The post-Covid era marks a significant turning point for the global franchising market.

Asian countries are 20-30 years ahead of Vietnam in franchising.

Technavio, a market research firm, predicts a surge in the global franchising market value from $2.9 trillion in 2023 to $4.3 trillion by 2027. This represents an astonishing 48% increase over four years, with an average annual growth rate of 9.58%. In comparison, the growth rate over the previous seven years (2017 to 2023) was only 20.8%.

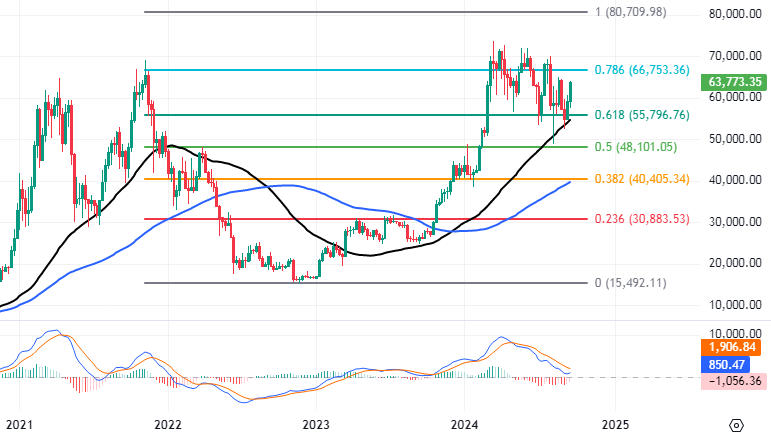

The primary driver of this robust growth is the shift in investment preferences after Covid. Investors are becoming more cautious, diversifying their portfolios, and recognizing the long-term sustainability of well-known brands. Consequently, investment funds are being redirected from real estate, cryptocurrencies, stocks, and bonds to franchising, which is perceived as a lower-risk option.

Additionally, the large-scale layoffs by major corporations post-Covid have resulted in a wave of unemployed professionals who are now turning to franchising as a means of self-employment, either as a long-term livelihood or as a supplementary source of income during the global economic crisis and the ensuing employment crisis.

As a result, franchising markets in all countries are thriving, particularly in developing countries with strong GDP growth, such as Vietnam.

“2024 has witnessed a surge in investment promotion activities in Vietnam from markets such as Japan, South Korea, Taiwan, China, Malaysia, and Singapore. With the third-largest population in Southeast Asia, Vietnam has naturally become a target market for all international franchising brands, especially those from Asia,” noted VietRF 2024 – an International Exhibition on Shop Technology and Franchise Brands in Vietnam, organized by COEX and Retail & Franchise Asia. The event featured the participation of 250 brands from 15 countries.

Compared to Vietnam, Asian countries with more advanced franchising industries have had a head start of 20-30 years, allowing them to establish numerous successful brands and models that are now being exported to Vietnam. Vietnam’s franchising industry is still in its infancy, and according to experts, it is currently in a phase of learning and adaptation to develop indigenous models and brands.

Figure 1: Scale of the franchising market in various countries.

Franchising in Vietnam: It’s Just the Beginning!

