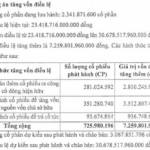

Thien Viet Securities Corporation (stock code: TVS) has recently approved a resolution to issue dividend shares for the year 2024.

The issuance ratio is set at 12% of the current outstanding shares, with a 100:12 implementation ratio, meaning shareholders holding 100 shares will receive 12 new shares.

The dividend shares will be sourced from undistributed after-tax profits and will not be subject to transfer restrictions. The issuance is scheduled for Q4/2025, following the completion of the shareholder offering.

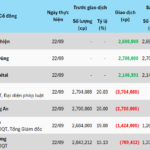

On September 24th, Thien Viet Securities finalized the list of shareholders eligible to purchase 33.4 million shares offered to existing shareholders. The rights issue ratio is 100:20, allowing shareholders with 100 shares to purchase 20 new shares.

These newly issued shares are unrestricted and transferable. Shareholders holding restricted shares will still be entitled to purchase new shares.

The registration and payment period for share purchases is from October 1st to 22nd, 2025, while the rights transfer period is from October 1st to 20th, 2025.

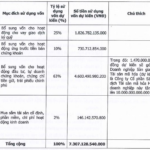

The offering price is set at VND 10,000 per share, with TVS expected to raise approximately VND 334 billion. The proceeds will be used to invest in stocks, bonds, fund certificates, and deposit agreements.

Upon completion of the offering, TVS’s outstanding shares will increase to 200.39 million, with a corresponding charter capital of over VND 2,003 billion.

Following the shareholder offering, Thien Viet Securities plans to issue over 24 million dividend shares.

In terms of business performance, TVS reported a 40.6% year-on-year decline in operating revenue to VND 411 billion for the first half of 2025.

Despite cost-cutting measures, pre-tax profit decreased by 25% to VND 115 billion. Consequently, after-tax profit stood at VND 96 billion, reflecting a nearly 25% decline compared to the same period last year. TVS attributed the profit decrease to unfavorable market conditions during this period.

DIC Corp to Offer 150 Million Shares to Fund Two Major Projects

DIC Corp is set to offer 150 million shares to shareholders at a price of 12,000 VND per share, aiming to raise up to 1.8 trillion VND in capital.

Leading Securities Firm to Invest Nearly $60 Million in Establishing a Crypto Asset Trading Platform

This leading securities firm is set to offer 365 million shares at an initial price of VND 20,000 per share, significantly boosting its chartered capital from VND 1,460 billion to over VND 5,100 billion. A key allocation of the raised capital will be directed toward establishing a cryptocurrency asset trading platform.