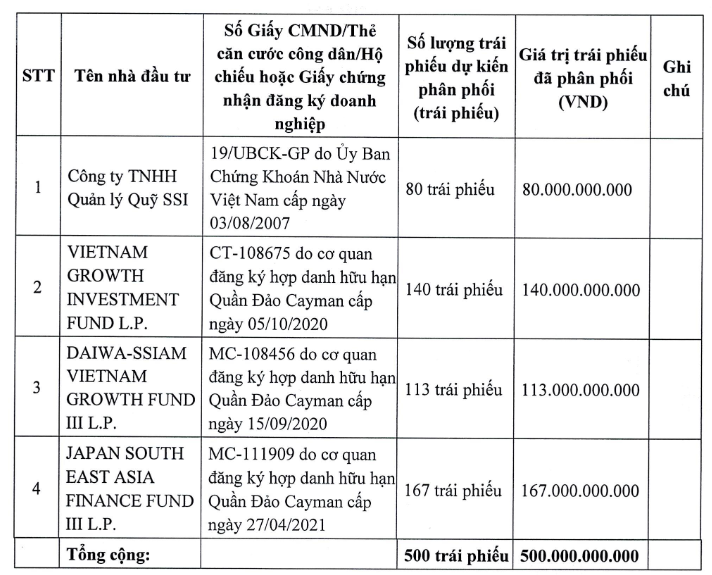

Transport and Stevedoring Joint Stock Company Hai An (HAH) recently announced that it has successfully completed the private placement of VND 500 billion bonds on February 2, 2024.

The bonds have a fixed interest rate of 6% per year, paid semi-annually. The bonds are restricted from transfer within 1 year for professional bond investors from the completion date of the offering.

The bonds can be converted into shares at the current conversion price of VND 27,300 per share, based on the conversion price not lower than 1.1 times the book value of 1 share (excluding the benefits of minority shareholders) based on the consolidated financial statements for the third quarter of 2023 of the company. The conversion price may be adjusted in accordance with the terms and conditions of the bonds and/or agreements with the Investor.

At the current conversion price, 1 bond can be converted into 36,630 shares. The conversion of bonds into shares must ensure compliance with the foreign ownership ratio of the issuing organization at the time of conversion.

There are 4 investors who purchased HAH bonds, including Japan South East Asia Finance Fund III L.P. with 167 billion, Daiwa-Ssiam Vietnam Growth Fund III L.P. with 113 billion, Vietnam Growth Investment Fund L.P. with 140 billion, and SSI Asset Management Limited Liability Company (SSIAM) with 80 billion.

In the stock market, HAH shares have been continuously increasing in the past 3 sessions. At the end of the trading session on February 5, HAH shares were priced at VND 39,700 per share, more than 45% higher than the current conversion price of the bonds.

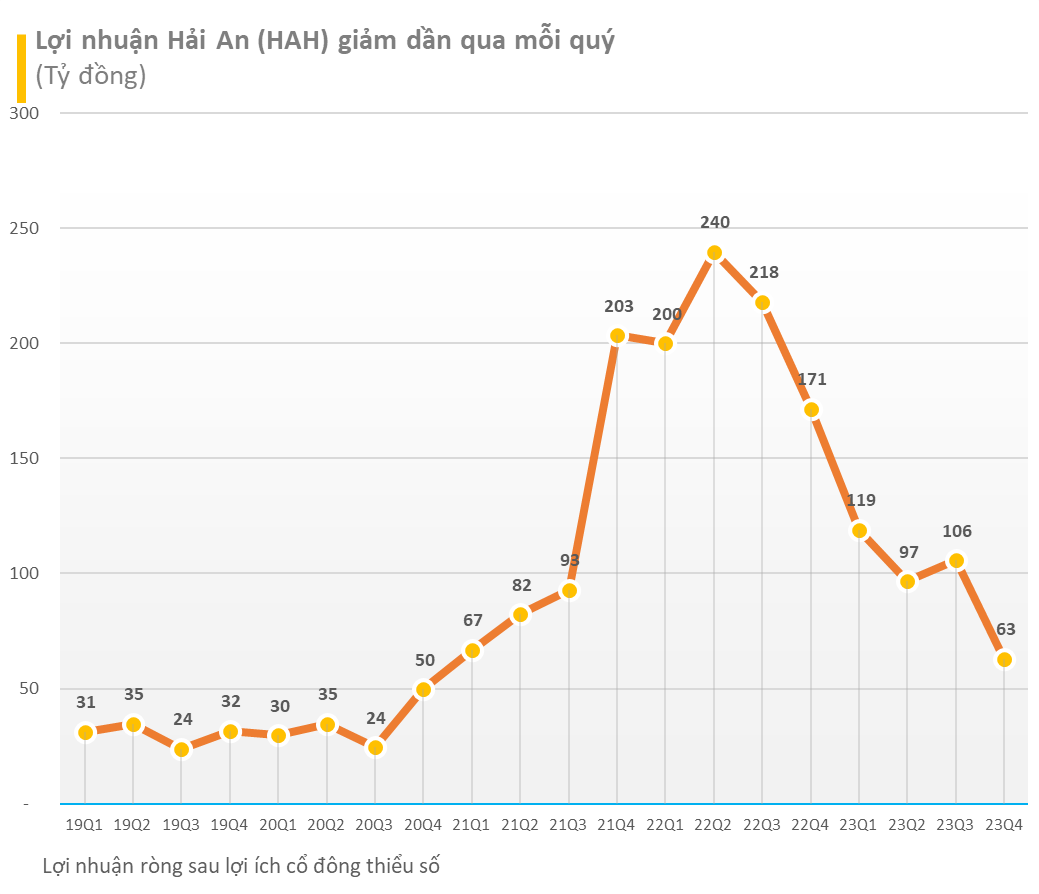

In terms of business results, in 2023, HAH achieved revenue of VND 2,613 billion, a decrease of 18%, and after-tax profit of VND 371 billion, a decrease of 64%.