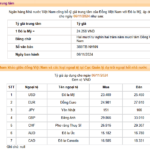

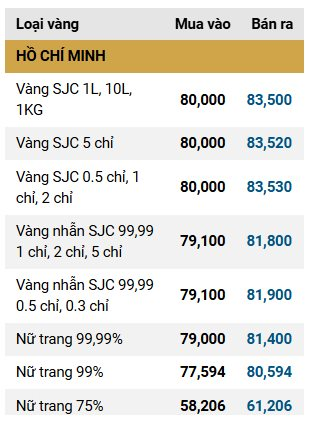

Gold prices witnessed a surge in the afternoon of November 15, with DOJI Group listing gold ring prices at 81.0-82.7 million VND per tael, an increase of 900 thousand VND on the buying side and 600 thousand VND on the selling side compared to the morning session. SJC Company also increased their prices by 400 thousand VND to 79.5-82.1 million VND per tael. Bao Tin Minh Chau followed suit with a rise of 600 thousand VND on the buying side and 450 thousand VND on the selling side, reaching 80.78-82.68 million VND per tael.

Earlier in the day, gold prices at several enterprises continued to drop by 300-400 thousand VND per tael, while most gold shops maintained their listed prices from the previous day’s close.

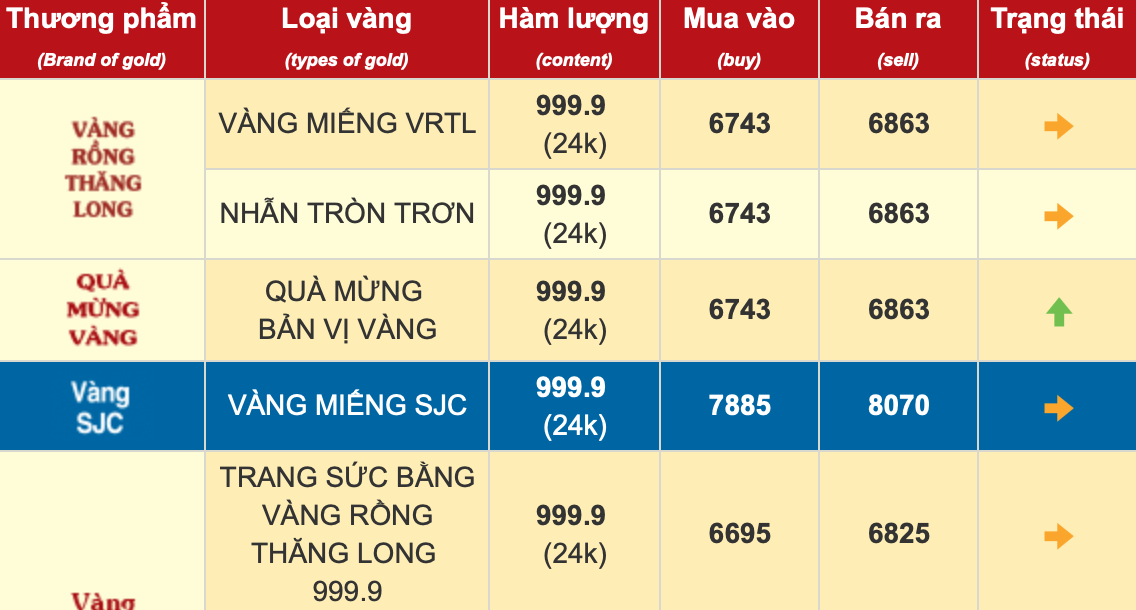

Specifically, DOJI Group listed gold ring prices at 80.1-82.1 million VND per tael, a decrease of approximately 400 thousand VND compared to the previous day. Bao Tin Minh Chau adjusted their prices for the same type of gold to 80.12-82.22 million VND per tael, while PNJ applied a range of 80.0-81.9 million VND per tael.

