According to Metric’s statistics, the total revenue from the top 5 e-commerce platforms in Vietnam is expected to reach VND 233.2 trillion in 2023, a growth of 53.4% compared to the previous year. Among these, the Beauty, Home & Lifestyle, Women’s Fashion, and Home Appliances sectors continue to contribute the most to this achievement, each accounting for 11% to 25% of the e-commerce market share.

At the same time, these sectors are still experiencing positive growth rates. Specifically, the Beauty sector witnessed a 52.2% increase in revenue in 2023 compared to 2022, while the Home Appliances sector saw a growth rate of 55.1%. However, these are not the most impressive growth rates.

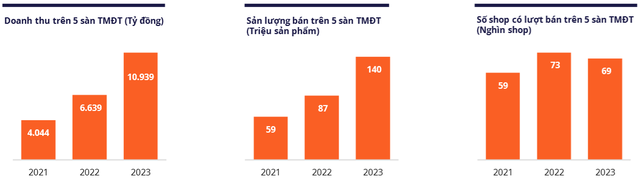

According to Metric’s data, the Grocery – Food sector currently contributes only around 5% of the total revenue, equivalent to about VND 11,000 billion, but it has grown by a staggering 64.8% compared to the previous year. This revenue comes from 69,000 stores with 140 million units of products sold. In particular, the highest growth rate was recorded in July at 102%, while September saw the highest revenue with nearly VND 1,000 billion.

Revenue and volume of the Grocery – Food sector on e-commerce platforms in 2023 (Source: Metric)

The mentioned revenue of VND 11,000 billion is equivalent to more than one third of the revenue generated by the WinMart/WinMart+ supermarket system and the Bach Hoa Xanh chain. In 2023, more than 3,600 WinMart/WinMart+ stores brought in revenue of VND 30,054 billion, while Bach Hoa Xanh recorded revenue of VND 31,600 billion.

The average price paid by consumers for a product in the Grocery – Food sector on e-commerce platforms in 2023 was VND 80,000. The best-performing price segments in terms of revenue and sales volume were from VND 10,000 to 50,000 and from VND 50,000 to 100,000. As for Shop Mall, the segments from VND 350,000 to 500,000, from VND 750,000 to 1,000,000, and from VND 1,000,000 to 1,500,000 brought in the highest revenue.

Without the cost of renting premises and managing a large workforce like physical stores, e-commerce platforms become not only a lucrative land for small businesses but also for big FMCG brands. The top 10 brands with the highest revenue are well-known names such as Ensure, Vinamilk, Tiger, TH, Nescafe, and Milo.

Top 10 brands with the highest revenue in the Grocery – Food sector in 2023 (Source: Metric)

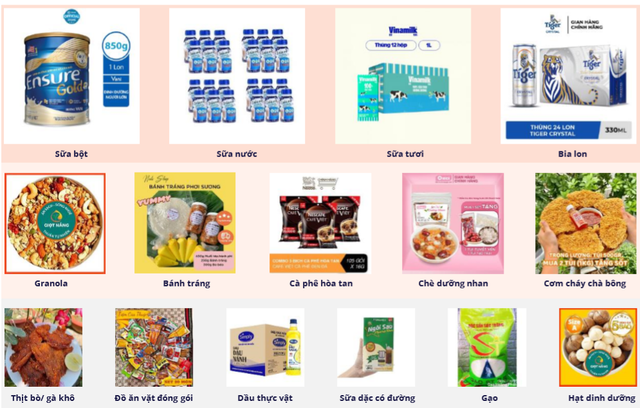

Due to the lack of advantages in fresh produce, the best-selling products in the Grocery – Food sector on e-commerce platforms are powdered milk, fresh milk, beer, and dry food such as rice paper, granola, instant coffee, rice, and cooking oil. For example, the 12 Boxes of Vinamilk Non-Sugar Fresh Milk 1L in a paper carton at the official Lazada store has sold over 100,000 units. In the official Ensure store on Shopee, there are at least 6 products with over 10,000 sales, and one product has attracted more than 233,000 units sold.

Best-selling products in the Grocery – Food sector on e-commerce platforms in 2023 (Source: Metric)

According to Metric, 2024 is expected to be a booming year for the e-commerce market. In particular, the Direct-to-Consumer (DTC) model will become more popular. Instead of using distributors, manufacturers will sell directly to consumers on e-commerce platforms. This allows manufacturers to have comprehensive control over their operations such as production, marketing, and sales. It also significantly reduces intermediary costs, resulting in higher profit margins.

For example, if the B2B2C model (Business to Business to Customer) is applied, manufacturers will have to spend about 35% to 40% of their product costs on distributors. In contrast, selling directly on e-commerce platforms incurs much lower fees (less than 10%), and the remaining amount can be deducted directly from the selling price or invested in product features. However, manufacturers applying this model need to understand the platform’s operating process, study the market’s customer approach, and establish reasonable sales policies to maintain a balanced relationship with distributors. The expansion of manufacturers into the e-commerce market is expected to lead to continued fierce price competition in 2024.

Hoang Thuy

–