Petrolimex reported that the 2024 global economic outlook remains uncertain, with risks such as:

- Subdued global economic growth due to the lingering effects of the pandemic

- Intensifying strategic competition between major countries

- Armed conflicts and geopolitical tensions (Russia-Ukraine, Red Sea)

- High inflation, tight monetary policy, and prolonged interest rate hikes

These factors could lead to a global recession and reduced consumer demand in many countries.

Petrolimex’s 2024 annual general meeting. Screenshot

|

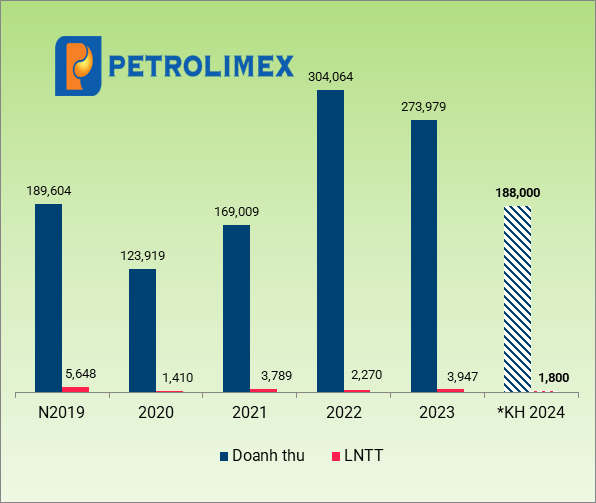

Given these unfavorable factors, Petrolimex’s Board of Directors has adopted a more cautious approach, setting targets for decline in several indicators. Specifically, the Group plans to submit to the general meeting a revenue target of 188 trillion VND, a 32% decrease compared to the previous year; a pre-tax profit target of 2.9 trillion VND, a 26% decrease; and a gasoline and oil sales volume target of just over 13 million m3/tons, a 9% decrease.

|

Petrolimex’s results for the years and plans for 2024

Source: VietstockFinance

|

Regarding profit distribution, Petrolimex proposed distributing a cash dividend of 15% for 2023, equivalent to over 1.9 trillion VND. For 2024, with the target of decline, the proposed dividend is 10%.

Implementing electronic invoices for the entire system costs only 1 billion VND.

In the discussion, shareholders raised questions about the difficulties in implementing the issuance of retail gasoline invoices. Mr. Luu Van Tuyen, Deputy General Director of Petrolimex, responded:

“In compliance with the Government’s decree on implementing electronic invoices for each sale at gas stations, Petrolimex rolled out the system simultaneously at 2,700 stores starting from July 1, 2023. The technology used for this rollout has been assessed and approved by state management agencies, with the highest level of trust in the implementation procedures for each sales transaction, as it is fully automated.”

Regarding the implementation costs, Mr. Tuyen said that Petrolimex had anticipated an approximately 40-fold increase in the frequency of invoice issuance. On average, there have been over 1 billion transactions annually at stores that require invoice issuance.

Mr. Luu Van Tuyen – Deputy General Director of Petrolimex. Screenshot

|

“However, when Petrolimex implemented Circular 15 of 2015 and Circular 218 amending Circular 08/2018, we had already prepared the technical infrastructure and solutions for this implementation from 2015 to the present. Therefore, when the decree was implemented, it cost only about 1 billion VND more to complete the rollout at over 2,700 PLX stores.”

Competition from electric vehicles is not significant yet, the Hai Ha Petro incident has an impact on the distribution system.

In response to a question about the risk of competition from the growing trend of electric vehicles, Chairman of the Board of Directors Pham Van Thanh stated that the market share of electric vehicles currently accounts for only 1%, replacing a small portion of family cars and not yet capable of replacing all vehicles used for transporting goods, water transport, aviation, and railways.

“The trend of electric vehicle development is increasing day by day, but at present, it does not pose a major competitive risk to the gasoline market. Gasoline still plays a very important role in transportation. According to research, this competition will only become significant in Vietnam in 5-7 years, but not at the moment. On the other hand, the investment in developing a charging station system is currently mainly done by VinFast, and they build the stations to charge their own vehicles. In the past few years, PLX and Vinfast have also cooperated as partners in providing charging station infrastructure. Therefore, in the short term, the development of electric vehicles has no impact on gasoline sales.”

Mr. Pham Van Thanh – Chairman of the Board of Directors of Petrolimex. Screenshot

|

However, Mr. Thanh acknowledged that this trend is also taking place globally. In preparation for the transition phase, Petrolimex is also interested in providing new forms of energy, clean, green energy, biofuels, and researching investment opportunities in developing electric vehicle charging stations in Vietnam and expanding services at gas stations.

A notable question from shareholders was about the incident that occurred at Hai Ha Petro, which led to the revocation of its business license. Mr. Tran Ngoc Nam – Deputy General Director and Member of the Board of Directors, said that Hai Ha Petro is a gasoline trader and can still organize business activities. However, as a major trader, Hai Ha Petro is no longer allowed to import.

Mr. Nam assessed that the incident at Hai Ha Petro has a certain impact on the market. “In Hai Ha’s distribution system, there are also franchisees, distributors, and agents who will base their decisions on Hai Ha’s previous supply capacity and will seek out other major traders. Petrolimex is just one of those major traders.

We do not believe that Petrolimex will benefit from this, but rather, based on the instructions of the Ministry of Industry and Trade, we will participate in the task of ensuring supply and ensuring national energy security.”

Series of resignations from the management board.

The general meeting of shareholders also approved the dismissal of 3 members of the Board of Directors and 2 members of the Supervisory Board. They include:

Mr. Le Van Huong – Member of the Board of Directors, retired from June 1, 2024.