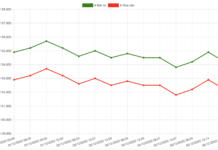

The VN-Index recorded a volatile trading week with high selling pressure in the last trading session. It is worth noting that market liquidity also increased dramatically in the final session of the week, with a trading value of over 30,000 billion VND (equivalent to nearly 1.2 billion USD) on HOSE, setting a new high since late September 2023. However, the index still ended the week of February 19-23 with a slight increase compared to the previous week’s session, stopping at 1,212 points.

Market movements are being cautiously evaluated by experts. With the sharp decline in trading volume, there is a high possibility that the VN-Index has reached a short-term peak and needs to retest support levels. Nevertheless, investors should not panic and sell off stocks, but observe supply and demand dynamics and wait for the market to establish a new equilibrium.

Signs of a distribution top appearing

Mr. Do Bao Ngoc – Vice Director of Vietnam Construction Securities

Funds have been rotating around groups of stocks, especially blue chips, pushing the VN-Index to increase quite rapidly recently. However, as the bullish momentum continues, selling pressure will increase, and a downward correction is inevitable. In addition, the VN-Index has approached a strong resistance zone around 1,230-1,250 points, which also puts pressure on the overall market.

Furthermore, the market has been greatly affected by profit-taking pressure on bank stocks towards the end of the trading session. However, Mr. Ngoc believes that this group of stocks does not have any negative information and it is just a normal profit-taking pressure after a good run of gains.

According to expert observations, a sharp downward correction and a sharp increase in trading volume after a long period of growth are signs of a short-term distribution session that has taken place after a significant market rally. When there are signs of distribution, there is a high possibility that the VN-Index has reached a short-term peak and will undergo a certain level of correction afterwards.

In terms of investment strategy, the expert suggests that those investors who are making profits should look for opportunities to take profits in recovery sessions. Short-term investors who do not hold stocks should not rush to “buy on dips” but wait for the market to find a new balance point for further investment.

“After a correction, the market needs to establish a new price level, a new balance zone, and accumulate around that zone. With the approach to the MA10 zone, I believe that the VN-Index is likely to retest the MA20 zone at around 1,200 – 1,205 points in the coming sessions,” said Mr. Do Bao Ngoc.

Not advisable to open new long positions

Mr. Dinh Quang Hinh – Head of Macro and Market Strategy Department at VNDirect Securities

Profit-taking pressure increased sharply in the final session of the past week after the VN-Index touched the resistance zone around 1,240 points. The market’s proximity to a strong resistance zone and the substantial increase in interbank interest rates in recent sessions have made investors cautious and triggered a wave of profit-taking.

The downward correction is also accelerated by strong net selling activities of foreign investors, focusing on some large-cap stocks. Although they have just experienced a significant correction, the VNDirect expert believes that investors should not be too panicky. The interest rate increases in the interbank market are only temporary due to “local liquidity shortage at a bank” and do not represent the overall picture of the system.

In terms of market fundamentals, some banks are still lowering deposit interest rates, while system-wide credit in January experienced negative growth due to the year-opening effect. With current low credit demand, Mr. Hinh believes that the pressure on deposit and lending rates is not significant, and the recent interest rate increase in the interbank market is temporary and will soon ease.

From a technical analysis perspective, the market has not lost its short-term uptrend as the VN-Index is still trading above the MA20 line, and the support zone of 1,190-1,200 points is expected to hold. Therefore, investors should not panic and sell off stocks, but observe supply and demand dynamics in the support zone of 1,190-1,200 points. Moreover, investors should not open new long positions as the market has just gone through a volatile session and needs to find its balance point again.

Banking sector still in focus

Mr. Ngo Minh Duc – Founder of LCTV Financial Investment Joint Stock Company

Since hitting a bottom in November 2023, the VN-Index has been continuously reaching new highs without any significant corrections. Therefore, the market correction is mainly due to profit-taking sentiment near the strong resistance level of 1,230. In the long term, the stock market still has many bright spots from a stable macro foundation, ongoing reductions in deposit interest rates, low bond yields, and the central bank’s loose monetary policy.

With these prospects, the expert believes that the stock market remains an attractive investment channel that can attract capital flows from other channels such as savings deposits, gold, etc., leading to increasing market liquidity. In fact, recent trading sessions with billion-dollar transactions have been continuously appearing, and the expert believes that liquidity will continue to increase even more in the near future.

With the view of a preserved uptrend, the expert predicts that the VN-Index will reach 1,320-1,380 points in 2024. However, within the long-term uptrend, there will still be alternating corrective phases, and the recent correction will not be prolonged. The market may regain its upward momentum in the upcoming week as global stock markets such as the United States and Japan are showing positive signals.

According to the expert, in a long-term uptrend, short-term corrections are always opportunities for external investors to participate. In the coming week, the spotlight group of stocks in the market may still be the banking sector. In addition, many real estate stocks are currently in a sideways consolidation phase, and it is likely that they will continue to move sideways next week. Therefore, investors can consider investing in these stock groups next week.