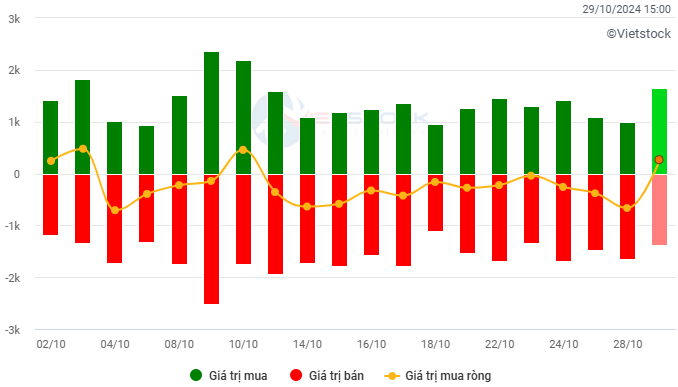

– Foreign investors returned to net buy on the HOSE with a value of nearly VND 256 billion and net sold more than VND 11 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

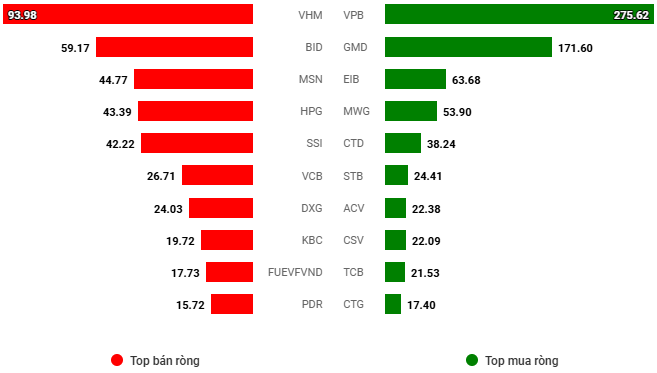

Net trading value by stock code. Unit: VND billion

– The green color returned in the trading session of October 29. The buy-side dominated from the beginning of the session and the active buying power helped to maintain the stable upward momentum until the end of the trading day. Although liquidity has improved compared to the low of the previous session, it is still below the 20-session average, indicating that investors are still cautious. At the close, the VN-Index gained more than 7 points to 1,261.78.

– In terms of impact, HVN, HDB, HPG and GVR were the stocks that led the top positive impact on the overall index, bringing in nearly 2.5 points to the VN-Index. On the opposite side, no stock exerted too much pressure on the market today, the 10 stocks with the most negative impact only took away less than 1 point from the VN-Index.

– The VN30-Index closed up 7.43 points, or 0.56%, to 1,335.76 points. The buy-side dominated with 22 gainers, 7 losers and 1 unchanged. Of which, VIB, HDB and BCM rose more than 2%, leading the gains. In contrast, the declining stocks recorded a modest decline, with TPB at the bottom, down just 0.6%.

The green color dominated all sectors. Among them, the telecommunications group continued to shine brightly with a gain of nearly 5%. Large-cap stocks in the industry all recorded outstanding gains, such as VGI (+6.53%), FOX (+2.01%), CTR (+1.25%), ELC (+1.68%), FOC (+1.1%) and YEG hitting the ceiling price, except for VNZ (-3.13%).

Following are the industrial, materials and non-essential consumer groups, all up more than 1%. Many stocks in these groups shone in purple, such as HVN, DLG, LIG; CSV, PBT, DHM; PSH, PLO, SRA,…

Divergence caused the essential consumer group to rise modestly, finishing last in today’s session. Positive buying power appeared in stocks such as VHC (+1.84%), PAN (+1.68%), MPC (+0.63%), ASM (+0.68%), IDI (+0.59%),… Meanwhile, VNM, SAB, VSF, MML, VCF, KDC,… were still dominated by red.

The VN-Index gained well in the context of trading volume still maintaining below the 20-day average. This reflects the cautious sentiment of investors. In the coming time, trading volume needs to improve to consolidate the uptrend. Currently, the Stochastic Oscillator indicator is likely to give a buy signal in the oversold region. If the indicator gives a buy signal and exits this region at the same time, the short-term outlook will become more positive.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator indicator is likely to give a buy signal

The VN-Index gained well amid trading volume still maintaining below the 20-day average. This reflects the cautious sentiment of investors. In the future, trading volume needs to improve to consolidate the uptrend.

Currently, the Stochastic Oscillator indicator is likely to give a buy signal in the oversold region. If the indicator gives a buy signal and exits this region at the same time, the short-term outlook will become more positive.

HNX-Index – Trading volume remains low

The HNX-Index increased after continuously hugging the Lower Bollinger Band. However, trading volume remained below the 20-day average, indicating that money flow has not returned to the market.

Currently, the Stochastic Oscillator indicator has given a buy signal again in the oversold region. If, in the coming sessions, the MACD indicator also gives a similar signal, the short-term outlook will be more optimistic.

Money Flow Analysis

Fluctuation of smart money flow: The Negative Volume Index indicator of the VN-Index cut down below the EMA 20-day moving average. If this state continues in the next session, the risk of a sudden drop (thrust down) will increase.

Fluctuation of foreign capital flow: Foreign investors returned to net buy in the trading session of October 29, 2024. If foreign investors maintain this action in the coming sessions, the situation will be more optimistic.

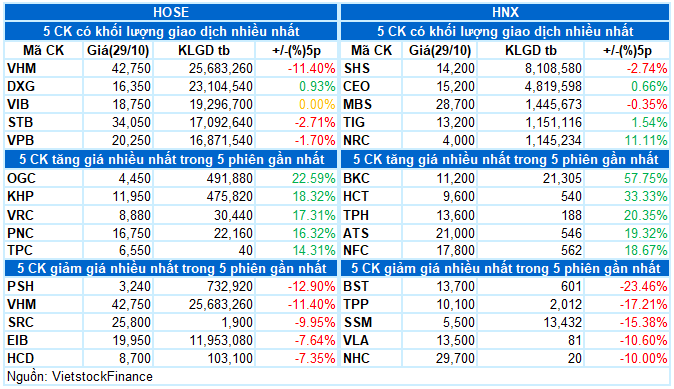

III. MARKET STATISTICS ON OCTOBER 29, 2024

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

The Gem Riverside Reality: DXG Cancels All Purchase Contracts After Prices Double

Although Gem Riverside, a project by DXG, had received bookings from customers as far back as 2018, the development remains stagnant and covered in overgrown grass today, with no signs of restarting anytime soon.

The Flow of Funds: Riding the Storm, How Far Will the Market Correction Go?

The stock market witnessed a steep decline of almost 33 points, or 2.5%, last week—the biggest drop since the end of June 2024. This significant downturn caused a break in the VN-Index’s support channel, which had been intact since the August 2024 lows. Experts unanimously deemed this a negative technical signal, a harbinger of potential challenges ahead for investors.

The Stock Market Blues: A Tale of Woes and Worries

The VN-Index has been struggling to conquer the 1,300-point threshold and is now falling deeply from this region.