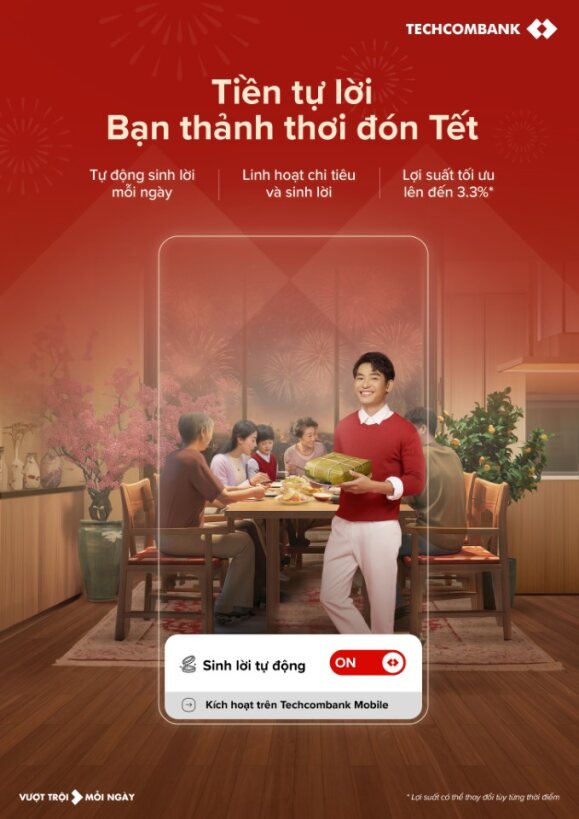

The “Auto Earning” feature on Techcombank Mobile, pioneering in Vietnam, your electronic banking transaction account can automatically generate profits every day, from idle funds. This is the optimal choice for customers who both want to use funds in their payment accounts at any time and want “idle money to generate income.” When you activate the “Auto Earning” feature on Techcombank Mobile, the standard amount, at 10 million in the customer’s payment account, will earn an interest rate of 0.1% per year like a regular demand deposit account. Amounts from 10 million and above will be converted into the automatically earning balance, with daily interest rates of up to 3.3% per year according to the policy of each period. Customers can flexibly adjust the standard threshold from 10 million and above on the Techcombank Mobile application according to their personal cash flow optimization needs.

What’s important is that with “Auto Earning”, customers can still use the entire existing account balance in their payment account whenever they have spending or payment needs. When customers have transactions that exceed the remaining amount in the Payment Account but still within the existing total balance, the “Auto Earning” feature will transfer the part of the money that the customer needs to use back to the regular Payment Account. The remaining balance displayed in “Auto Earning” will continue to earn interest with the same interest rate. The automatically transferred money to the payment account will include corresponding interest according to the “Auto Earning” policy.

Sharing about the “Auto Earning” feature, Mr. Nguyen Anh Tuan, Head of Techcombank Retail Banking Division, said: “With the vision of “Transformation of the financial industry, enhancing the value of life,” Techcombank has always been a leader in bringing digital utilities and superior experiences to customers. The “Auto Earning” feature is evidence of our effort to create outstanding utilities for customers, further affirming Techcombank’s role in personal financial management, helping each customer achieve their individual financial goals as well as reduce financial anxiety.”

The “Auto Earning” feature of Techcombank marks Vietnam’s pioneering bank providing an optimal solution that helps customers’ idle funds in the payment accounts to automatically generate daily interest. At the same time, this feature once again establishes Techcombank’s credibility in the journey of digital transformation, by both being the first bank to offer free online transfer transactions – Zero Fee, and being the leader in implementing the feature to help idle funds in accounts automatically generate income. Previously, in 2016, Techcombank was the first bank in the market to announce a policy of free of charge for all online electronic transfer transactions – Zero Fee, and since then, has created a spreading effect throughout the banking system. The “Auto Earning” feature is also expected to help Techcombank continue to win customer satisfaction.

Through the superior solution “Auto Earning”, Techcombank desires to create conditions for every customer to achieve their financial goals faster, while optimizing funds when necessary to implement business plans or life expectations.

Instructions on how to enable the “Auto Earning” feature

Step 1: Download Techcombank Mobile, create a bank account on the application.

Step 2: Select the Auto Earning feature on Techcombank Mobile – on the main screen.

Step 3: Select an account to connect to the Auto Earning feature.

Step 4: Confirm the conditions, terms of service registration, and automatic transfer contract.

Step 5: Successfully activate.