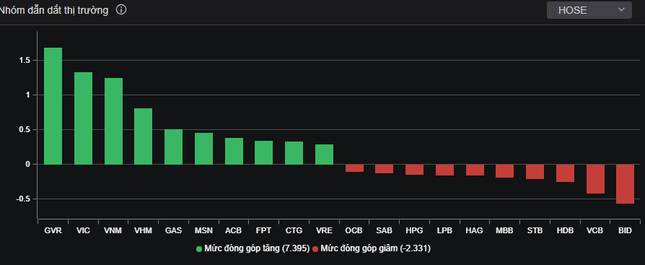

In today’s trading session (February 16), VN-Index continued to be vibrant as the electronic board early turned green. The money flow had a smooth circulation when banking stocks, after a strong wave in previous session, gradually cooled down and became differentiated. TCB, VPB, ACB, CTG,… maintained a slight increase, while VCB, BID, MBB, STB,… were tinged with red.

Conversely, real estate stocks had an impressive trading session, attracting nearly VND 4,300 billion. Major stocks such as VIC, VHM, VRE, NVL, DXG, SCR, HQC… all increased significantly. Especially, some industrial real estate stocks hit the ceiling, such as NRC, FIR, PPI, BII.

The VN30 group maintained positive influence with as many as 17 stocks increased, nearly double the number of decliners.

The highlight of the session belonged to the plastic-chemical manufacturing stocks as these stocks had the strongest recovery. With industry-wide increase of up to 3.33%, GVR made a remarkable turnaround by opening in red but then reversed and hit the ceiling successfully with nearly 7.5 million units traded.

Insurance and food and beverage stocks also became bright spots as BVH, BMI, MIG, PGI, ABI, VNM, MSN… all maintained their green color.

Conversely, agriculture-forestry-fishery sector experienced the sharpest decline in the market with a decrease of 1.85%, mainly due to the pressure of HAG, HNG and SSC.

Today, foreign investors continued to net sell nearly VND 317 billion on HOSE, focusing on STB, VNM, VND and MWG, while on HNX, foreign investors collectively sold stocks such as PVS, DTD.