I. MARKET ANALYSIS FOR JUNE 19, 2025

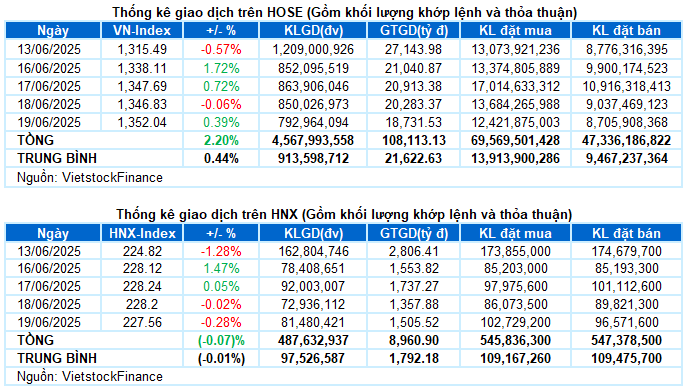

– The main indices showed mixed performance during the June 19 trading session. Specifically, the VN-Index rose by 0.39%, reaching 1,352.04 points. Conversely, the HNX-Index fell to 227.56 points, a decrease of 0.28%.

– The matching volume on the HOSE decreased by 6.7%, reaching nearly 793 million units. Meanwhile, the HNX recorded over 81 million units, an increase of 11.7% compared to the previous session’s low.

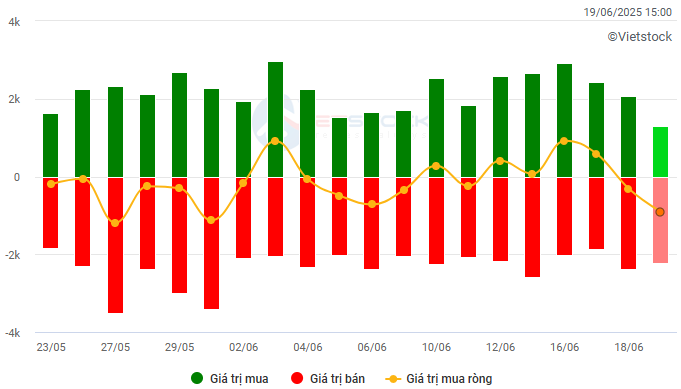

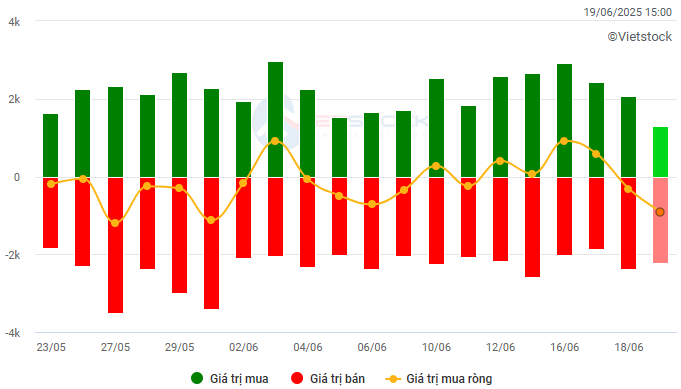

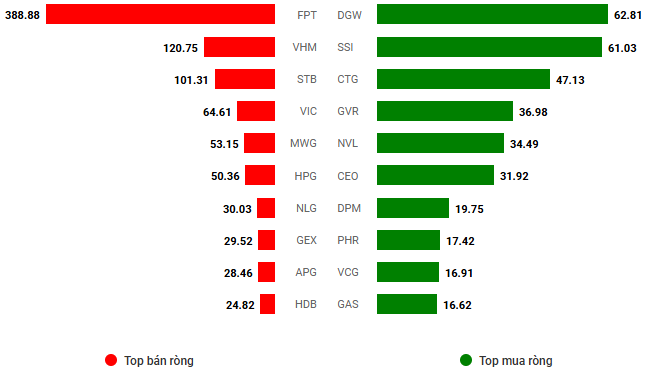

– Foreign investors continued to aggressively sell on the HOSE, with a net sell value of more than VND 896 billion, but still net bought nearly VND 22 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM exchanges by date. Unit: VND billion

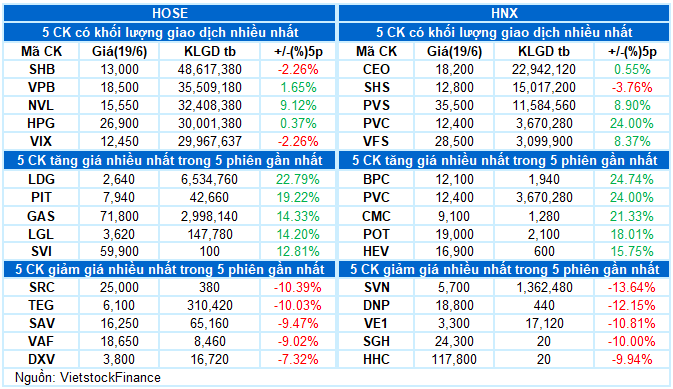

Net trading value by stock ticker. Unit: VND billion

– The stock market continued to experience strong fluctuations during the derivatives expiration session. Despite starting in the green, the buying power was not strong enough to maintain the advantage as investor caution remained evident. Selling pressure pushed the index back down, trading below the reference level in the late morning session. Efforts to support the large caps in the afternoon session helped the VN-Index challenge the 1,350-point mark once again. This time, the index successfully maintained its upward momentum until the end of the session, closing at 1,352.04 points.

