After a long Lunar New Year holiday, the bullish cash flow returned to the stock market, boosting the momentum of the main index. As of February 29, the VN-Index closed at 1,252.73 points, up nearly 8% from the beginning of the month and up nearly 11% from the beginning of the year. Average trading volume (HOSE) also improved from VND 16.7 trillion last month to over VND 20.8 trillion this month.

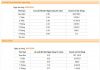

However, foreign investors continued to increase selling pressure on the market. According to statistics from VietstockFinance, foreign investors sold over VND 2.7 trillion on HOSE in February. Of these, the most notable sessions were on February 22 and 23, with a total net selling value of over VND 1.7 trillion, accounting for nearly 63% of the total net selling value of the month.

On HNX, foreign investors also net sold nearly VND 364 billion, and combined with the two exchanges, foreign investors net sold over VND 3.1 trillion.

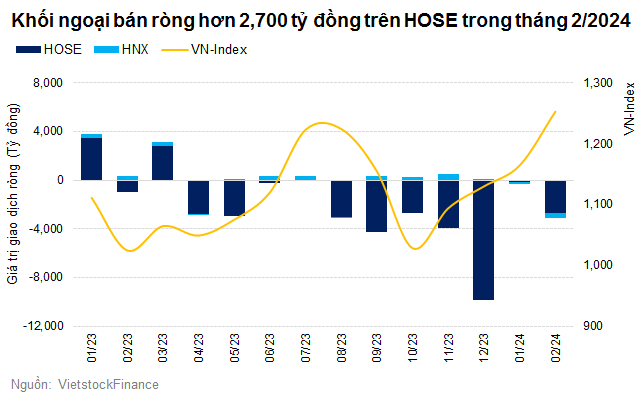

As for the ETFs, both domestic and foreign funds remained cautious in deploying capital in the Vietnamese stock market. According to a report by Yuanta Securities, as of February 23, 2024, Fubon FTSE had a net buying value of $3 million, while VanEck and SSIAM VNFIN LEAD had net buying values of $1.3 million and $0.8 million respectively. On the other hand, Ishares MSCI Frontier 100 had the largest net selling value, at nearly $24 million.

The reason for the ETF capital not being fully deployed in the Vietnamese stock market, according to Ms. Bui Hoang Minh – Head of Research and Investment Advisory Department at HSC, is due to the approaching strength of the US dollar towards the threshold of 105 as the US economy outperforms other developed countries in the world, fueled by significant advancements in artificial intelligence (AI) despite high interest rates. Major global investment funds have also increased their investment allocations in developed countries.

|

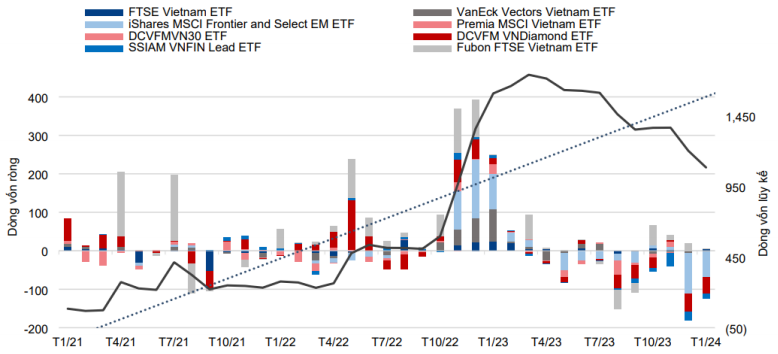

Net capital flows of ETFs investing in Vietnam

Source: Bloomberg, HSC

|

In addition, the significant interest rate differential between VND and USD in the interbank market has led to speculative activities to take advantage of the difference.

Therefore, when interest rates in the US are higher than those in developing countries in the Asian market, capital deployment will first be activated in the US market and the bond market, rather than in neighboring and emerging markets like Vietnam.

Regarding this factor, Ms. Minh noted that the VND is likely to depreciate for the third consecutive year in the first 6 months of 2024 due to the interest rate differential, the movement of the DXY index, and the decrease in foreign exchange reserves below 3 months of imports.

The Head of HSC also said that if the Federal Reserve starts cutting interest rates in late Q2 or Q3 2024, as expected by investors, the interest rate differential between Vietnam and the US will continue to prolong, making foreign capital hesitant and unlikely to return to Vietnam soon.

However, in terms of valuing the Vietnamese stock market, both P/E and P/B ratios are still attractive, so she remains optimistic about the capital inflow from foreign investors.

According to SSI Research analysts, the trend of net selling by foreign investors may reverse in 2024 following the Fed’s gradual interest rate cuts and Vietnam’s opportunity to be upgraded by FTSE Russell to an emerging market in the 2024-2025 period.

“The inflow of foreign investor capital may not recover immediately, but the selling pressure from foreign investors is expected to no longer be as strong as last year,” the analysis team concluded.

The main driving force of the market will mainly come from individual investors, accounting for 92.2% of the average daily trading volume of the entire market in 2023. The research team predicts that the VN-Index will have significant jumps in 2024 thanks to this capital flow.

Returning to the story of foreign investors in the Vietnamese stock market, on HOSE, retail giant MWG faced significant net selling with a value of VND 760 billion. In the food group, VNM was the second most heavily sold with over VND 688 billion, while MSN was the fifth most heavily sold, with nearly VND 419 billion. In addition, banking stocks such as VPB, TPB, STB, and VCB also featured among the top net selling stocks.

On the other hand, MSB was the most heavily bought stock, reaching VND 824 billion. DGC and “national” stock HPG ranked second and third in terms of net buying, at VND 594 billion and VND 557 billion respectively.

On HNX, SHS and PVS were the most heavily sold stocks, with net selling values of nearly VND 365 billion and VND 273 billion respectively. Conversely, foreign investors continued to be the most significant net buyers of IDC, with a net buying value of over VND 282 billion, which was significantly higher than the other stocks in the group such as CEO (VND 41 billion) and DHT (VND 27 billion).