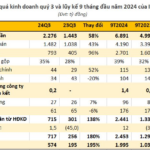

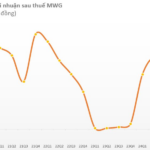

MWG, one of Vietnam’s largest iPhone 16 retailers, has reported impressive financial results for Q3 2024, with a 13% year-on-year increase in net revenue to 34.147 trillion VND. What’s more, the company’s after-tax profit soared to nearly 806 billion VND, a staggering 21-fold increase compared to the same period in 2023.

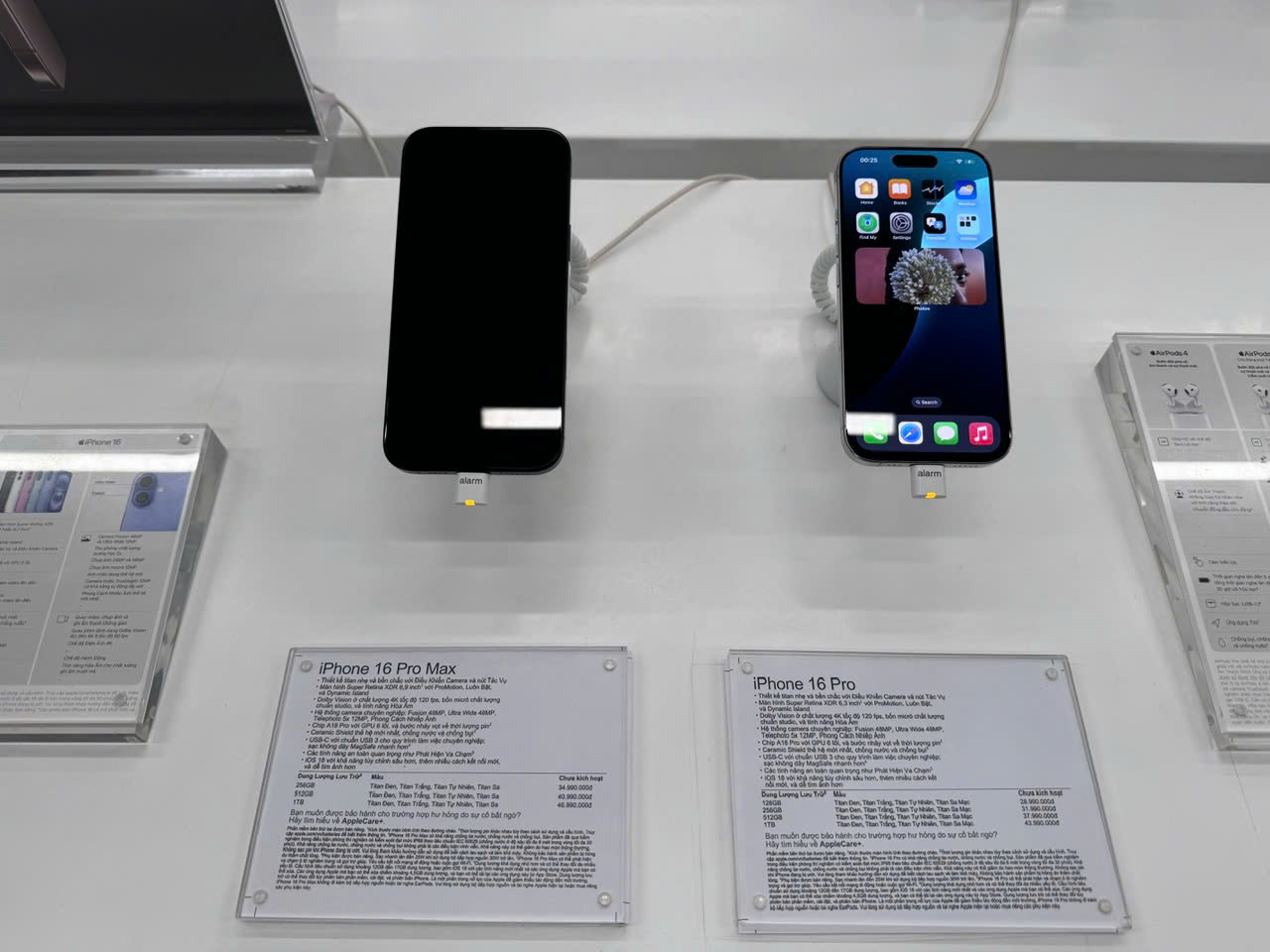

iPhone 16 Pro and iPhone 16 Pro Max were the most popular choices among customers.

For the first nine months of the year, MWG recorded a 15% year-on-year increase in net revenue to 99.767 trillion VND, with after-tax profit reaching 2.881 trillion VND. This performance surpasses the company’s annual targets, with nearly 80% of the revenue goal and a 20% surplus in after-tax profit already achieved.

The report also highlighted the performance of the MWG and Dien May Xanh chains (including Topzone), which contributed a combined revenue of 66.700 trillion VND for the first nine months, a 7% increase year-on-year. In September alone, these chains achieved a 7,800 billion VND turnover, an 8% increase compared to the same period last year and a 4% increase from the previous month.

The strong performance in September, typically a low season for electronics sales, can be attributed in part to the launch of the new iPhone models. In fact, iPhone sales in September increased by over 50% compared to August, just a few days after the new models went on sale…

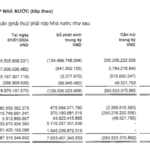

As of the end of September, MWG operated 1,023 The Gioi Di Dong stores (including Topzone), unchanged from the previous month. Meanwhile, Dien May Xanh reduced its store count by one to 2,030 outlets.

Another iPhone 16 retailer, Digiworld (DGW), reported a 15% year-on-year increase in revenue to over 6.200 billion VND for Q3 2024. This growth was driven by a 26% increase in mobile phone sales, totaling 2.230 trillion VND, thanks to strong demand for the new iPhone 16 and Xiaomi models. Additionally, the office equipment segment grew by 27% year-on-year, contributing 1.150 trillion VND in revenue.

-

Despite Store Closures, The Gioi Di Dong Maintains Sales Momentum

After accounting for management, promotional, and advertising expenses, Digiworld’s after-tax profit for Q3 reached nearly 122 billion VND, a 19% increase year-on-year. For the first nine months of the year, Digiworld achieved 16.200 billion VND in revenue and 303 billion VND in net profit, representing 71% and 62% of their annual targets, respectively.

According to preliminary reports from iPhone 16 retailers in Vietnam, approximately 40,000 units were sold on the first day of launch (September 27), generating over 1.200 trillion VND in revenue.

The Ice Cream King: Tràng Tiền Brand Owner Reports Triple Profit Plan

Despite a challenging first half of 2024, One Capital Hospitality Joint Stock Company (HNX: OCH) demonstrated resilience, posting a profit of VND 135 billion for the first nine months of the year.

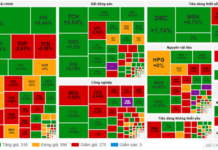

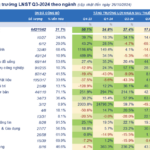

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.