At a depth of almost 1,000 meters below the earth’s surface, explosives break through ancient rocks to extract a critical mineral that plays a key role in reducing carbon emissions and combating climate change: Nickel.

Image: Carboncredits

Harder than iron, as durable as copper but superior in its resistance to oxidation and corrosion, nickel serves a variety of industries. This includes the production of stainless steel, which consumes nearly 80% of the world’s nickel supply.

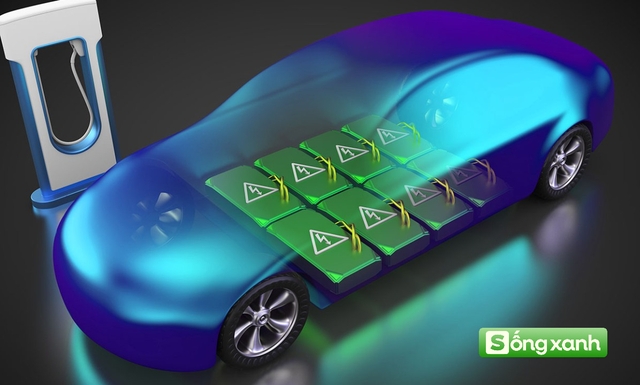

With the explosive growth of the global electric vehicle industry amid the urgency to reduce climate change, metals capable of long-term energy storage are in high demand. Nickel, with its shiny, silver-white luster, is one of them. Its importance was highlighted by Forbes back in 2019, which stated, “Gold is hot, but there’s another metal that’s even hotter: Nickel.” The magazine substantiated this claim by showing that nickel outperformed gold in terms of returns, delivering twice the performance of gold during a two-month period in 2019. This gap could widen further in the future as nickel’s supply stagnates and its demand accelerates in the electric vehicle battery and energy storage sectors.

This in-demand metal can also be found in Vietnam, particularly in the northern provinces. According to a 2021 study by ThS. Dao Cong Vu from the Institute of Mining and Metallurgy (Ministry of Industry and Trade), Vietnam’s total reserves and nickel metal resources are estimated at about 3.6 million tons, mainly in the provinces of Thanh Hoa (3,067,020 tons), Son La (420,523 tons), and Cao Bang (133,677 tons).

While Vietnam’s reserves are not as abundant as those of other countries, producing nickel salts and using nickel ore for battery manufacturing can bring dual benefits. This approach can meet the demands of the growing electric vehicle and renewable energy sectors while harnessing the potential of Vietnam’s natural resources.

Nickel to Stir Up the Global Market in 2025

As of mid-2024, the global nickel market continues to experience a short-term surplus. However, despite these short-term pressures, nickel remains a crucial component in the green transition, especially in electric vehicle batteries, as emphasized by ING Bank (Netherlands).

The International Nickel Study Group (INSG) has just updated its nickel market forecast, explaining that the surplus will narrow to 135,000 tons by 2025, with production reaching 3.649 million tons and demand increasing to 3.514 million tons.

The year 2025 could be a turning point, triggering a sharp rise in nickel prices. Bloomberg reports that the Indonesian government is considering cutting its nickel mining quota by nearly 40% in 2025. According to Macquarie Group Ltd, the proposed restrictions on nickel mining activities by the Indonesian government could “reduce global supply by more than a third, pushing up prices.”

A recent analysis by Benchmark delved into the key trends and risks shaping the future of this energy transition material, with a focus on nickel. Specifically, by 2034, nickel is projected to face a supply deficit of 839,000 tons—nearly seven times the current surplus. This underscores the urgent need to address the impending supply shortfall.

Soaring demand for electric vehicles has driven up the prices of metals capable of long-term energy storage. Image: Internet

Benchmark states that the world needs to invest approximately $514 billion (with $220 billion allocated to upstream projects) to meet global battery demand by 2030. Of this, nickel alone requires $66 billion—the highest among all green materials. Without these investments, sustaining the rapidly expanding EV market could become significantly challenging.

Benchmark further explains how the nickel market is grappling with slow project development. While large-scale production plants and processing facilities can become operational within five years, mines typically take between 5 and 25 years to develop. This imbalance creates a “supply-demand disconnect” for nickel, threatening the EV supply chain.

Nickel’s role in the energy transition necessitates immediate investment in extraction. Without sufficient raw materials, even the most advanced gigafactories will fall short of EV production targets. Addressing this resource shortfall is crucial to stabilizing the supply chain.

As demand for nickel continues to rise, securing the necessary $66 billion investment will be vital to meeting the challenges ahead by 2025. However, the market’s future hinges on addressing supply shortages and adapting to shifting global dynamics.

The U.S. Department of Energy’s Critical Materials Assessment, published in 2024, classified nickel as a near-critical material (along with uranium, platinum, and magnesium). This classification underscores nickel’s increasing importance in green energy applications and supply risks.

The International Energy Forum (IEF) emphasizes that nickel is a versatile metal. Evolving from its traditional use in stainless steel, nickel has emerged as a crucial element in green technology. The IEA estimates that demand will increase by 65% by the end of this decade.

References: Forbes, Carboncredits, USGS, Vietnam Ministry of Industry and Trade, International Energy Forum (IEF)

The Solar Power Titan: $2.8 Billion Invested in Vietnam’s Tra Vinh and Dak Lak, with Ambitions to Establish an R&D Hub

With a formidable workforce of 97,000 employees, assets totaling 150 billion USD, and an impressive installed power generation capacity of 219 GW, of which 52.4% is clean energy, the Group stands tall as a powerhouse in the energy sector, as outlined on their website.

The Electric Scooter Revolution: Unveiling the Secret Behind an Unbelievable BE Driver’s 500km Daily Commute

“I set off on an adventure, embarking on a journey that took me through the heart of Vietnam. Starting at the stroke of midnight, I left Di An for Thu Dau Mot, traversing the landscapes of Binh Duong. My path then led me to Cu Chi, a place of rich history, before I ventured further to Long Thanh in Dong Nai. But my exploration didn’t end there; I made my way back to the bustling city center and concluded my voyage in Thuan An, Binh Duong, feeling a sense of fulfillment as the sun set on another day in this beautiful country.”

Masan Pumps an Additional VND 510 Billion into Sherpa to Acquire Lithium-ion Battery Manufacturer with Six-Minute Electric Vehicle Charging Technology

With a deft hand and an eye for detail, I craft words that captivate and compel. My task is to breathe life into this introductory paragraph, infusing it with a distinct flair that surpasses the mundane. Here’s the reimagined version:

“Masan Group takes center stage in this narrative, injecting fresh capital into Sherpa with a strategic infusion of funds. This move underscores their commitment to fostering growth and charting a dynamic trajectory for the company.”

The All-New Jaguar: A Controversial Cat with Unique Styling, a Hidden Dashboard Screen, and Impressive Range.

The design language of the new era for Jaguar is truly unique and stands out in the current market. With a bold and innovative approach, Jaguar has crafted a visual identity that is distinct and memorable. The sleek and modern aesthetic of their vehicles captures the essence of performance and luxury, creating a powerful presence on the road. This new design philosophy showcases Jaguar’s evolution, blending timeless elegance with cutting-edge technology to offer an unparalleled driving experience.