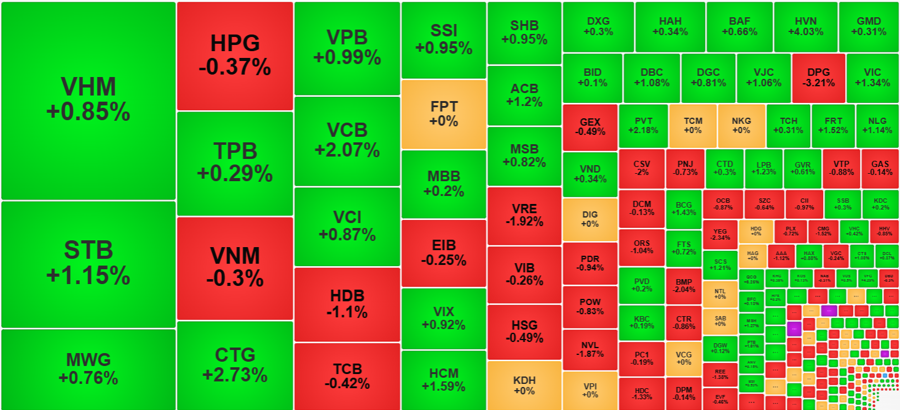

The morning’s sluggish state quickly transformed into a more dynamic afternoon session as investor sentiment improved, driving the market higher. The VN-Index made a strong recovery, led by gains in blue-chip stocks, particularly the banking sector, with VHM and VIC also contributing significantly. The index closed 5.85 points or 0.46% higher, a significant improvement from the 0.05-point loss in the morning session.

Market breadth turned positive, with 199 gainers and 169 losers (compared to 132 gainers and 212 losers in the morning). This positive shift was accompanied by a 28% increase in trading volume on the HoSE in the afternoon session, indicating stronger participation and a potential shift in market sentiment.

The VN30-Index, representing the 30 largest stocks by market capitalization, also witnessed a delayed but powerful surge, driven primarily by VCB and VHM. VHM took the lead, gaining nearly 1.9% shortly after the market reopened, while VCB accelerated later, with its price changing by +2.6% between 1:30 pm and 2:10 pm. At the close, VCB and VHM recorded solid gains of 2.07% and 0.85%, respectively, while VIC and CTG also contributed with increases of 1.34% and 2.73%.

Overall, 17 stocks in the VN30 basket improved their prices from the morning session, while 10 declined. Unfortunately, the losers included some large-cap stocks from the top 10, such as HPG, TCB, and GAS.

The positive momentum from the blue-chip and index gains trickled down to the broader market, triggering a series of reversals. Many stocks changed color, and even those that didn’t turn positive showed signs of bottom-fishing activities. In the afternoon session, 43.3% of stocks recovered more than 1% from their lows, compared to only 25.5% in the morning.

The laggards in today’s session were mostly illiquid stocks. Of the 67 stocks that closed more than 1% lower, only 13 had trading volumes exceeding 10 billion VND. On the other hand, the gainers witnessed more dynamic trading, with STB, CTG, VCB, HCM, and ACB recording transactions above 100 billion VND. HVN, DBC, VJC, VIC, and PVT also contributed to the improved liquidity, with decent trading volumes and price gains of at least 1%.

Total trading value on the two exchanges surged in the afternoon session, reaching 6,505 billion VND, a 29% increase from the morning session. However, the full-day trading value remained modest at approximately 11,556 billion VND, a 2.2% decrease from the previous session. Large block trades, particularly on the HoSE, boosted the total trading value, with approximately 7,100 billion VND in negotiated trades on that exchange alone. Across all three exchanges, the total trading value reached 19,269 billion VND, a 35% increase from the previous day.

Foreign investors continued to be net sellers in the afternoon session, with significant net selling in MSN of around 866 billion VND. For the day, MSN witnessed net selling of -1,332.8 billion VND. VHM, STB, HDB, MWG, VRE, and HPG were also among the stocks that experienced net foreign selling. On the buying side, VPB, CTG, SHB, VIX, and HVN recorded net foreign buying.

The Market Beat: When Diversification is Key

The market closed with the VN-Index down 3.15 points (-0.25%) to 1,258.63, while the HNX-Index bucked the trend, rising 0.32 points (+0.14%) to 225.88. The market breadth tilted towards decliners with 368 losers and 324 gainers. The large-cap stocks in the VN30-Index basket painted a similar picture, with 17 stocks in the red, 8 in the green, and 5 unchanged.

The Momentum of Declines Persists

The VN-Index ended the week on a bearish note, forming a Black Marubozu candlestick pattern while slicing through the middle Bollinger Band. This reinforces the increasingly pessimistic outlook. Moreover, trading volume remaining below the 20-day average underscores the growing investor caution. The MACD indicator continues its downward trajectory, reinforcing the sell signal. This suggests that the risk of short-term corrections persists.

The Wolf of Wall Street: Brokers’ Prop Trading Losses Mount in Market Rout

The proprietary trading arms of securities companies recorded net selling with a value of VND 94 billion across the entire market.

The Beat of the Market on 10/28: Indecision Looms, Telecom Services Shine Brightly

At the end of the trading session, the VN-Index rose 2.05 points (+0.16%) to 1,254.77, while the HNX-Index dipped 0.03 points (-0.01%) to 224.59. The market breadth tilted towards gainers with 389 advancers and 283 decliners. The large-cap stocks also witnessed a sea of green, as reflected in the VN30-Index, with 15 gainers, 9 losers, and 6 stocks holding steady.