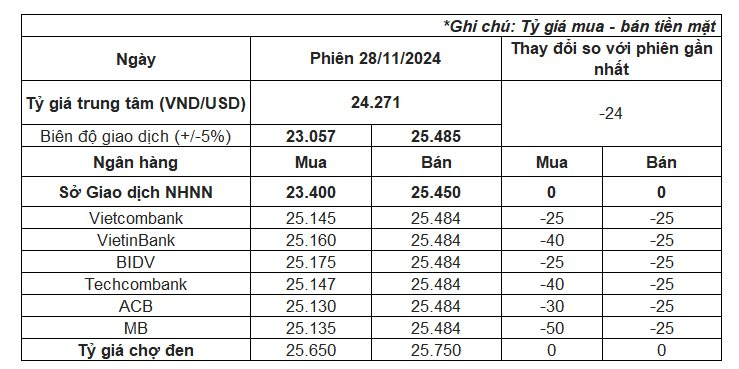

On November 28th, the State Bank of Vietnam (SBV) devalued the daily reference exchange rate by 24 VND to 24,271 VND per USD. With a 5% fluctuation band, commercial banks are allowed to trade the US dollar between 23,057 VND and 25,485 VND.

The SBV also maintained the buying/selling exchange rate applicable to foreign currency transactions by authorized entities at 23,400/25,450 VND per USD.

In the interbank market, the Vietnam dong-US dollar exchange rate ended at 25,383 VND/USD on November 28th, down 32 dong from the previous session on November 26th.

Major banks in Vietnam recorded a downward trend in the USD/VND exchange rate on November 28th. The selling rate was set at 25,484 VND/USD, 25 dong lower than the previous day, but still close to the ceiling rate allowed by the central bank (just 1 dong lower). For over a month, commercial banks have been listing the USD/VND exchange rate at or near the ceiling rate.

On the buying side, many banks significantly reduced their rates by 25-50 dong compared to the previous day’s figures.

Since the beginning of the year, the US dollar has appreciated by approximately 1,050 dong, or 4.3%, against the Vietnamese dong. Specifically, in October and November, the dong depreciated by 3% against the US dollar.

In the unofficial market, the USD/VND exchange rate remained unchanged on the morning of November 28th. Currently, money changers are buying and selling US dollars at 25,650 VND and 25,750 VND, respectively. Compared to the end of 2023, the black-market exchange rate has increased by approximately 1,000 dong, or 4%.

The cooling of the USD/VND exchange rate in Vietnam coincides with a decline in the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of major currencies, from its two-year high to below 106 points.

The USD/VND exchange rate has been under pressure recently due to the continuous appreciation of the US dollar following Donald Trump’s decisive victory in the US presidential election, as well as the Republican Party’s majority in both the Senate and the House of Representatives, which enables Trump to more easily advance his policy agenda.

Trump’s policies on issues such as immigration and new tariffs are expected to boost economic growth and inflation, reducing the likelihood of interest rate cuts by the Federal Reserve and strengthening the US dollar.

In addition to international factors, the demand for foreign currency tends to increase during this time of the year due to seasonal factors, putting further pressure on the exchange rate. Moreover, the State Treasury’s demand for foreign currency to pay off foreign debts has also contributed to the recent rise in the USD/VND exchange rate.

According to the ACB Research Department, the pressure on the exchange rate is significant, influenced by both domestic and international factors. However, the market has demonstrated a good ability to self-balance, and the SBV has not had to utilize foreign reserves to intervene.

“The exchange rate is expected to cool down in December thanks to an increase in foreign currency supply from remittances and exports,” said ACB Research Department.

The Vietnamese Dong’s Devaluation: A Tricky Tightrope for Vietnam’s Central Bank

The HSC predicts a slight increase in the policy rate to 4.75% and 5% by the end of 2025 and 2026, respectively. This forecast is based on a thorough analysis of economic indicators and market trends. With inflationary pressures mounting and a need to curb rising prices, a gradual increase in interest rates is expected to stabilize the economy and encourage sustainable growth.

The Greenback’s Freefall: A Sudden Drop

The U.S. dollar’s relentless rally on international markets came to an end last week (November 25-29, 2024) as President-elect Donald Trump’s comments on tariffs stirred up anxiety in the financial world.