“A Little Mistake Won’t Be Noticed”: An Outdated Mindset

The “60-Day Intensive Campaign to Transition from Lump-Sum Tax to Declaration” is underway in many localities. However, the market is also experiencing information distortion as business owners seek “loopholes” to evade compliance. Notably, some are using dual bookkeeping systems (one internal, one for tax purposes) or low-cost software not directly connected to tax authorities to underreport revenue.

Commenting from a professional standpoint, Mr. Đỗ Duy Thanh, Director of FnB Director Consulting and Founder of Horeca Business School, asserts that the mindset of “a little mistake won’t be noticed” among small business owners is now entirely outdated.

“The tax department currently employs Big Data and AI to cross-verify data from multiple sources: electronic invoices, bank transactions, electricity consumption, and industry-specific input materials to identify anomalies,” Mr. Thanh emphasizes.

According to this expert, minor errors or deliberate revenue concealment may not be immediately detected. However, within 6-12 months, intelligent algorithms will flag these irregularities, placing the business under risk monitoring.

“Once flagged for post-audit, tax authorities can impose back taxes based on historical data, spanning up to 5-10 years,” Mr. Thanh adds.

The penalties and back taxes incurred will far exceed the tax savings initially sought.

Risks from “Seemingly Valid” Invoices

Beyond intentional evasion, Mr. Đỗ Duy Thanh warns of another pitfall: choosing the wrong tools. Many business owners opt for cheap, pirated, or non-compliant software to cut initial costs.

“An invoice may appear complete but could have incorrect XML structure, formatting, or identification codes, or fail to transmit to the Tax Department on time, rendering it invalid,” explains the Director of FnB Director Consulting.

Mr. Đỗ Duy Thanh – Photo: Vietnam F&B Summit 2025

Mr. Thanh highlights three severe legal consequences for such businesses: administrative penalties, invoice disqualification or revenue reassessment, and in-depth tax audits.

He also points out a less obvious but equally damaging risk: loss of partner trust.

“If you issue an invoice to a company and it’s deemed invalid by tax authorities, the buyer will lose the expense deduction and may hold you accountable,” he warns.

This means businesses not only face fines but also risk losing customers and market reputation.

Three Criteria for Choosing a Tax Declaration Partner

Amid the plethora of software solutions, Mr. Đỗ Duy Thanh likens selecting a provider to choosing a legal guardian. He advises business owners to scrutinize three non-negotiable criteria for long-term financial safety and transparency.

Business owners transitioning their tax models

First, ensure integration. Given the F&B sector’s reliance on POS-generated invoices, prioritize software that integrates electronic invoicing with the same brand for seamless connectivity and error reduction. Second, verify legal compliance. Providers must be certified by the Tax Department to ensure XML-compliant invoices and timely transmission to authorities. Lastly, operational support and transparency are critical. Software should enable data locking and audit trails to prevent fraud, with providers offering technical support for data verification.

“The cost saved on cheap software pales in comparison to potential audit risks,” Mr. Thanh concludes.

In Vietnam, iPOS.vn stands out as a leading provider of F&B-specific solutions, fully meeting these stringent criteria. Recognized by the General Department of Taxation, iPOS.vn’s solutions comply with Circular 78 and support businesses in adhering to the “3 Rights”: Right Regulations, Right Procedures, and Right Guidance. Choosing reputable providers like iPOS.vn is a proactive measure, ensuring F&B businesses operate confidently within an increasingly regulated environment.

iPOS.vn will launch new tax transition solutions in 2025:

FABiBox: A mobile sales management app for small businesses, optimizing operations and e-invoicing without a POS device.

Automated Bookkeeping & Tax Declaration: Ensures compliance, reduces manual effort, and minimizes tax filing errors.

How Does the Elimination of Presumptive Tax Impact Online Businesses?

The rise of online sales, social media platforms, and livestreaming has revolutionized commerce, giving birth to new roles like influencers (KOLs) and key opinion consumers (KOCs). Starting in 2026, the lump-sum tax system will be discontinued, with significant adjustments targeting e-commerce-related businesses.

Revised Title:

“Vietnam Tax Consultancy Association Chair: Annual Tax-Exempt Revenue Threshold of VND 200 Million is Insufficient”

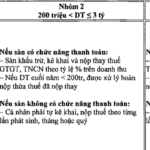

One of the pressing concerns for small businesses is the upcoming 2026 tax exemption threshold of 200 million VND/year, which many feel is misaligned with current economic realities.

“Deputy Director of the Tax Department: The More Transparent and Open Businesses Are, the Less Likely They Are to Face Administrative Violations”

Mr. Mai Sơn, Deputy Director of the Tax Department, emphasizes: “The more transparent and compliant business households are, the less likely they are to face administrative violations. With proper collaboration with tax authorities, those who adhere to regulations will not be subject to inspections. In practice, audits are only conducted when there is a perceived risk.”

30-Year-Old Industrial Fair Transforms into International Event at VEC

Building on the resounding success of the 2025 Autumn Fair, all eyes in the industry are now turning to the highly anticipated “Vietnam Industry & Technology Week 2025,” taking place from November 12-15 at the Vietnam Exhibition Center (VEC).