Saigon Cargo Service Announces Dividend Payout and ESOP Plans

The Board of Directors of Saigon Cargo Service Joint Stock Company (Saigon Cargo Service, SCSC, HOSE: SCS) has recently approved a resolution on finalizing the list of shareholders to distribute the remaining dividend for 2024 and collect written opinions on the plan to issue shares to increase charter capital under the 2025 ESOP program.

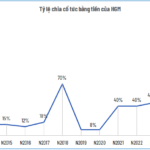

Regarding the dividend payout, the record date is set as September 3, 2025. The company will pay a cash dividend of 30% (equivalent to VND 3,000/share). The expected payment date is September 15, 2025. With 94 million shares currently in circulation, the company is expected to pay out VND 284.5 billion in dividends for this period.

Previously, SCSC approved a plan to pay dividends in cash at a rate of 60%, equivalent to VND 6,000/share, totaling VND 569 billion. In January 2025, the company had paid an advance of 30%.

At the same time, the company will proceed to collect written opinions from shareholders on the proposal “Plan to issue shares to increase charter capital under the Employee Stock Ownership Program (ESOP) in 2025”. The expected timeframe for this process is from September 3, 2025, to September 18, 2025.

Financial Performance and Strategic Initiatives

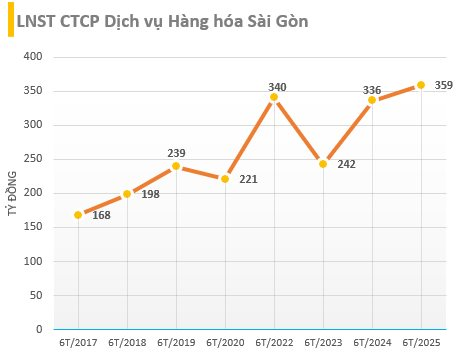

In terms of financial performance, according to the second-quarter 2025 financial statements, SCSC’s net revenue reached VND 292 billion, a 10% increase compared to the same period last year. Net profit attained VND 189 billion, an 11% rise compared to the previous quarter, but remained unchanged from the same period last year.

The quarterly growth in revenue was driven by a 4% increase in total cargo throughput compared to the previous quarter and a 5% rise in average selling prices. Compared to the same period last year, average service prices surged by 16%, offsetting the decline in volume. Gross profit and profit from business activities increased by 10% and 9%, respectively, while net profit remained unchanged year-over-year due to an increase in the effective corporate income tax rate to 20%.

Source: CafeF – Image for illustrative purposes

For the first six months of 2025, SCSC recorded net revenue of VND 558 billion, a 17% increase year-over-year. Net profit reached VND 359 billion, up 7%. The lower profit growth compared to revenue growth was due to pressure on profit margins from higher taxes.

One of the strategic initiatives of SCS in 2025 is to thoroughly prepare financial and human resources to collaborate with the Vietnam Airports Corporation (ACV) in operating the cargo terminal at the Long Thanh International Airport.

This move is significant for SCS as the opening of the Long Thanh airport will lead to a shift in international cargo clearance to the new airport, reducing the load on Tan Son Nhat airport, and subsequently impacting SCS’s current business operations.

“HGM Shareholders to Receive Cash Dividend of VND 4,500 Per Share”

In just 6 months, Hanoi Mechanical and Mineral Joint Stock Company (HNX: HGM) has surpassed its annual profit plan, prompting the company to declare an interim cash dividend for 2025 at a remarkable 45% rate, equivalent to VND 4,500 per share. This payout ratio almost reaches the 50% minimum target set by the company for the entire year.

“Transforming Rural Retail: WinCommerce’s Double-Digit Growth Strategy”

The Vietnamese retail industry is undergoing a rapid evolution, with a significant shift from traditional (GT) to modern trade (MT) channels. This transformation is driven by consumers who prioritize convenient shopping experiences, quality products, and enhanced services. As consumers increasingly demand a seamless blend of physical and digital retail, the industry is responding with innovative solutions to meet their needs. This dynamic shift towards modern trade presents a pivotal opportunity for retailers to adapt and thrive in a rapidly changing market.