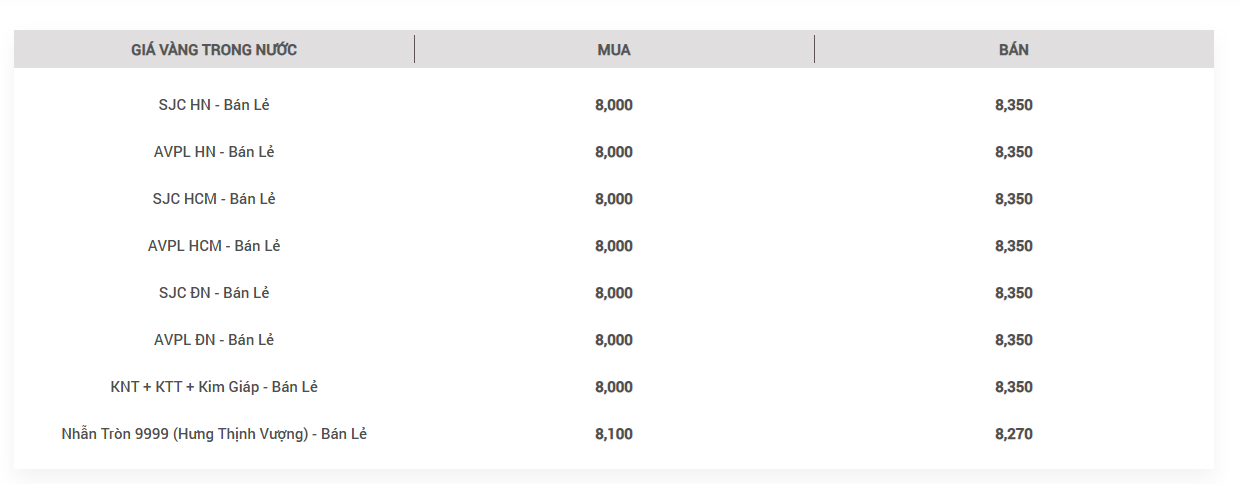

Meanwhile, SJC Company kept their gold ring and gold bar prices unchanged at 79.1-81.9 million VND and 80.0-83.5 million VND per tael, respectively.

Since the beginning of the week, domestic gold prices have dropped by approximately 3-3.5 million VND per tael. Compared to the peak at the end of October, gold prices in the country have decreased by about 8-8.5 million VND per tael.

On the international market, gold prices plunged to 2,530 USD per ounce on the night of November 14 but rebounded strongly, reaching 2,569 USD per ounce by 9:30 AM on November 15, an increase of about 39 USD from the previous night’s low.

Overall, gold has had an impressive year, hitting a record high of 2,790 USD per ounce in late October, marking a more than 40% increase from its February low. However, according to an analyst, the medium-term upward trend of gold has been damaged, and it may take time for macroeconomic factors to reignite the precious metal’s rally.

Kelvin Wong, Senior Market Analyst at OANDA, noted that the strong performance of risky assets following Donald Trump’s victory in the US presidential election prompted investors to sell gold and shift to other assets. Additionally, a stronger US dollar and rising yields on 10-year US Treasury bonds have posed significant challenges to gold. With gold breaking below the medium-term support levels of 2,600 and 2,590 USD, as well as falling below its 50-day moving average, the medium-term upward trend has been compromised. The next support levels are 2,484 and 2,415 USD; if prices break below 2,285 USD, the long-term upward trend may be at risk. To resume the upward momentum, gold prices need to surpass the medium-term resistance level of 2,664 USD and aim for the 2,850-2,886 USD zone.

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

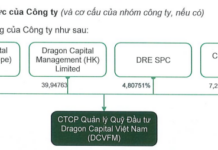

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.

The Greenback’s Fate: USD/VND Rates Ahead of the US Presidential Election Outcome

The US Presidential election results will pave the way for varying trade policy scenarios, which will have a significant impact on the global economy and, more specifically, on Vietnam.