Climate change is becoming an increasingly important challenge for many countries worldwide, impacting all sectors of the global economy, politics, diplomacy, and security. At the 26th United Nations Framework Convention on Climate Change (COP26), Vietnam and over 150 other countries pledged to achieve net-zero emissions by 2050.

In order to achieve the goal of becoming a high-income country by 2045 and achieving net-zero emissions by 2050, Vietnam is facing the challenge of building a low-carbon economy while maintaining a high pace of development. This requires unity and strong efforts from various sectors, as well as support from international and domestic financial institutions.

As the leading sector in the economy, providing and coordinating funding based on rigorous risk assessment processes, banks play an important role in driving significant change for businesses that are their customers in establishing new standards for sustainable development.

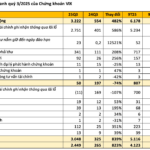

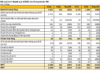

Aggregate data from the Credit Institutions Department (State Bank of Vietnam) shows that during the period of 2017-2022, credit outstanding for green sectors in the system grew by an average of over 23% per year. By June 30, 2023, green credit outstanding reached nearly VND 528.3 trillion, accounting for about 4.2% of the total outstanding credit of the entire economy.

Banks are also leading the way in environmental protection activities, energy savings, waste classification in internal operations. Recently, the State Bank of Vietnam has implemented many solutions for credit institutions to contribute to the implementation of the National Green Growth Strategy, such as: Approving the Green Banking Development Project in Vietnam, building an Action Program to implement the National Strategy on Green Growth, issuing regulations on environmental and social risk management in credit activities, gradually increasing the proportion of green credit outstanding…

Credit institutions have also shown great interest in responsible green credit development, building preferential credit policies for customers with projects and business plans that meet green growth objectives in the context of increasing demand for green products and products that meet environmental protection requirements. Some leading banks in implementing green development strategies include TPBank, ACB, SHB, HSBC,…

Among them, Tien Phong Commercial Joint Stock Bank (TPBank) is one of the pioneer financial institutions in implementing comprehensive ESG (Environment, Social and Governance) strategies in Vietnam, making the bank not only a provider of financial products and services, but also an active partner participating in social and environmental protection activities.

The bank allocates a portion of credit to clean energy and renewable electricity projects to minimize negative environmental impacts. This not only goes hand in hand with the global trend of clean energy but also demonstrates TPBank’s orientation towards accompanying green future development and improving the quality of life in the community.

TPBank also closely collaborates with the Asian Development Bank (ADB) to provide capital flow to women-led businesses. This is an important step for TPBank to empower Vietnamese women to confidently build their careers, accompany them in the initial stage of development, contribute to creating strong women-led businesses, and actively contribute to social development.

At the same time, TPBank has been implementing many community activities. The bank has actively participated in charity projects, from building public works to schools and charity houses. In particular, to commemorate its 15th anniversary, TPBank has launched a volunteering campaign in various parts of the country, including Ha Giang, Dien Bien, Truong Sa, and Dat Mui – Ca Mau. These campaigns are evidence of TPBank’s commitment to fulfilling its social responsibility and environmental protection.