Here are the most notable financial events worldwide in the week of February 26 to March 1:

1/ US Economic Growth Beats Expectations

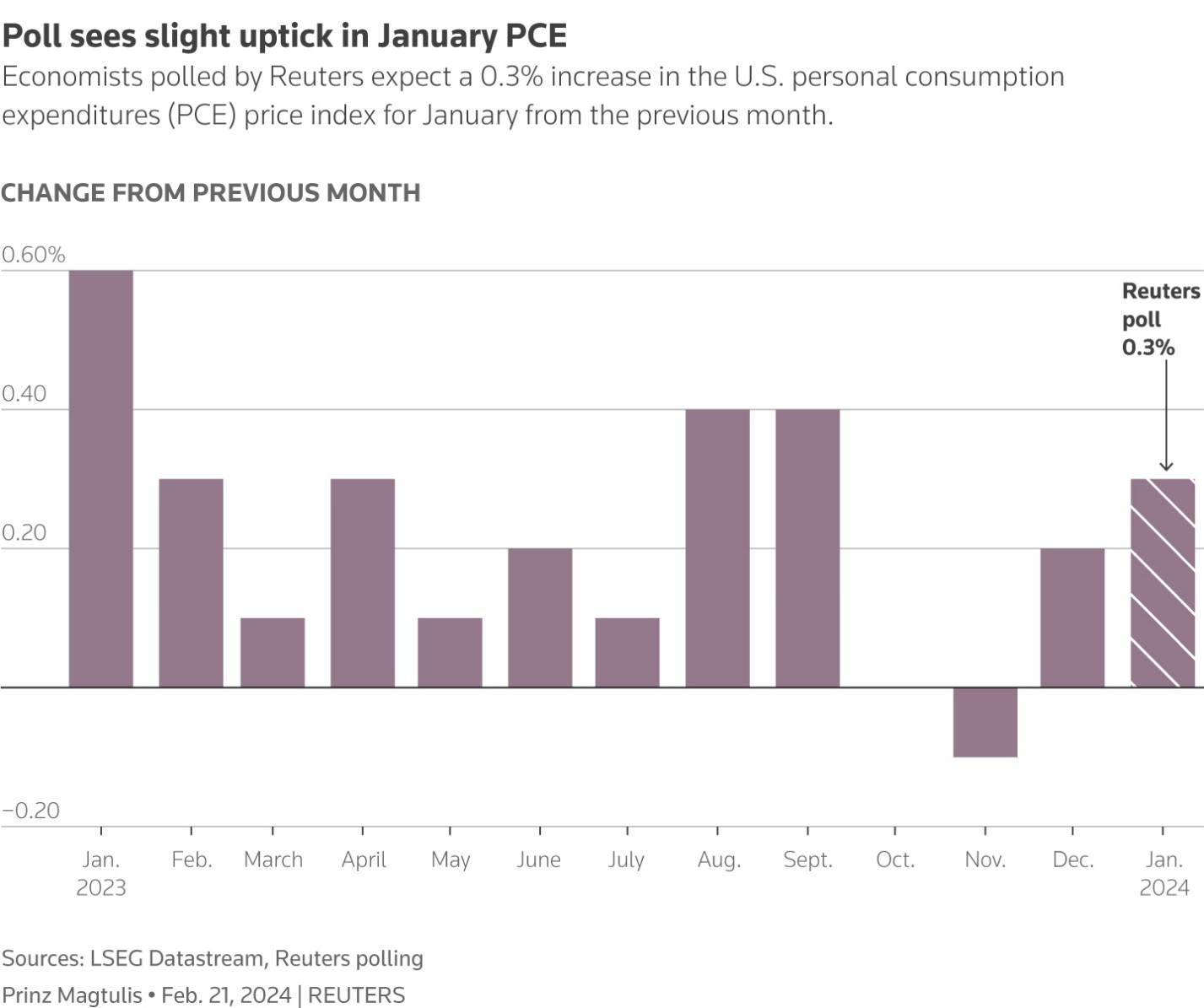

The US inflation (Personal Consumption Expenditures (PCE) Price Index released on Thursday, February 29) will once again be the center of attention in the market, as it could provide investors with a different view of a growing economy compared to the expectations of many.

