In Vietnam, the National Payment Corporation of Vietnam (NAPAS) plays a pivotal role in operating the national switching system, connecting all commercial banks, credit institutions, and numerous financial entities. This system is gradually integrating Vietnam’s payment infrastructure deeply into regional and international networks.

Seamless, Secure, and Efficient Operations

On October 7th, the seminar titled “One Touch, Endless Trust – Shaping the Future of Digital Payments” was co-hosted by Tien Phong Newspaper and NAPAS under the guidance of the State Bank of Vietnam.

Speaking at the event, Mr. Nguyen Hoang Long, Deputy General Director of NAPAS, emphasized: The national switching system operated by NAPAS under the State Bank’s guidance now connects all commercial banks, credit institutions, and many financial entities, processing tens of millions of transactions daily with a total value reaching hundreds of trillions of VND. This payment infrastructure acts as the “lifeblood” of the economy, ensuring continuous capital flow and contributing to sustainable stability and growth.

Statistics show that approximately 70 million transactions are processed daily through NAPAS. QR code payments have permeated every aspect of people’s lives.

Mr. Nguyen Hoang Long – Deputy General Director of NAPAS.

To fulfill this foundational role, NAPAS focuses on maintaining 24/7 stable operations, ensuring absolute security, and continuously modernizing its technological infrastructure. Seamless 24/7 operations are the top priority. The system must process transactions at high speeds, avoiding congestion during peak periods like holidays, while ensuring synchronized connectivity across all banks. Any disruption could have a cascading effect on nationwide economic activities.

Equally critical is ensuring safety and security. Amid increasingly sophisticated cybercrime, NAPAS employs multiple defense layers: data encryption, multi-factor authentication, strict legal compliance, and proactive risk management. More importantly, maintaining user trust is essential for the sustainable growth of digital payments.

NAPAS also continuously invests in technology modernization, transitioning to international standards ISO 20022 and PCI DSS to enhance compatibility and security. A backup center ensures rapid system recovery in case of incidents. Flexible scalability allows the system to handle rapid transaction growth without interruption.

The scope of the payment infrastructure has expanded significantly, extending beyond interbank transfers to support retail payments, bill payments, and public services.

Looking ahead, NAPAS will further expand processing capacity, enhance AI applications for real-time detection of unusual transactions, and implement biometric authentication to protect users. The goal is to build a widespread, user-friendly, low-cost payment infrastructure serving both urban and remote areas, promoting financial inclusion.

Expanding Cross-Border Connectivity

With the rise in international trade and tourism, the demand for cross-border payments has become a driving force for payment infrastructure innovation.

Under the State Bank’s guidance, NAPAS has pioneered cross-border connectivity through two methods: QR code payments (VietQR Global) and NAPAS card payments.

NAPAS pioneers cross-border connectivity.

For QR payments, NAPAS has expanded its network to Thailand (2022), Cambodia (2023), and Laos (2025). Vietnamese users can pay at QR-accepting locations in these countries, while international visitors can use VietQRPay in Vietnam thanks to standardized international technical specifications. Each cross-border transaction via NAPAS has a limit of under 500 million VND, with favorable exchange rates enhancing competitiveness. Two-way connectivity with China is expected by 2026, along with expansion to Singapore, South Korea, India, Indonesia, and Japan.

Simultaneously, NAPAS card payments have been deployed. Vietnamese users can pay at over 3.4 million BC Card acceptance points in South Korea and withdraw cash from ATMs of Wooribank, NICE, CitiBank, as well as in Thailand, Malaysia, and Laos. These initiatives enhance Vietnam’s payment system autonomy, reduce reliance on international organizations, and promote regional financial integration while elevating the status of the local currency.

Moving forward, NAPAS remains committed to becoming a modern, secure, efficient, and integrated national payment infrastructure. The company will accelerate technology investment, apply AI for risk detection, expand cross-border QR services, and collaborate with international organizations to optimize costs. With seamless 24/7 operations, multi-layered security, and an expanding service scope, NAPAS is making significant contributions to digital economic and social development, solidifying Vietnam’s position on the regional and global financial map.

Tech Trends Reshaping Finance: Insights from Expert Nguyen Xuan Thanh

Mr. Nguyen Xuan Thanh, from Fulbright University, asserts that the banking sector is entering the era of artificial intelligence, and those who lag in innovation risk being left behind.

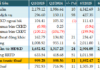

SBV Payment Surge: Cashless Transactions Hit 25x GDP in 2024

At the seminar titled “Cashless Payments: Towards Convenience, Safety, and Comprehensive Connectivity” held on the morning of October 7th, Mr. Phạm Anh Tuấn, Director of the Payment Department at the State Bank of Vietnam (SBV), revealed that in just the first 8 months of 2025, key indicators for digital payments and transactions have shown robust growth. Interbank payment transactions surged by 19% in volume and 69.1% in value. Notably, cashless payments have reached a scale 25 times the GDP of 2024.

2025 Asset Channel Realignment: Gold, Land, and Condos Take the Lead, Stocks Stabilize, While Savings and USD Yield “Lowlands”

At the “Real Estate Market Overview Q3/2025” event, themed “Leading the Beat,” Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, shared valuable insights into the current state of the real estate market.