Vietnam’s stock market opened on October 31st with a dip in the red, but strong bottom-fishing by investors helped the main VN-Index surpass references by the end of the morning session. In the afternoon, a flood of investor money pushed the VN-Index even higher.

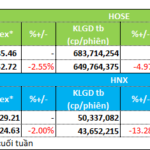

At the close of October 31st, the VN-Index rose 5.85 points to 1,264.48. The HNX-Index increased by 0.49 points to 226.36. Conversely, the UPCoM-Index decreased by 0.08 points to 92.38.

Market liquidity saw a significant improvement, with total trading value across all three exchanges reaching nearly VND 19,300 billion. On the HoSE exchange alone, liquidity exceeded VND 18,050 billion.

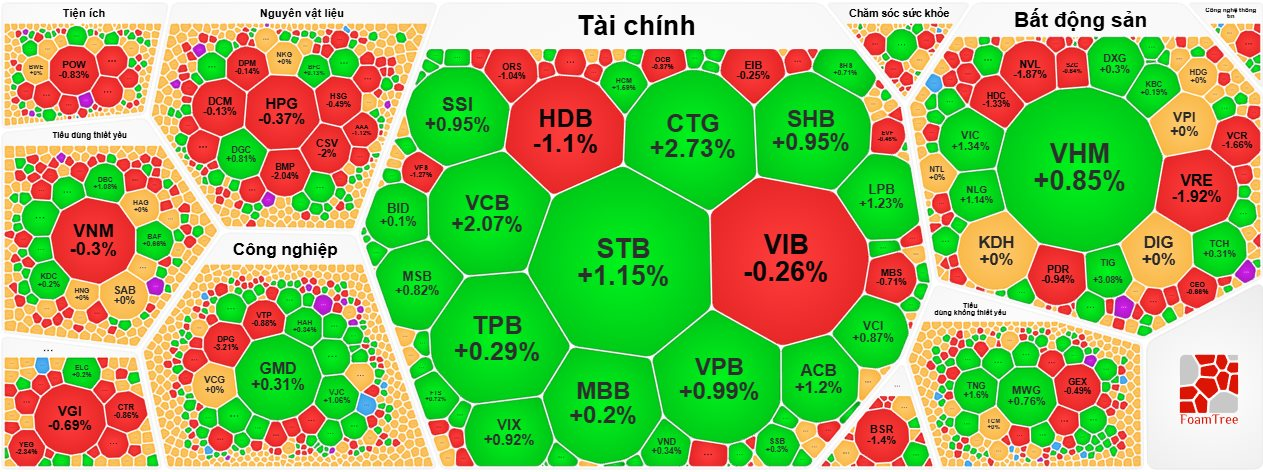

The market breadth tilted towards the green, with “king” stocks attracting strong cash flow from investors after a series of banks announced positive Q3 financial statements.

“King” stocks were in high demand during the October 31st session.

Leading the charge in this group were the “Big 4” duo of VCB (+2.07%) and CTG (+2.73%). Following closely were ACB (+1.2%), STB (+1.15%), and LPB (+1.23%). Trailing slightly were VPB, SHB, TPB, BID, and BVB, all with gains of less than 1%.

On the flip side, HDB (-1.1%), VIB (-0.26%), EIB (-0.25%), TCB (-0.42%), OCB (-0.87%), and NAB (-0.31%) saw losses.

In the real estate sector, the “Vin” duo of VHM and VIC led the charge with increases of 0.85% and 1.34%, respectively. TIG (+2.08%), NLG (+1.14%), DXG (+0.3%), TCH (+0.31%), and BCM (+1.05%) also saw gains.

Conversely, blue-chip stocks in this sector dipped into the red, with VRE (-1.92%), NVL (-1.87%), HDC (-1.33%), VCR (-1.66%), PDR (-0.94%), and SZC (-0.64%) all losing value.

Meanwhile, mid-and small-cap stocks surged, with NRC and CIG hitting the ceiling, rising 7.69% and 6.95%, respectively. QCG of Quoc Cuong Gia Lai continued its upward trajectory, climbing 6.25% to VND 11,900 per share, while CKG of Construction Kien Giang rose 6.4% to VND 26,600 per share.

