According to the latest survey, the deposit interest rate at the Bank for Investment and Development of Vietnam (BIDV) in early February continued to decrease compared to a month ago. The interest rate applied to deposits with terms for individual customers, receiving interest at the end of the term, fluctuates in the range of 1.9 – 5% per year. Meanwhile, deposits with terms for corporate customers have a deposit interest rate of 1.9 – 4.2% per year.

Image illustration

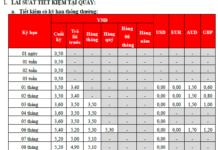

BIDV deposit interest rate for individual customers

In early February, BIDV’s deposit interest rate for individual customers decreased at most terms compared to the beginning of January, with an adjustment of about 0.2 – 0.3% per year. Currently, the bank applies a deposit interest rate in the range of 1.9 – 5% per year for the form of receiving interest at the end of the term.

For deposits with terms of 1 – 2 months, the current deposit interest rate is 1.9% per year. Meanwhile, at terms from 3 – 5 months, customers will enjoy a common interest rate of 2.2% per year.

BIDV applies an interest rate of 3.2% per year for terms from 6 – 9 months. Customers with deposits at terms of 12 – 18 months will receive an interest rate of 4.8% per year.

The highest interest rate for individual customers that BIDV is offering is 5% per year, applicable to terms from 24 months and above.

BIDV deposit interest rate table for individual customers in February 2024

|

Term |

Interest rate |

|

Non-term |

0.10% |

|

1 Month |

1.90% |

|

2 Months |

1.90% |

|

3 Months |

2.20% |

|

5 Months |

2.20% |

|

6 Months |

3.20% |

|

9 Months |

3.20% |

|

12 Months |

4.80% |

|

13 Months |

4.80% |

|

15 Months |

4.80% |

|

18 Months |

4.80% |

|

24 Months |

5% |

|

36 Months |

5% |

Source: BIDV

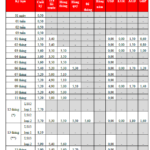

BIDV deposit interest rate for corporate customers

In early February 2024, the deposit interest rate BIDV for corporate customers also recorded a decrease of 0.2 – 0.3% per year at most terms compared to a month ago. Currently, BIDV applies an interest rate range of 1.9% – 4.2% per year for term deposits, receiving interest at the end of the term.

Specifically, BIDV applies an interest rate of 1.9% per year for terms of 1 – 2 months. Customers deposit with terms from 3 months to 5 months will enjoy an interest rate of 2.2% per year.

At terms of 6 – 11 months, they can receive the same interest rate of 3.2% per year.

Long-term deposits enjoy preferential interest rates by BIDV. Specifically, with deposits from 12 months and above, corporate customers will enjoy the highest interest rate of 4.2% per year.

Meanwhile, non-term deposits are subject to an interest rate of 0.2% per year.

BIDV deposit interest rate table for corporate customers in February 2024

|

Term |

VND |

|

Non-term |

0.20% |

|

1 Month |

1.90% |

|

2 Months |

1.90% |

|

3 Months |

2.20% |

|

4 Months |

2.20% |

|

5 Months |

2.20% |

|

6 Months |

3.20% |

|

7 Months |

3.20% |

|

8 Months |

3.20% |

|

9 Months |

3.20% |

|

10 Months |

3.20% |

|

11 Months |

3.20% |

|

12 Months |

4.20% |

|

24 Months |

4.20% |

|

36 Months |

4.20% |

|

48 Months |

4.20% |

|

60 Months |

4.20% |

Source: BIDV

Note that the above interest rates are for reference only and may change over time as well as depending on market conditions. Customers should contact the nearest BIDV branch for detailed information.

BIDV is currently one of the largest banks with the largest scale of operations and transaction network in Vietnam. By the end of 2023, BIDV’s total assets exceeded VND 2.3 million trillion, leading the banking industry and surpassing other giants in the industry such as VietinBank (VND 2,033 trillion), Agribank (VND 2 trillion), Vietcombank (VND 1,839 trillion).

In 2023, BIDV’s outstanding customer loans increased by 16.8% – much higher than the general growth rate of the banking industry (13.71%) and reached a record level in the bank’s history, reaching VND 1,778 trillion. Customer deposits also increased by 15.7%, exceeding VND 1,704 trillion.