Buy NT2 shares at a reasonable price of 32,300 VND/share

According to Phu Hung Securities (PHS), thermal power companies, specifically gas-fired power plants like Petro Power Nhon Trach 2 Power Company (NT2) (HOSE: NT2), will benefit significantly in the first half of 2024 as hydropower plants will face difficulties due to El Nino.

NT2’s electricity selling price is expected to remain high throughout 2024. However, the high electricity selling price will be disadvantageous for NT2 in the second half of 2024 when El Nino is over and hydropower plants will return strongly with competitive electricity selling prices. At the same time, gas-fired power plants will also have to compete with coal-fired power plants (low price) and renewable energy.

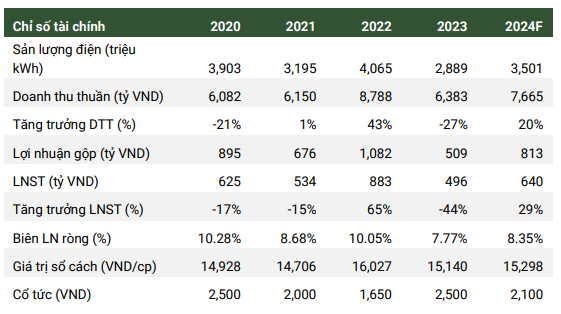

PHS estimates that the average monthly electricity generation of NT2 in 2024 will be 291.8 million kWh, an increase of 21% compared to 2023 (due to a major maintenance), but a decrease of 14% compared to 2022.

|

Projected business results of NT2 in 2024

Source: PHS

|

The business results of NT2 in 2024 are expected to improve significantly after a difficult year in 2023. Gross revenue is projected to reach 7,665 billion VND and net profit after tax is projected to reach 640 billion VND, an increase of 21% and 29% respectively compared to 2023.

Hydropower will still face disadvantages due to El Nino in the first half of 2024, which will support higher electricity prices. PHS expects NT2’s gross margin and net profit margin to recover slightly and stabilize at 11% and 8% respectively throughout 2024. In addition, NT2 will complete the depreciation of its power plants from 2026, so the Company’s gross profit is expected to increase significantly from then on.

Furthermore, NT2 has a strong and sustainable cash flow from its business operations, allowing the Company to continue reducing debt and paying high dividends in the future.

Based on these points, PHS recommends buying NT2 shares at a reasonable price of 32,300 VND/share.

Read more here.

Buy HDG shares with a target price of 32,300 VND/share

According to the forecast of MB Securities (MBS), the electricity revenue of Ha Do Group Corporation (HDG) (HOSE: HDG) in 2024 will increase by 6% compared to the same period to reach 2,046 billion VND, then decrease slightly by 4% to 1,960 billion VND in 2025, but it will continue to contribute the largest proportion to the revenue structure.

In particular, hydropower production will have a slight recovery from the second half of 2024, supported by plants that maintain good water levels and the end of El Nino. Renewable energy generation will maintain stable production levels.

However, the main driver for HDG’s profit growth comes from the sale of Charm Villa phase 3. Currently, the project has completed the exterior of all products and is ready for sale.

|

Projected revenue and profit of Charm Villa Phase 3 project

|

In a context where there is no pressure on cash flow, the Company is still waiting for a favorable market time to benefit from the price increase in the area. MBS estimates that the project will generate a total revenue of 2,108 billion VND and a net profit of 971 billion VND, with delivery progress of 34%, 41%, and 25% in the period of 2024-2026.

Therefore, HDG’s net profit is expected to grow by 37% and 18% respectively compared to the same period, reaching 977 billion VND and 1,149 billion VND in 2024-2025.

With the risks from the solar power project misconduct, HDG’s share price has dropped by 13% since the Government Inspectorate’s document, reflecting investors’ concerns about the Company’s prospects. MBS sees this as a good opportunity to accumulate a low-priced stock (P/E 2024 8.6x, 16% lower than the industry average) and high-quality assets.

After quantifying the risks from the misconduct projects, MBS maintains a buy recommendation for HDG shares with a target price of 32,300 VND/share.

Read more here.

Monitor HAH shares with a target price of 43,700 VND/share

FPT Securities (FPTS) evaluates the business operations of Hai An Transport and Stevedoring Joint Stock Company (HAH) (HOSE: HAH) in 2024 will continue to be affected by the oversupply situation of transportation capacity.

The total tonnage of HAH’s fleet is expected to reach over 21,000 TEUs (an increase of 20.1% compared to the same period) as it receives 3 new vessels in 2024. However, the company’s operational capacity is only expected to increase by 10% due to the slight recovery in demand, leading to continued surplus pressure on the fleet.

According to FPTS, HAH will have to sign new leases for vessels at lower freight rates compared to the same period in 2023. The leasing revenue of HAH in 2024 could reach 456 billion VND, a decrease of 26.1%.

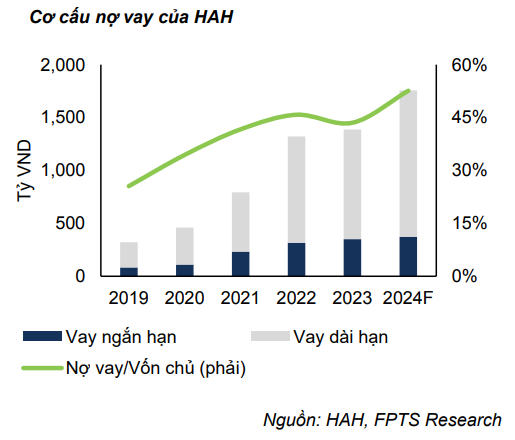

In addition, HAH has used borrowings and bond issuances to supplement capital for investing in new vessels, resulting in a debt-to-equity ratio of 44% at the end of 2023, and is expected to increase to 55% in 2024. At the same time, HAH’s interest expense in 2023 increased by 28.4%.

Despite the expected mild growth in demand and the maintenance of low freight rates, the risk of HAH’s debt is still manageable as the EBIT/Interest expense ratio in 2024 is estimated to decrease from 6.6x to 3.4x.

FPTS forecasts that HAH’s gross profit in 2023 could reach 485 billion VND, a decrease of 20.6% compared to the same period. The gross profit margin decreases by 5.3 percentage points to 18.1%. In which, the gross profit margin of the shipping and port operations will reach 15.2% and 45.4% respectively. HAH’s pre-tax profit in 2024 is estimated to decrease by 35.8% compared to 2023, reaching 297 billion VND.

In conclusion, FPTS recommends monitoring HAH shares with a target price of 43,700 VND/share.

Read more here.

—