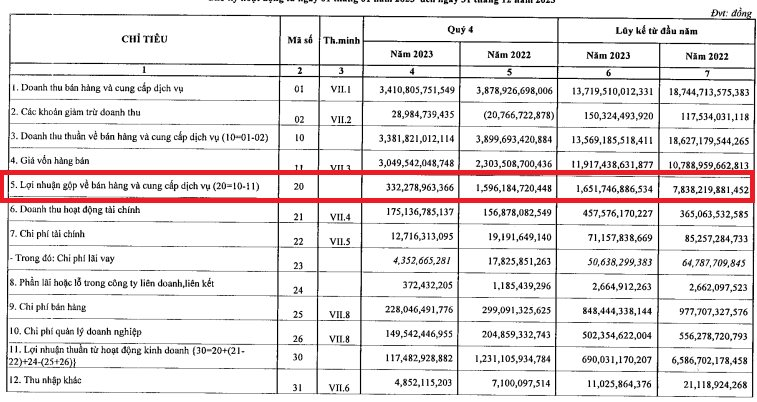

Petrovietnam Fertilizer and Chemicals Corporation (DPM; HoSE: DPM) has just announced its consolidated financial statements for the fourth quarter of 2023, with a 79.18% decrease in gross sales revenue compared to the same period, reaching 332 billion VND. After-tax profit reached nearly 107 billion VND, a decrease of 90.44% compared to the fourth quarter of 2022.

Accumulated for the year 2023, DPM recorded a gross profit of 1,651 billion VND, a decrease of 78.93% compared to the previous year.

Although net revenue reached 13,569 billion VND, a decrease of 13.28%, the cost of goods sold increased by 32.39% to 11,917 billion VND, leading to a sharp decline in gross profit.

According to the report, financial activities brought in 457 billion VND (an increase of 25.34%); Other profit-loss was a loss of 3.3 billion VND (compared to a profit of 5.2 billion VND in 2022); The share of profit in joint ventures and associations brought in 2.6 billion VND, almost flat compared to the previous year.

Furthermore, DPM has managed to reduce operating costs quite well in 2023: Financial expenses amounted to 71.1 billion VND (a decrease of 16.54%); Sales expenses amounted to 848 billion VND (a decrease of 13.22%); Management expenses amounted to 502 billion VND (a decrease of 9.69%).

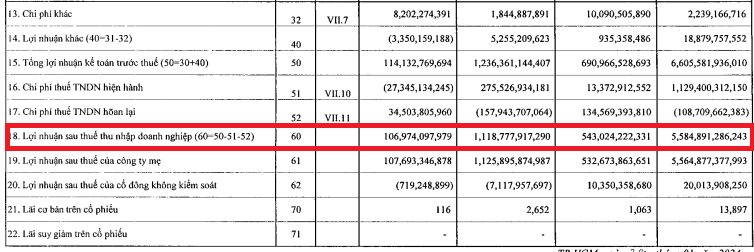

As a result, DPM’s after-tax profit in 2023 was 543 billion VND, a staggering 90.28% decrease compared to the previous year (5,584 billion VND). The after-tax profit of the parent company in 2023 was 532 billion VND, a decrease of 90.43% compared to the previous year. Basic earnings per share, from 13,897 VND/share in 2022, plummeted to only 1,063 VND/share in 2023.

As of December 31, 2023, DPM’s total assets amounted to 13,322 billion VND, a decrease of 24.73% compared to the beginning of the year (equivalent to a decrease of more than 4,376 billion VND). Among them, current assets amounted to 9,594 billion VND, a decrease of 29.34% (equivalent to nearly 4,000 billion VND). Cash and cash equivalents amounted to 1,241 billion VND, a decrease of 40.42%. Inventory decreased by 50.64% compared to the beginning of the year, down to 1,910 billion VND.

DPM’s total payables as of the end of 2023 amounted to 1,764 billion VND, a decrease of 52.08% compared to the beginning of the year. Short-term liabilities amounted to 1,476 billion VND, a decrease of more than 50%.

Notably, DPM’s financial borrowings at the end of 2023 amounted to 0. This means that the company has spent more than 700 billion VND to repay financial borrowings in 2023.

In the stock market, at the end of the trading session on January 31, DPM’s stock price was at 32,750 VND/share, a decrease of 2.24% compared to the previous trading session, with a trading volume of more than 1.7 million shares.