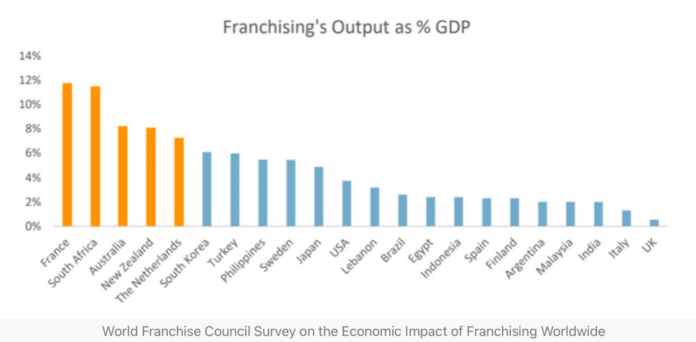

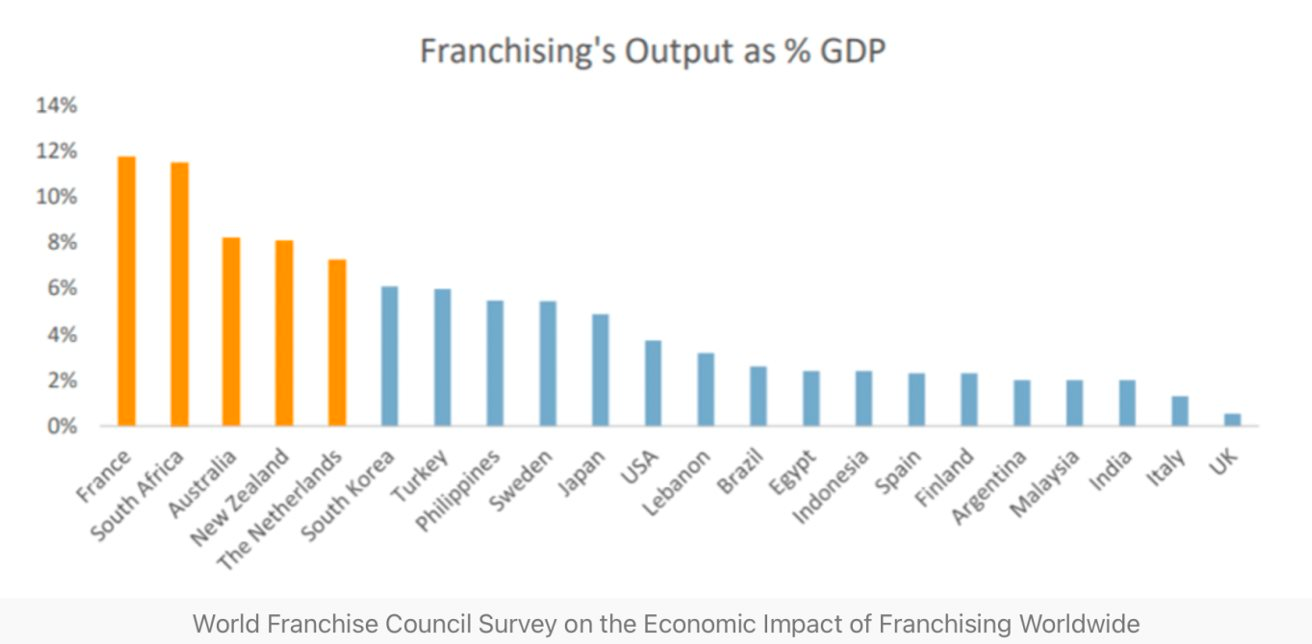

According to franchising expert Nguyen Phi Van, franchising is one of the most successful models of exporting business models and brands globally, especially for small and medium-sized enterprises (SMEs). It has caught the attention of many governments worldwide due to its significant contribution to their countries’ GDP, ranging from 3% to 12% in several cases.

The World Franchise Council (WFC) reports that several countries in the Asia-Pacific region, including Australia, New Zealand, South Korea, the Philippines, Japan, Indonesia, Malaysia, and India, have thriving franchising industries that contribute significantly to their respective GDPs.

This highlights the importance of franchising for countries aiming to develop a knowledge-based economy, as franchising represents the export of intellectual capital with the highest value.

Franchising and licensing are also the preferred methods for technology companies to accelerate their global market expansion.

Therefore, for countries aiming to foster an innovative economy, franchising and licensing offer the optimal solution for startups and SMEs facing capital and resource constraints.

“However, franchising and licensing are relatively new concepts in Vietnam. The number of Vietnamese brands that have successfully franchised internationally through exclusive national franchising can be counted on one hand, and there are hardly any brands that have franchised internationally long enough to be considered a success. It’s just the beginning,” said Phi Van.

This indicates a vast potential for market growth and presents an opportunity for Vietnamese brands aspiring to go global. Franchising is not only the best way for SMEs to accelerate their international expansion but also a revenue and brand value growth channel for large Vietnamese corporations, especially in manufacturing, agriculture, and retail.

Figure 2: Franchising Expert Nguyen Phi Van.

Vietnamese Businesses and the Two Critical Factors in Franchising

Given the nascent stage of Vietnam’s franchising industry, Phi Van pointed out two critical issues that could be considered bottlenecks for successful franchising. These are:

+ Firstly, franchisors often lack a thorough understanding of franchising and fail to establish a professional foundation to support investors in their franchising endeavors.

+ Secondly, due to the novelty of franchising in Vietnam, many investors are unfamiliar with the industry, leading to misunderstandings about their roles and responsibilities, which can result in unnecessary conflicts in collaboration.

Therefore, businesses intending to engage in franchising in Vietnam should exercise caution and focus on the following three aspects. Firstly, they must invest in building a solid franchising system, avoiding a haphazard or imitative approach that invites constant revisions.

Secondly, businesses should be prudent in selecting suitable partners and refrain from signing agreements with anyone simply because they have the financial means and the intention to invest. Franchising is not a suitable investment channel for everyone. Successful franchising investors are those who possess industry knowledge.

Lastly, businesses should pursue their market expansion in Vietnam concurrently with franchising, rather than solely relying on franchising as their only growth strategy in the domestic market. Nonetheless, whether or not they choose to franchise in Vietnam, businesses should incorporate franchising into their international expansion strategy. Franchising is one of the most effective ways for Vietnamese businesses to develop their brands and achieve success.

One notable example of a highly successful franchise is Mixue, which has become a “concern” for local brands. Commenting on the risk of an international brand dominating the market through franchising, the expert candidly stated: “This is an inevitable outcome in the knowledge economy. Those who master the formula for successful international development will come out on top.”

Phi Van expressed that instead of blaming these brands for their market dominance, Vietnamese businesses should focus on learning faster, implementing more structured strategies, and growing more rapidly to reclaim their domestic market share and compete with these international brands on a global scale.