The warrant market, reflecting expectations of stock price increases, has started to heat up again since June 2023, after months of stagnation. The total issuance value of the market was nearly 3.7 trillion dong in the past year.

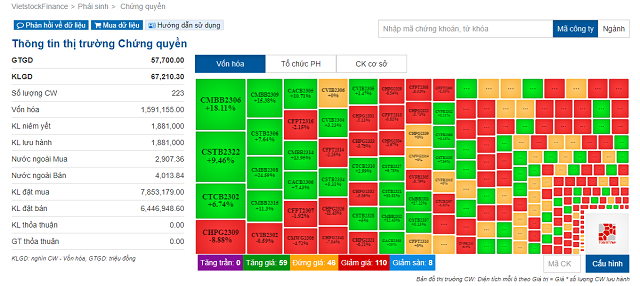

Keep up with all the information about the warrant market on VietstockFinance

|

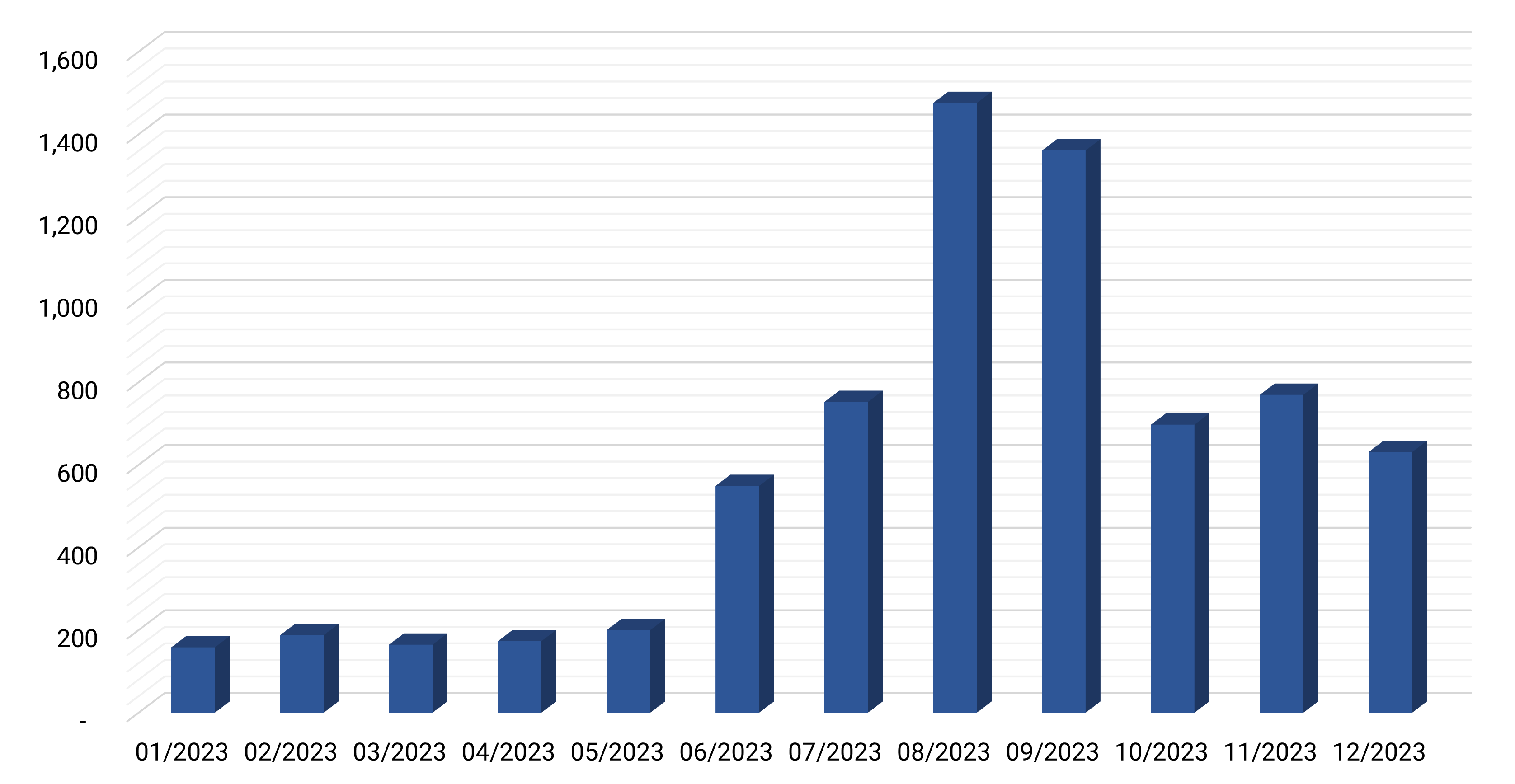

The warrant market in 2023 started off slowly with only about 300 to 400 million CW traded. In fact, the number in April 2023 was only about 200 million. At that time, the trading value ranged from 150 billion dong to 200 billion dong.

