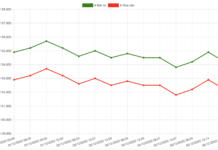

At Bao Tin Minh Chau, the price of pure 9999 gold rings is listed at 65.53-66.58 million VND per tael, an increase of 100 thousand VND per tael compared to yesterday. DOJI Group also increased 250 thousand VND per tael to 65.3-66.45 million VND per tael.

Saigon Precious Metals, Gems and Jewelry Company has lower listed prices, with 24k pure gold rings priced at 64.3-65.6 million VND per tael, an increase of 200 thousand VND per tael compared to yesterday. Phu Nhuan Jewelry (PNJ) also adjusted to 64.2-65.5 million VND per tael.

The SJC gold price remained stable in the early morning compared to the end of yesterday, with the popular selling price around 79.5 million VND per tael. For example, Saigon Precious Metals, Gems and Jewelry Company listed SJC gold bars at 77.6-79.6 million VND per tael. DOJI Group applied a price range of 77.55-79.55 million VND per tael.

Previously, on February 29, the SJC gold price fluctuated sharply as it increased to nearly 80 million VND per tael and then reversed to adjust.

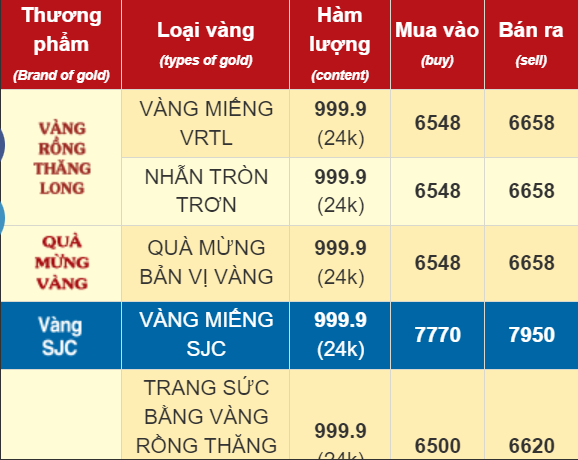

Gold price at Bao Tin Minh Chau on March 1

Internationally, spot gold prices have just risen from $2,030 per ounce to nearly $2,050 per ounce. At 9:30 AM on March 1 (Vietnam time), international gold stood at $2,045 per ounce.

Converted at the USD/VND exchange rate at commercial banks, the international gold price is only equivalent to 61 million VND per tael (excluding taxes and fees). Meanwhile, estimated at the USD exchange rate in the free market, the international gold price is equivalent to about 63 million VND per tael (excluding taxes and fees).

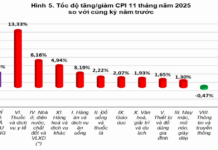

Gold has risen sharply despite the DXY index measuring the strength of the USD recovering to the 104 level after the US announced inflation data with a 0.4% increase in the Consumer Price Index in February. Analysts believe that there will be no major changes in the US monetary policy, and the US Federal Reserve (FED) is expected to have difficulty cutting interest rates in March but will start in the second half of 2024.

However, many investors are still betting on gold because political instabilities are expected to continue to be a driving force in boosting the safe-haven role of precious metals.