Steel stocks continued their downward spiral, with HPG (-0.37%), HSG (-0.49%), VGS (-1.15%), TVN (-2.67%), and TIS (-3.08%) all losing value.

Similarly, fertilizer stocks took a hit, with CSV (-2%), DCM (-0.13%), DPM (-0.14%), and LAS (-0.47%) all declining.

Conversely, the aviation duo of HVN and VJC attracted strong investor interest, soaring 4.03% and 1.06%, respectively.

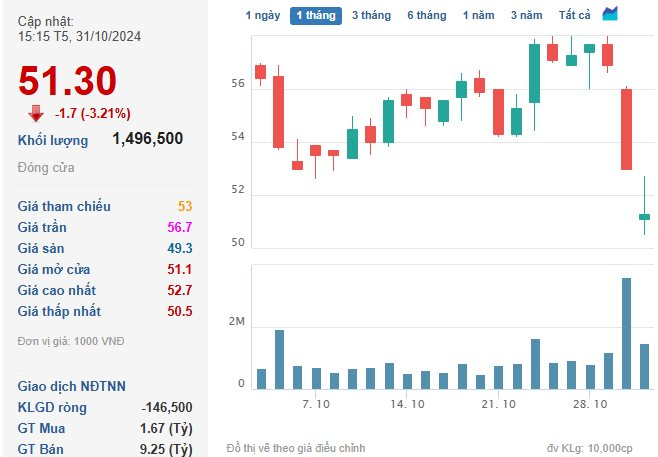

DPG of Dat Phuong Group remained in the spotlight during today’s trading session. After plunging in the previous session, DPG continued to be offloaded by investors.

DPG continued to be heavily sold off by investors. (Source: Cafef)

At the close of October 31st, DPG’s share price stood at VND 51,300, down 3.21% from the previous session, with a matched order volume of nearly 1.5 million units.

This marked the third consecutive session of losses for this stock, with a price drop of over 11% following the company’s Q3 financial report.

Foreign investors maintained their net-selling position in the stock market, offloading nearly VND 1,700 billion worth of shares on the HoSE exchange. MSN was the most sold-off stock, with a net sell value of over VND 1,332 billion. This was followed by VHM (VND 202.54 billion), STB (VND 71.11 billion), HDB (VND 57.86 billion), and MWG (VND 41.49 billion).

On the buying side, foreign investors scooped up VPB the most, with a net buy value of VND 87.59 billion. CTG (VND 42.69 billion), VIX (VND 26.93 billion), and HVN (VND 22.03 billion) were also among the top purchases.

The VN-Index Plunges to a 12-Week Low: A Bold Move to Cut Losses and Look to the Future

The market suffered a brutal sell-off in the afternoon, with trading liquidity on both exchanges doubling from the morning session, and stocks plunging across the board. The VN-Index evaporated 1.06% (-13.49 points) and broke through the short-term bottom at the beginning of October, falling to 1257.41 points.

The Cash Flow Conundrum: Unraveling the Divide in Real Estate’s Portfolio.

Market liquidity eased slightly in the past trading week. Money flow indicated a divergence among real estate stocks.

The Market Tug-of-War Rages On

The VN-Index slipped back into the red, despite positive effects from the two recent recovery sessions, indicating that the tug-of-war between bulls and bears is still ongoing. Moreover, trading volume remaining below the 20-day average suggests a lack of returning liquidity in the market. Currently, the MACD and Stochastic Oscillator indicators continue to trend downward, reinforcing bearish signals and dampening short-term prospects.

The Dollar’s Turbulent Ride: A Year-End Review of the Volatile Currency Market

Sharing at the Khớp Lệnh program on October 28, 2024, Mr. Nguyễn Việt Đức, Digital Sales Director of VPBank Securities Joint Stock Company (VPBankS), stated that the exchange rate is currently under significant pressure and has been the main factor hindering the stock market’s performance in recent times. He also highlighted the presence of numerous variables that could come into play towards the end of the year.