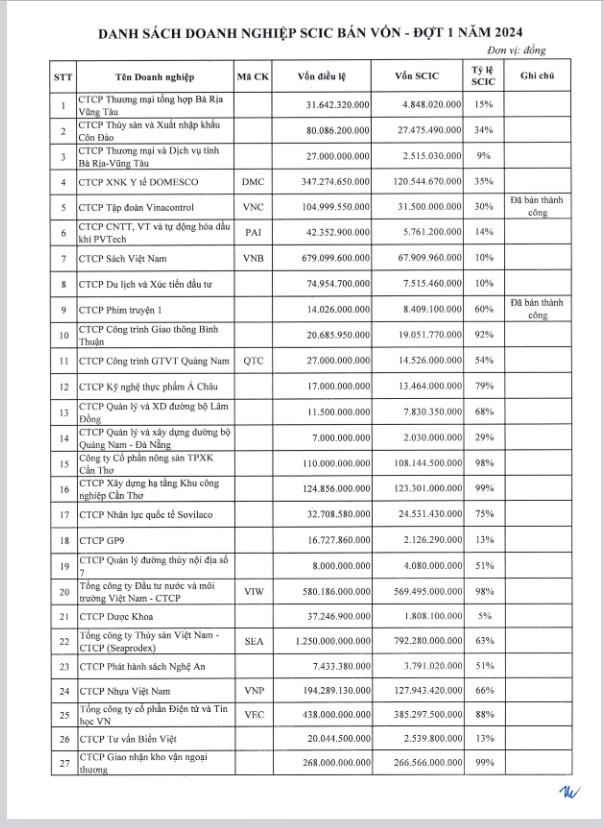

The State Capital Investment and Business Corporation (SCIC) has recently announced the list of divestments for the first phase of 2024, consisting of 27 enterprises.

According to the list released by SCIC, there are 27 enterprises, including Vinacontrol Group Joint Stock Company (VNC) and Film and Television Joint Stock Company 1, which have been successfully sold.

Among them, there are several notable names that are trading on the stock market such as Domesco Corporation (DMC-HOSE), Vietnam Book Corporation – Savina (VNB-UPCoM), Vietnam Fisheries Corporation – Seaprodex (SEA-UPCoM), Quang Nam Transport and Works Construction Joint Stock Company (QTC-HNX); Vietnam Water Investment and Environment Joint Stock Company (VIW-UPCoM); Vietnam Plastics Corporation (VNP-UPCoM); Vietnam Electronics and Informatics Corporation (VEC-UPCoM).

Recently, SCIC announced that it will publicly auction 6,790,996 shares of Vietnam Book Corporation, located at 44 Trang Tien, Trang Tien Ward, Hoan Kiem District, Hanoi, with a starting price of 15,700 VND/share, and an increment of 100 VND/share. The company has a charter capital of over 679 billion VND and is engaged in office leasing, business, and book publishing, among other activities.

Prior to this, international securities company Hoang Gia Securities Joint Stock Company (IRS) was scheduled to organize a competitive bidding session for shares of the State Capital Investment and Business Corporation at GP9 Hanoi Joint Stock Company on March 7, 2024. However, by the registration and deposit deadline (4:00 pm on February 28, 2024), no investors had registered to participate.

According to the regulations in Article 13 of the Competitive Bidding Regulations for shares of GP9 Hanoi Joint Stock Company issued by the State Capital Investment and Business Corporation, attached to Decision No. 01/2024/QD-TGD dated January 30, 2024, of the General Director of Hoang Gia Securities Joint Stock Company, the competitive bidding session for shares did not meet the requirements for organization. Therefore, IRS announced that it would not hold a competitive bidding session for shares of the State Capital Investment and Business Corporation at GP9 Hanoi Joint Stock Company on March 7, 2024.

Recently, at the Conference on Announcement and Implementation of the Development Strategy until 2030, Vision until 2035, and Business Plan, Investment Plan until 2025 of the State Capital Investment and Business Corporation (SCIC) on January 18, Mr. Nguyen Chi Thanh, Chairman of the SCIC Council, stated that the current portfolio of SCIC no longer includes many efficient enterprises, and the number/value of enterprises being transferred is also not significant.

“Therefore, SCIC needs to further enhance investment activities and transform its operating model into a financial institution to fulfill the role of the government’s investor,” Mr. Thanh said.

According to SCIC, as of now, SCIC’s portfolio still consists of 113 enterprises, excluding 12 enterprises held according to the draft Restructuring Plan of SCIC, the majority of which are inefficient enterprises that are difficult to divest.

Among them, 37 enterprises belong to the category of restructuring, handling real estate; 34 enterprises, including enterprises facing dissolution, bankruptcy, small ownership ratio, and difficult business operations… (some enterprises have unsuccessfully divested more than 6 times); 24 enterprises need to resolve issues regarding legal matters, debts, and second capital settlement in order to meet the conditions for divestment; 04 enterprises belong to Announcement No. 281. Among them, divestment can only be feasibly implemented for 09 enterprises…