Economists surveyed by Reuters expect US January CPI to rise by 0.3%, after rising by 0.2% in the previous month. The stronger than expected PCE could continue to dampen expectations of an early Fed rate cut.

Recent data such as consumer prices, producer prices, and employment have shown that the world’s largest economy continues to grow despite high interest rates for many months. The result of these is that the Federal Reserve is increasingly cautious about postponing interest rate cuts. This also drives up US bond yields as well as the USD.

The market predicts that US PCE inflation for January will rise.

2/ Data from Europe

The preliminary data for February, which will be released on March 1, will show the inflation picture in the euro area – which rose to double digits in 2022 – is returning to the 2% target. The index fell to 2.8% in January from 2.9% in December and is quickly cooling off due to weak growth and falling energy prices.

Important aggregate data will come from Germany, France, and Spain – all taking place before the ECB meeting on March 7. European Central Bank (ECB) Vice-President Luis de Guindos said that more time and data are needed before policymakers can confidently declare that interest rates are at record highs and it’s time to start cutting. In the meantime, wage growth has slowed but still remains above an appropriate level for 2% inflation.

Overall, European policymakers still have to consider between keeping interest rates high to curb inflation and determining the right time to start cutting rates for the first time.

Inflation in the Eurozone is nearing the 2% target.

3/ Key indicators from China and Japan

Policymakers in China and Japan are facing a tough battle to improve gloomy economic growth prospects.

Japan’s inflation figures will be released on Tuesday (February 27) – and expectations are that consumer prices have cooled down again in January, which could give the Bank of Japan (BOJ) another reason to exit negative interest rate policy this year. The Bank of Japan is caught in a recession and sluggish consumer spending, but maintaining an extremely loose policy would mean the yen will lose even more.

In China, authorities are increasingly making every effort to consolidate a fragile economic recovery after the strongest reference rate rate cut ever and the heightened legal pressure to revive the market. PMI data released on Friday (March 1) will provide a clearer view of the efficacy of Beijing’s economic supportive measures. However, investors still remain unimpressed with these measures.

Chinese factory activity has been continuously declining from October to date.

4/ The Global Trade Situation

Increased protectionism and geopolitical conflicts have cast a shadow over global trade, with global trade growing by only 0.2% in 2023 – the weakest pace in five decades except during periods of global recession.

The World Trade Organization (WTO), beginning ministerial-level meetings in Abu Dhabi on Monday (February 26), what can it do to reverse this? Most observers conclude that there is very little likelihood of a turnaround. The WTO is hampered by disputes among member countries and above all by domestic politics in many countries that have affected free trade – the goal for which the WTO was established to promote.

Prior to the November election in the US, there are very few chances that Washington will remove obstacles in the appointment of new members to the appellate body of the WTO – meaning that the organization’s critical dispute resolution agency will not function.

Meanwhile, prospects for agreements in key areas such as agriculture and fisheries remain murky – meaning that trade cannot be seen as the driving force behind the global economy in the near future.

Uncertain prospects for global trade.

5/ 2 Years of Russia-Ukraine Conflict

Saturday (February 24) marked the 2nd anniversary of the eruption of the Russia-Ukraine conflict. This conflict has shaken and shaped the global commodity markets. To this day, energy prices and many commodities have returned to lower levels than before the conflict, except for gold – an inflation hedge – which is higher than February 2022. However, Russia is still cut off from the global financial system after a series of sanctions, and is still facing new constraints from Washington, the UK, and other countries, the impacts of which are still significant for global financial and commodity markets. Volatility can be seen in some key markets over the past 2 years.

Volatility in some markets over the past 2 years.

Reference: Reuters