Statistics from the Ho Chi Minh City Stock Exchange (HOSE) show that the market began to pick up in June and the trading volume reached over 1 billion CW around August and September with an average value of about 1.5 trillion dong during the peak period.

|

Total trading value of the warrant market in 2023 (Unit: billion dong)

Source: VietstockFinance

|

Which securities firm had the largest warrant issuance scale?

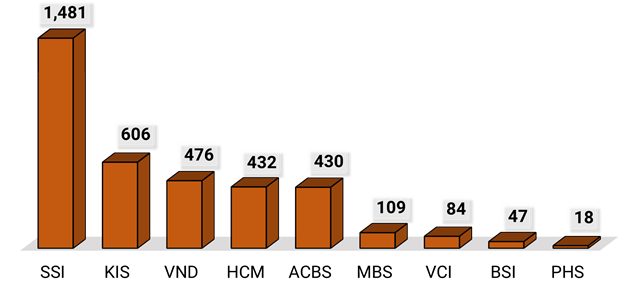

According to VietstockFinance, in 2023, 9 securities companies provided a total of 310 valid warrant products to the market, with a total value of 3.7 trillion dong. Compared to the average market capitalization of 4.4 million trillion dong of HOSE, warrants only contribute a very small part to the overall stock market.

Securities Corporation of SSI (HOSE: SSI) had the largest issuance scale with over 1,480 billion dong, accounting for 40% of the market.

The following positions belong to KIS Vietnam Securities Corporation, with 606 billion dong; VNDIRECT Securities Corporation (HOSE: VND) with 476 billion dong; Ho Chi Minh City Securities Corporation (HOSE: HCM) with 432 billion dong.

The lowest is Phu Hung Securities Corporation (UPCoM: PHS) with a modest scale of only 18 billion dong.

However, KIS dominates in terms of the number of warrants, with 134 codes, followed by SSI, HCM, and VND with 55, 31, and 28 codes respectively.

|

Warrant issuance scale in the market in 2023 (Unit: billion dong)

Source: VietstockFinance

|

Which warrant maturity is the most popular?

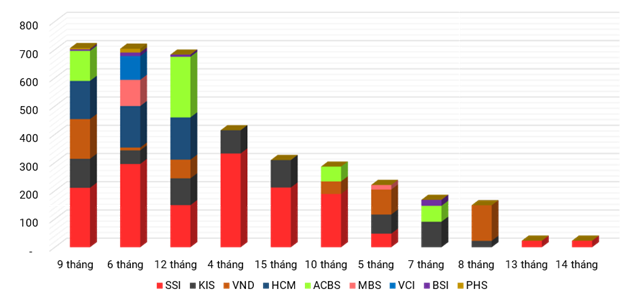

The 9-month warrant maturity is the most popular with an issuance value of 705 billion dong, followed by 6 months with 703 billion dong, and 12 months with 682 billion dong. The lowest is the 13 and 14-month maturities, with only a little over 23 billion dong each.

SSI offers the most diverse maturities for investors. In 2023, 4 and 6 months were the most popular maturities with values of 332 billion dong and 295 billion dong respectively. This company also offered a 13 or 14-month warrant, the only one on the market.

|

Warrant issuance value by maturity (Unit: billion dong)

Source: VietstockFinance

|

Which stock is the most preferred as an underlying asset?

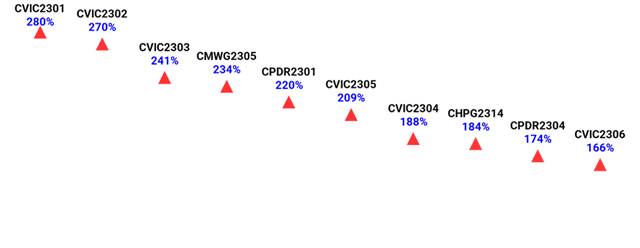

There is no one else but HPG that was chosen as the most preferred underlying asset for warrants. The highest price ever reached with the issuance price, warrants CVIC2301, CVIC2302, and CVIC2303 had at times a fluctuation of 280%, 270%, and 240% respectively – the highest in the market. All of these codes are issued by KIS.

In the top 40 list, KIS contributed 27 codes, accounting for 68%, most of which came from VIC warrants (6 codes), followed by HPG and PDR with 5 codes each, while only 2 codes belonged to SSI.

|

The top 10 warrants with the highest price increase compared to the issuance price

Source: VietstockFinance

|

In 2023, the CHPG2305 warrant had the highest increase from the bottom. Investors have witnessed this code increase by over 700% in the past year, reaching its peak at the end of August. Next, we can mention CPDR2302 and CFPT2303 with about 550% increase. VIC also contributed 3 codes – CVIC2301, CVIC2302, CVIC2303 – which had a range of fluctuations from 460% to 500%.

|

The top warrants with the highest increase in 2023

Source: VietstockFinance

|

Tu Kinh