– In terms of impact, TCB was the ticker with the most positive contribution to the VN-Index, adding 2 points. VIC, GVR, and CTG also contributed nearly 3 points to the index. On the other hand, HPG, FPT, and HVN were the three tickers with the most negative influence, but they only took away less than 1 point from the VN-Index.

– The VN30-Index closed 0.44% higher at 1,439.3 points. The market breadth was positive, with 17 gainers, 9 losers, and 4 unchanged tickers. TCB and GVR were the top performers, surging over 3%. In contrast, BVH and SHB were the worst performers, falling more than 1%.

Sectors showed a clear divergence. Real estate took the lead with a 0.59% gain, with notable performers including VIC (+1.59%), KBC (+3.01%), VPI (+1.16%), CEO (+4.6%), SZC (+1.67%), KHG (+1.4%), and LDG, which hit the daily limit-up.

Additionally, the financial sector also turned green, driven by large-cap stocks such as CTG (+1.37%), TCB (+3.66%), BID (+0.42%), LPB (+1.41%), EIB (+0.43%), and SSB (+0.84%)

In contrast, the energy sector continued to correct, falling more than 1%, mainly due to large-cap stocks such as BSR (-1.31%), PVS (-1.11%), PVD (-0.23%), and PVC (-0.8%)…

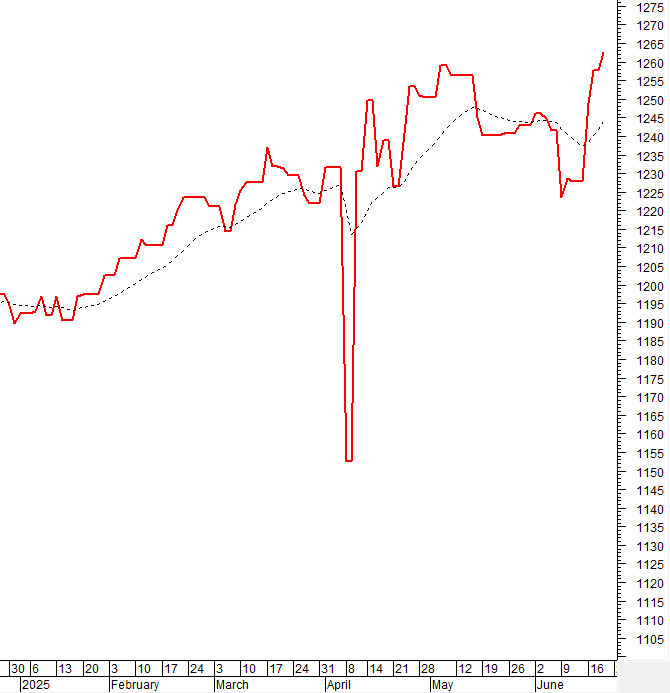

The VN-Index advanced and successfully broke above the 1,350-point resistance level. However, a confirmation from trading volume is needed to reinforce the sustainability of this upward trend. Currently, the Stochastic Oscillator is trending upward and has given a buy signal, while the MACD may also provide a similar signal as the gap with the Signal Line narrows. These indicators support the positive short-term outlook for the index.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Breaking Above the 1,350-Point Resistance

The VN-Index rose and successfully surpassed the 1,350-point resistance level. However, confirmation from trading volume is necessary to solidify the robustness of this upward trend.

At present, the Stochastic Oscillator continues to trend upward after generating a buy signal, while the MACD may also yield a similar signal as the gap with the Signal Line narrows. These indicators bolster the positive short-term outlook for the index.

HNX-Index – Testing the 200-day SMA

The HNX-Index continued its downward trend and is currently testing the 200-day SMA. If this level is breached in the upcoming sessions, downside risks may increase.

Additionally, trading volume has consistently remained below the 20-session average in recent times, indicating limited participation from investors.

Money Flow Analysis

Movement of smart money: The Negative Volume Index of the VN-Index has crossed above the 20-day EMA. If this state persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign capital flow: Foreign investors continued to net sell during the trading session on June 19, 2025. If foreign investors maintain this stance in the coming sessions, the situation may turn more pessimistic.

III. MARKET STATISTICS FOR JUNE 19, 2025

Economic and Market Strategy Division, Vietstock Research Team

– 5:00 P.M., June 19, 2025

The Ticking Time Bomb of Maturity: Blue-chips Bounce Back, VN-Index Soars Past 1,350 Points

The VN30 stock group’s impressive recovery this afternoon propelled the VN-Index on an upward trajectory for almost the entire session. The index closed above the reference level, with trading volume on the HoSE surging 24.3% compared to the morning session. This marks the first time since May 2022 that the VN-Index has closed above the 1350-point mark.