The stock market on February 28 witnessed a sudden surge in trading on oil and gas stocks. Stocks such as BSR, GAS, PVS, PVB, PVT, PVC, PLX, OIL,… all increased by over 2%. The most notable was PVD as the stock quickly hit the trading limit in just a few minutes after the opening of the session, reaching its highest level in 9 years.

The strong performance of oil and gas stocks may come from the transfer of funds between industry sectors. While banking, securities, real estate, and steel stocks have experienced strong capital inflows recently, the oil and gas sector has been relatively quiet for a long time. In addition, the oil and gas sector also has some notable stories that may impact stock prices.

According to a recent analysis report by SSI Research on PVD stock, the focus in the industry is Saudi Aramco, one of the major oil producers in the Middle East, which recently canceled its plan (announced in 2022) to increase production capacity by 8% to 13 million barrels per day. The analysis department points out that the current growth cycle of the drilling industry is mainly driven by the strong increase in oil production from the Middle East, so any changes in this strategy could lead to changes in the current growth cycle of the industry.

In addition, the progress in implementing the Lot B – O Mon gas power project is also being closely monitored by investors. Recently, the Chairman of Vietnam Oil and Gas Group (PVN) has called on relevant units to focus on resolving obstacles and accelerating the progress of the upstream gas source, especially the O Mon IV thermal power project; focus on meeting the conditions to obtain the Final Investment Decision (FID) for the Lot B gas project as planned in April 2024.

Earlier, in late October 2023, PVN and its partners signed important documents such as the Lot B Framework Agreement; the agreed content of the O Mon Gas Sales Contract; awarded the EPC#1 Contract. Accordingly, the joint venture between PVS and McDermott (USA) was awarded the EPCI#1 package, with an approximate value of 1.1 billion USD. In addition, PTSC M&C – a subsidiary of PVS – also won the EPCI#2 package for the upstream project, which involves the construction of some wellhead platforms and internal pipeline systems.

According to SSI Research, in 2024, with the forecast of a difficult increase in oil prices, the Lot B – O Mon project will still be the main driving force of the oil and gas industry, compensating for the gradually depleted domestic gas fields. The Vietnamese government still maintains the goal of extracting the first gas flow by the end of 2026.

However, there are still obstacles in resolving the FID, especially in signing the GSPA/GSA with committed production volume, gas price, and final investment decision for the O Mon 3 & 4 power plant project. These issues need to be clarified by the government and specific measures need to be taken. SSI Research believes that the updated news about the project will continue to support the stock prices of the oil and gas industry, especially the upstream companies.

Profit differentiation

According to the assessment of SSI Research, the oil and gas industry may continue its profit differentiation trend in 2024. Middle-stream stocks such as GAS and BSR may continue to record a decrease in profit of about 5%-10% due to reduced consumption as current reserves are gradually depleted (for GAS) and plants are temporarily shut down for maintenance (for BSR). PLX will have a core profit growth due to stable production growth.

On the contrary, upstream companies such as PVD and PVS may maintain their growth momentum thanks to active E&P activities in the region and the main benefit from the Block B project. Particularly, PVD is forecasted to have the highest profit growth in the industry (about 80%) mostly due to higher operating capacity and stable drilling rig rental rates.

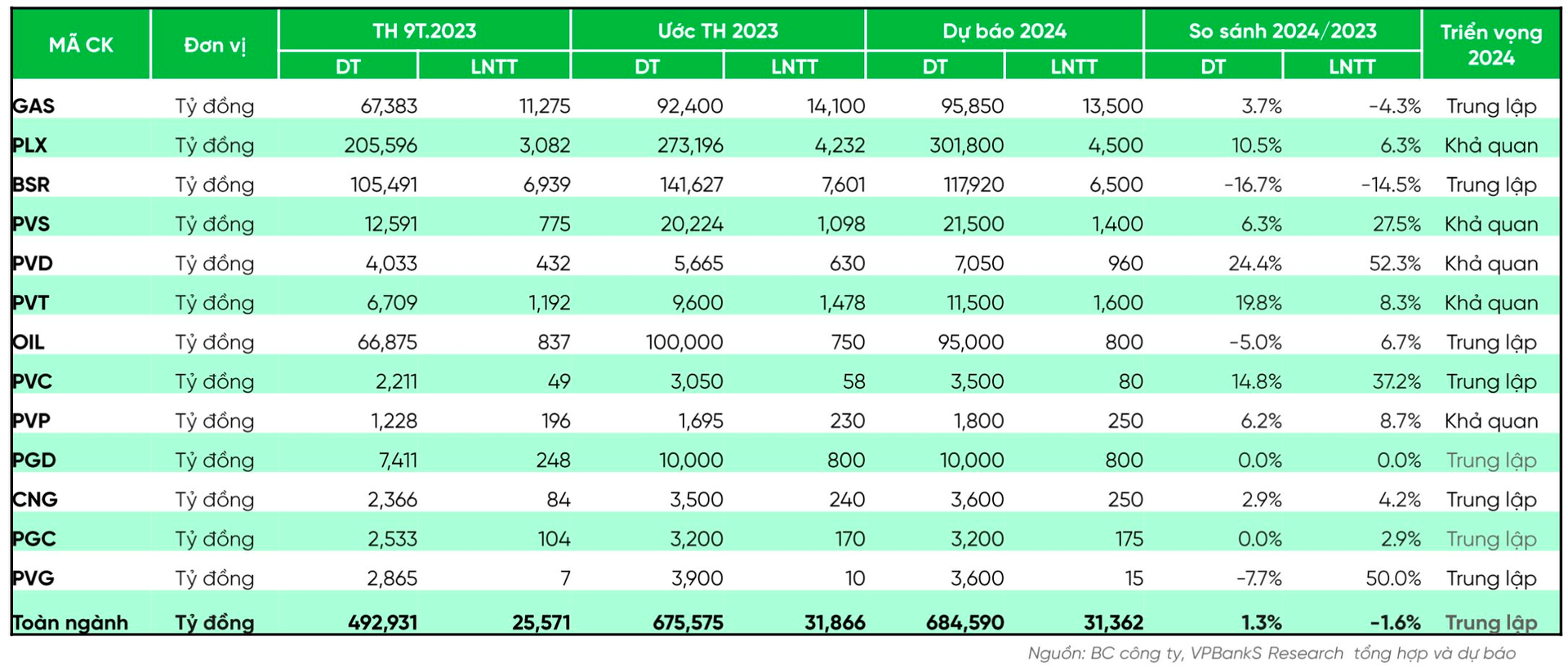

Similarly, VPBank Securities (VPBankS) also believes that the oil and gas industry will have clear differentiation shown through the forecast of revenue and profit growth of each company. PVD, PVS, and PVC are expected to have strong profit growth while most other companies have single-digit growth, or even negative growth for GAS and BSR.

Overall, VPBankS forecasts that the revenue and profit of the oil and gas industry in 2024 will reach 684,590 billion and 31,362 billion VND, respectively, equivalent to 101% and 98% of 2023. According to the forecasts of many organizations, oil prices will face adjustment pressure in the first half of the year and fluctuate around 75-80 USD/barrel as non-OPEC supply continues to increase, especially from the United States.

However, oil prices are expected to rise to around 80-85 USD/barrel in the second half of 2024 as the economy recovers due to reduced interest rates. According to VPBankS, oil prices at 75-85 USD/barrel will fundamentally continue to support the business operations of the domestic oil and gas industry, especially the implementation of upstream investment projects such as Lot B – O Mon; White Lion 2B project, etc.